Box sets » Financial transactions

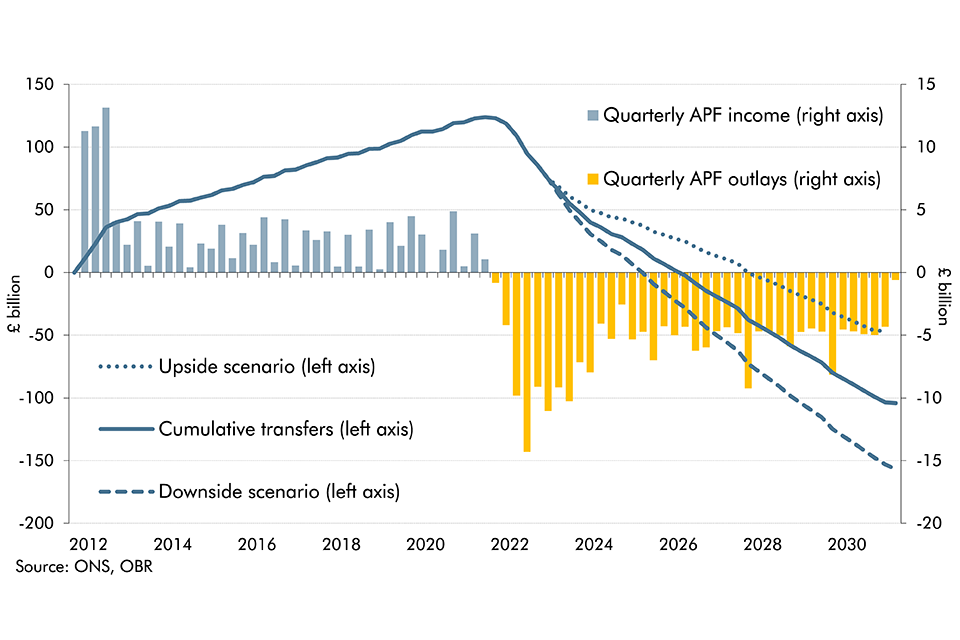

The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. In this box we updated our estimate of the lifetime direct costs of the APF and scenario analysis looked at the impact of changes in interest rates on this lifetime cost.

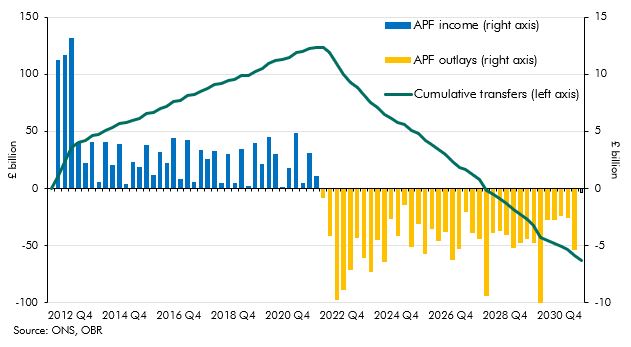

Up to July 2022 the Bank of England's quantitative easing (QE) activities had made large profits resulting in large transfers to the Treasury but since then flows have reversed. This box described what the whole lifetime direct costs of QE would be based on our March EFO assumptions.

