We incorporate sales of financial assets in our forecasts when firm details are available that allow the effects to be quantified with reasonable accuracy and allocated to a specific year. In the case of the sale of student loans the government also considers whether a sale offers value for money. This box looked at the way in which the Government uses discount rates to evaluate value for money, how this does not mean the sales strengthen the public finances and whether future sales are likely to proceed.

This box is based on Bank of England and HM Treasury data from October 2018 and January 2018 respectively.

Between 2018-19 and 2023-24, we expect asset sales to lower public sector net debt (PSND) by £55.3 billion. About a quarter will come from the sale of pre-2012 or ‘Plan 1’ student loans.

We incorporate sales of financial assets in our forecasts when firm details are available that allow the effects to be quantified with reasonable accuracy and allocated to a specific year. In this case, the Government has clearly stated its intention to sell and the size of the remaining loan book is sufficient to raise the proceeds assumed in the forecast with room to spare.

But, in the rationale for selling the loans that the Government presented to Parliament last year, it stated that: “Selling financial assets, like student loans, where there is no policy reason to retain them, and value for money can be secured for the taxpayer, is an important part of the Government’s plan to repair the public finances”.a So there is clearly a risk that the Government could abandon or delay the sales when the time comes if it were to believe that they did not offer value for money at the prospective price. So, we need to judge if this is a realistic prospect.

One way to judge value for money would simply be to assess if selling the loans is likely to strengthen (or ‘repair’) the long-term health of the public finances. As we discussed in a working paper earlier this year, this appears to be the case under the current National Accounts accounting treatment – but misleadingly so. The European System of Accounts 2010 treats student loans like normal loans, but unlike normal loans the repayments depend on the borrower’s income and are time-limited. This means that by design a significant proportion of the principal plus interest for any given cohort of loans will be written off around 30 years after the borrowers graduate. Public sector net borrowing has been reduced by the build-up of never-to-be-repaid capitalised interest but then the loans are sold before the write-offs hit the deficit.b

If the Government was selling a corporate asset (like the bank shares that it bought during the financial crisis) the sale could offer value for money because the sale price might reflect the fact that the asset was intrinsically more valuable in the hands of the private than the public sector – because the private sector is generally thought to be better at running banks (most of the time, at least). But, in the case of the student loans, the asset is worth the same – the purchasers of the loans are not taking over the collection of repayments in the hope of collecting larger sums.

When selling student loans, the Government is simply swapping an uncertain flow of future revenue for a certain – but smaller – upfront sum. In effect, it is simply securitising a portion of future income tax receipts and then selling them at a discount to their expected value. (The sale of the first tranche of Plan 1 loans, which took place in November 2017, involved the Government exchanging loans with a face value of £3.5 billion for £1.7 billion in up-front cash. Only part of the £1.8 billion difference reflected the size of the expected write-offs.) This does not strengthen the public finances in any meaningful sense – it is simply an alternative way to finance the budget deficit, and a relatively expensive one at that given current borrowing costs.

But this is not how the Government judges ‘value for money’ for the purpose of asset sales like these. Instead it applies the social cost benefit analysis methodology set out in the Treasury’s ‘Green Book’ on project appraisal.c This imposes three requirements on asset sales: first, that an efficient market exists for the asset; second, that the sale is structured to promote efficient pricing; and third, that the sale value exceeds the Government’s ‘retention value’ – the price above which it is better off selling the asset than keeping it, given the revenue flow it would forego, the opportunity cost of tying up cash and the risk around uncertain future repayments.

The Government assesses the retention value by forecasting the cash flows to be derived from the asset and then applying a discount rate to turn them into a present value that can be compared to the prospective sale proceeds. The higher the discount rate, the smaller the retention value and the more likely it is that the sale is deemed to offer value for money.

This discount rate comprises elements for inflation and the ‘social rate of time preference’ (which together determine the nominal social rate of time preference) and an element for the riskiness of the asset in question.

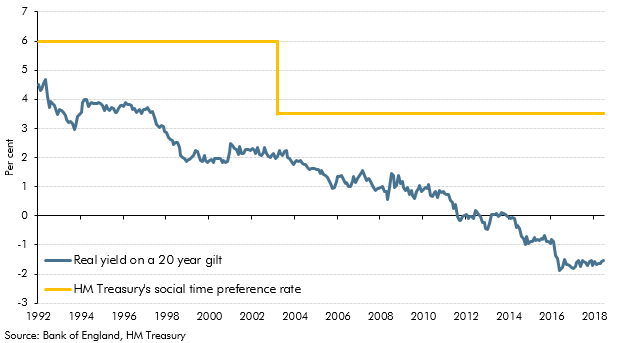

The Green Book specifies that over long time horizons the inflation component should be the long-term projection for GDP deflator inflation from the OBR’s Fiscal sustainability report, currently 2.2 per cent, but for student loan sales the Treasury uses the higher Retail Prices Index (RPI) inflation rate of 3.0 per cent. (The ONS no longer deems the RPI to be a National Statistic as it falls short of international statistical standards.) The normal social rate of time preference in the Green Book is 3.5 per cent, comprising 0.5 per cent for pure ‘time preference’ (the preference for value now rather than later), 2 per cent for a ‘wealth effect’ (which reflects expected growth in per capita consumption), and 1 per cent for ‘catastrophe risk’ (which accounts for hard-to-foresee, systemic events). This real social rate of time preference has exceeded real yields on government bonds for decades.

Chart B: Market implied and Treasury’s real discount rates

In the case of student loans, instead of including the element for catastrophe risk, the Government estimates an asset specific risk by assessing the returns that investors would expect to generate from similar assets and from risky assets in general (using a capital asset pricing model (CAPM) for the latter) and puts this on top of the 5.5 per cent nominal ‘risk-free rate’ (RPI inflation plus 2.5 per cent). Also employing a CAPM approach, the National Audit Office (NAO) used the price at which the sale occurred to estimate that market participants’ implied risk premium (plus any ‘novelty discount’) was 4.9 per cent.d But the Government does not disclose publicly the asset specific risk element – and therefore the overall discount rate used to estimate the retention value – as this would disclose to would-be purchasers the price at which the Government was willing to sell. This of course makes it hard for the public to judge whether this approach genuinely guarantees value for money. However, the Government does disclose this information on a confidential basis to the NAO and PAC.

At 5.5 per cent, the nominal risk-free element alone looks high relative to both yields on government bonds of similar average maturity to the sold loans (1.6 per cent on 12-year gilts) and the discount rate used to value student loans in the Department for Education’s accounts (3.8 per cent). As the NAO has noted, this would have made the retention value comparatively “conservative” and the value for money hurdle relatively easy to clear.

To inform the sale, UKGI also estimated how potential buyers might value the loans. The discount rate used for this estimate comprised a 1.6 per cent risk free rate, an asset specific risk premium, and a ‘novelty premium’. The final component – which will presumably fall over time – represents the extent to which market participants discount relatively unfamiliar asset classes. (For the sale of Royal Mail, the novelty premium was estimated to be between 5 and 15 per cent.) Green Book guidelines do not require the Government to be compensated for the novelty premium.

On the basis of the (necessarily incomplete) information available to us, we assume for now that the planned sales will clear the value for money hurdle and go ahead. We will need to keep this under review and also to judge whether there will be sufficient private-sector demand for the sales to take place. This will depend on conditions in financial markets and the extent to which potential volatility would be expected to affect demand for this particular type of asset.

This box was originally published in Economic and fiscal outlook – October 2018