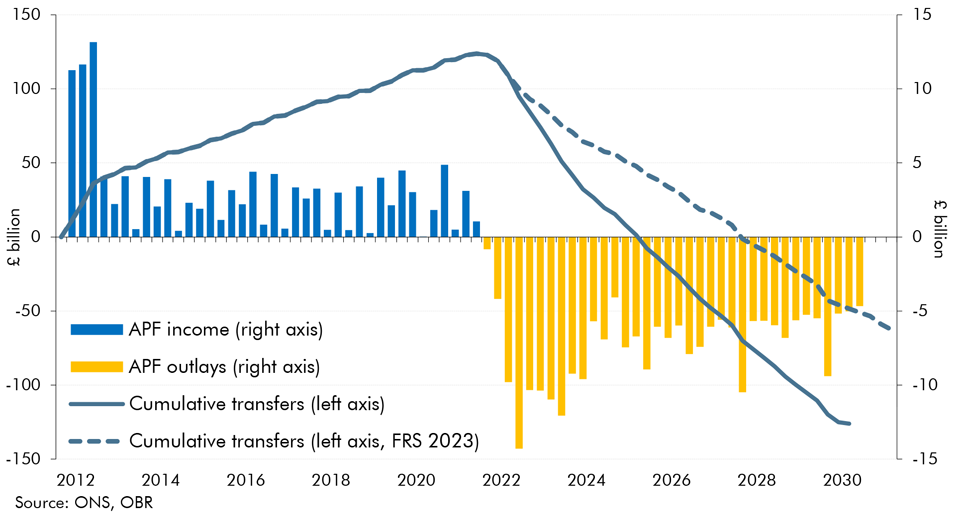

The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. Since the sharp rise in interest rates in 2022, historic profits from the APF have turned to losses. This box looked at the impact of these losses on fiscal aggregates and the lifetime direct cost of QE.

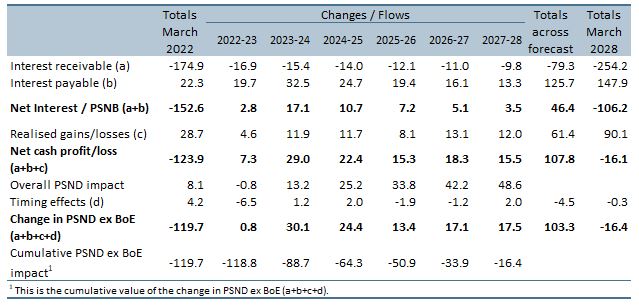

The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. Following sharp rises in interest rates in 2022 the APF has started to make large cash losses. This box looked at the causes of those losses and how they feed through to fiscal aggregates.

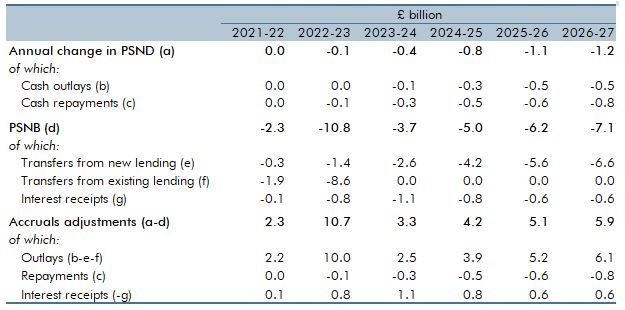

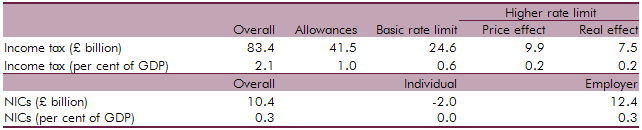

On 24 February 2022 the Government introduced a raft of changes to the working of the higher education student loans system in England. In this box we: summarised the reforms, explained their impacts on the complex accounting for student loans, and showed the overall impact on the latest forecast.

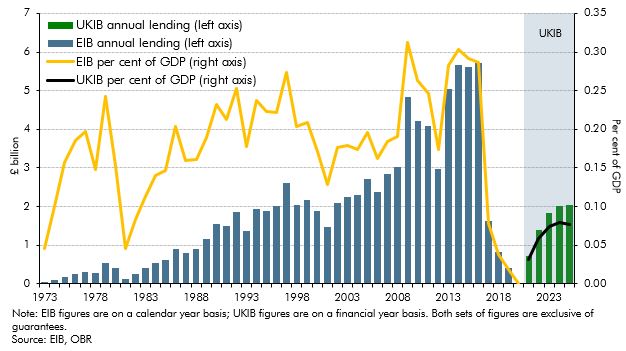

The Government announced the establishment of a new UK Infrastructure Bank (UKIB) at Budget 2021 to tackle climate change and support regional and local economic growth. It does this in part by replacing some of the activity of the European Investment Bank (EIB). This box looked at how UKIB will operate and how this compares to the EIB, as well as briefly exploring potential fiscal and classification risks.

The accounting treatment for student loans changed dramatically in 2019 adding more than £10 billion to the deficit. This box summarised the history of this change and a review into the design of post-18 education financing.

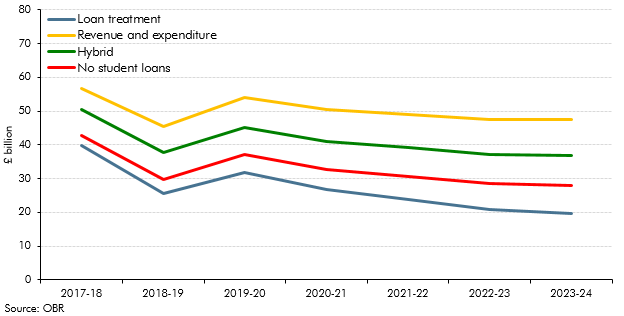

The accounting treatment applied to the burgeoning stock of student loans has been the subject of much interest over the past year, with reports from the House of Lords Economic Affairs Committee, the House of Commons Treasury Select Committee and the Office for National Statistics. In July, we published our own contribution in Working Paper No. 12: Student loans and fiscal illusions. In this box we analysed the possible impacts of different accounting treatments on our estimate of the deficit.

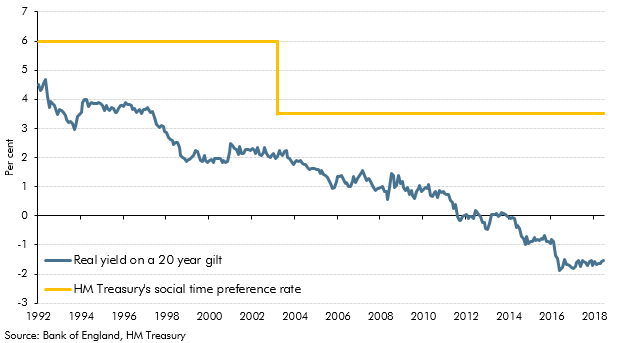

We incorporate sales of financial assets in our forecasts when firm details are available that allow the effects to be quantified with reasonable accuracy and allocated to a specific year. In the case of the sale of student loans the government also considers whether a sale offers value for money. This box looked at the way in which the Government uses discount rates to evaluate value for money, how this does not mean the sales strengthen the public finances and whether future sales are likely to proceed.

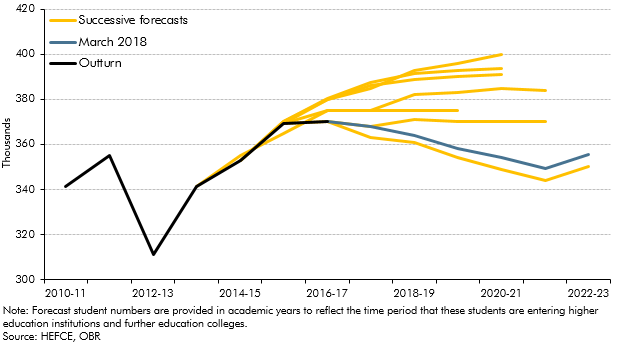

Student loans are the largest component of our financial transactions forecast, and even small changes to information about student numbers can have a significant impact on our public sector net debt forecast. This box from our March 2018 EFO discussed our previous and current student numbers forecasts and the factors that we take into account when producing them.

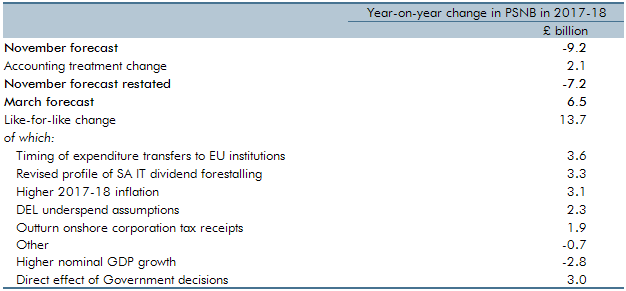

For the first time in any Economic and fiscal outlook, our March 2017 forecast showed post-measures borrowing rising year-on-year in one year of the forecast – 2017-18. This box explored the factors that explained why borrowing was expected to rise in that year, when our November 2016 forecast had assumed it would continue to fall.

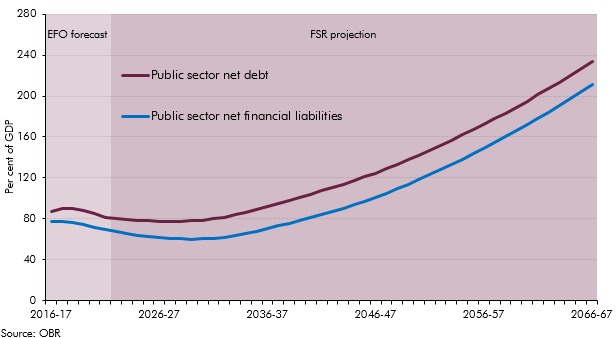

At Autumn Statement 2016 the Government asked us to forecast two new balance sheet metrics: PSND excluding the Bank of England and public sector net financial liabilities (PSNFL), a broader measure covering all the public sector’s financial assets and liabilities recorded in the National Accounts. This box presented our long-term projections for these two new balance sheet metrics with particular focus on PSNFL as PSND with and without the Bank of England tended to converge in our medium-term forecast and were expected to continue to do so over the long-term.

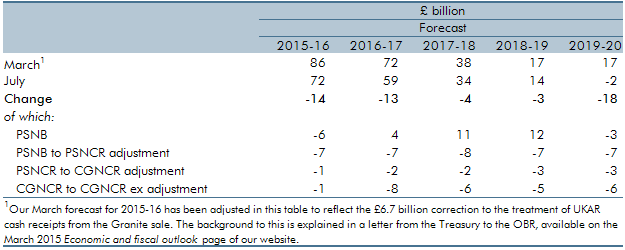

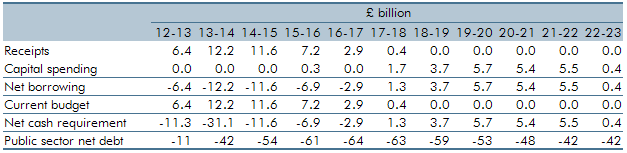

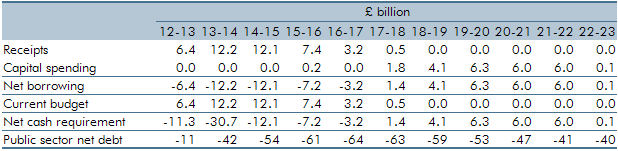

Our March 2015 Economic and fiscal outlook forecast highlighted that CGNCR ex outturn were significantly lower than what implied by our fiscal forecast. This box decomposed the revisions to CGNCR ex since our March 2015 forecast and it explained the factors that contributed to the divergence between our CGNCR ex forecast and the outturn.

Our March 2015 Economic and fiscal outlook forecast highlighted large changes in our debt interest forecast since previous fiscal events and the added complexity that debt interest was expressed net of the effect of gilts held by the Bank of England Asset Purchase Facility (APF) associated with past quantitative easing. This box described how we produced the debt interest forecast and illustrated some of the sensitivities to which it was subject.

Public finances data are subject to regular classification and methodological changes. This box outlined the classification changes associated with the implementation of the new 2010 European System of Accounts (ESA10). Annex B of our March 2014 EFO explained these changes in more detail.

This box explored the implications of the new 2010 European System of Accounts (ESA10) on our public finances forecast, ahead of its incorporation in our December 2014 EFO. Annex B of our March 2014 EFO explained these changes in more detail.

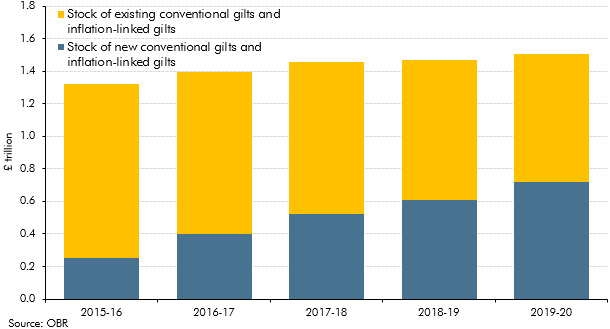

The Bank of England’s purchases of gilts under its quantitative easing (QE) programme are undertaken by its subsidiary, the Asset Purchase Facility (APF). Since late 2012-13, the Exchequer received excess cash held in the APF on an ongoing basis. This box summarised the approach used to estimate the fiscal impact of projected APF flows and the changes in these projections since our December 2013 Economic and fiscal outlook forecast. It also highlighted the large uncertainty about the timing and pace of quantitative easing (QE) unwinding.

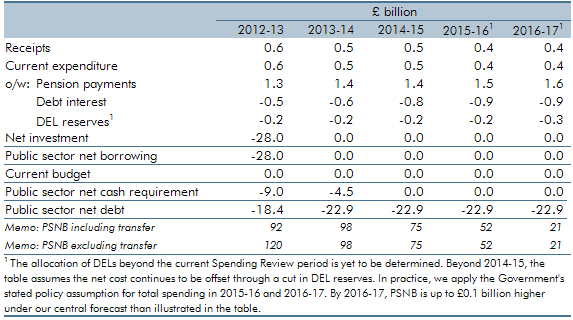

In 2012-13, excess cash held in the Bank of England’s Asset Purchase Facility (APF) has been transferred to the Exchequer on an ongoing basis requiring us to forecast future flows. This box outlined the forecasted APF flows and the changes in these estimates since March.

Public finances data are subject to regular classification and methodological changes. This box outlined potential classification changes ahead of the PSF review. Annex B of our March 2014 EFO explained these changes in more detail.

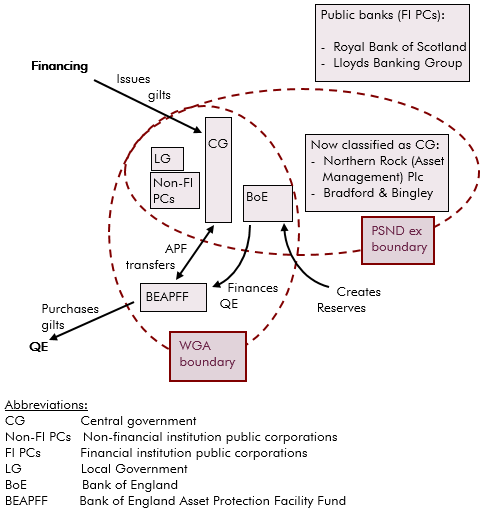

In 2013 the National Accounts measure of PSNB and PSND widened to include Bradford and Bingley and Northern Rock (Asset Management), and also included the APF transfers from the BEAPFF to central government. This box explained how the QE and APF transactions are treated in WGA and in the National Accounts, and the differences between them.

The Government announced that it intends to take on Royal Mail’s historic pension deficit with effect from April 2012. This box explored how the transfer of the relevant assets and liabilities will impact the public sector finances.

The Government announced in June 2011 that it intended to take on Royal Mail’s historic pension deficit with effect from April 2012. This box explored the provisional estimates of the impact this transfer had on the public finances.

We only include the impact of asset sales in our projections once sufficiently firm details are available for the effects to be quantified with reasonable accuracy. This box considered the risks that currently unquantifiable future asset sales may present to our projections.

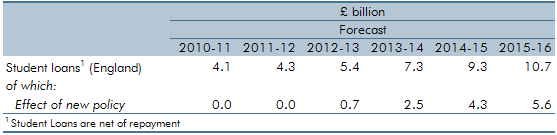

The Government carried out a number of reforms to the student finance support system, shifting funding from direct grants to loans to students. This box looked at the impact of student loans on public sector net debt.

The Government undertook a number of interventions in the financial sector in response to the financial crisis and subsequent recession of the late 2000s. This box provided an update of the estimated net effect of them on the public finances as of November 2010.

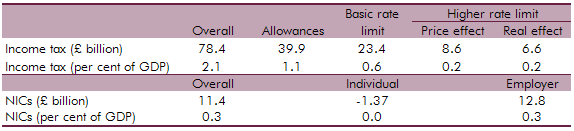

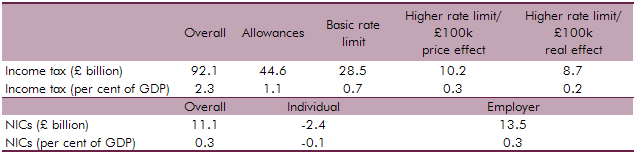

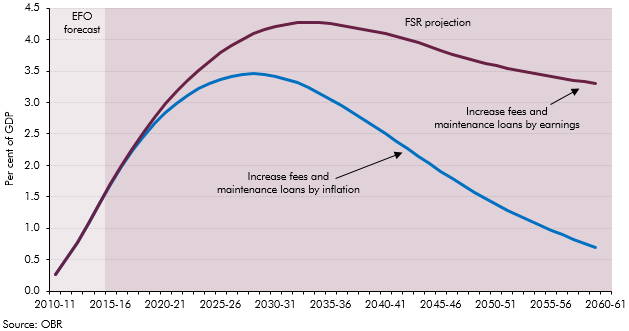

The Government set out proposals in England for a basic threshold of tuition fees of £6,000 per annum as well as an absolute limit of £9,000 in exceptional circumstances for undergraduate courses with effect from the 2012-13 academic year. This box outlined the effect of this student loan policy on the public finances.