The OBR

The Office for Budget Responsibility was created in 2010 to provide independent and authoritative analysis of the UK’s public finances. It is one of a growing number of official independent fiscal watchdogs around the world. We have 5 main roles:

- economic and fiscal forecasting to accompany the Autumn Budget and Spring Statement;

- evaluate the Government’s performance against its fiscal targets;

- assess the long-term sustainability of the public finances and analyse the public sector’s balance sheet;

- evaluate fiscal risks from 2017; and

- scrutinise tax and welfare policy costings at each Budget.

For more information, see our What we do page.

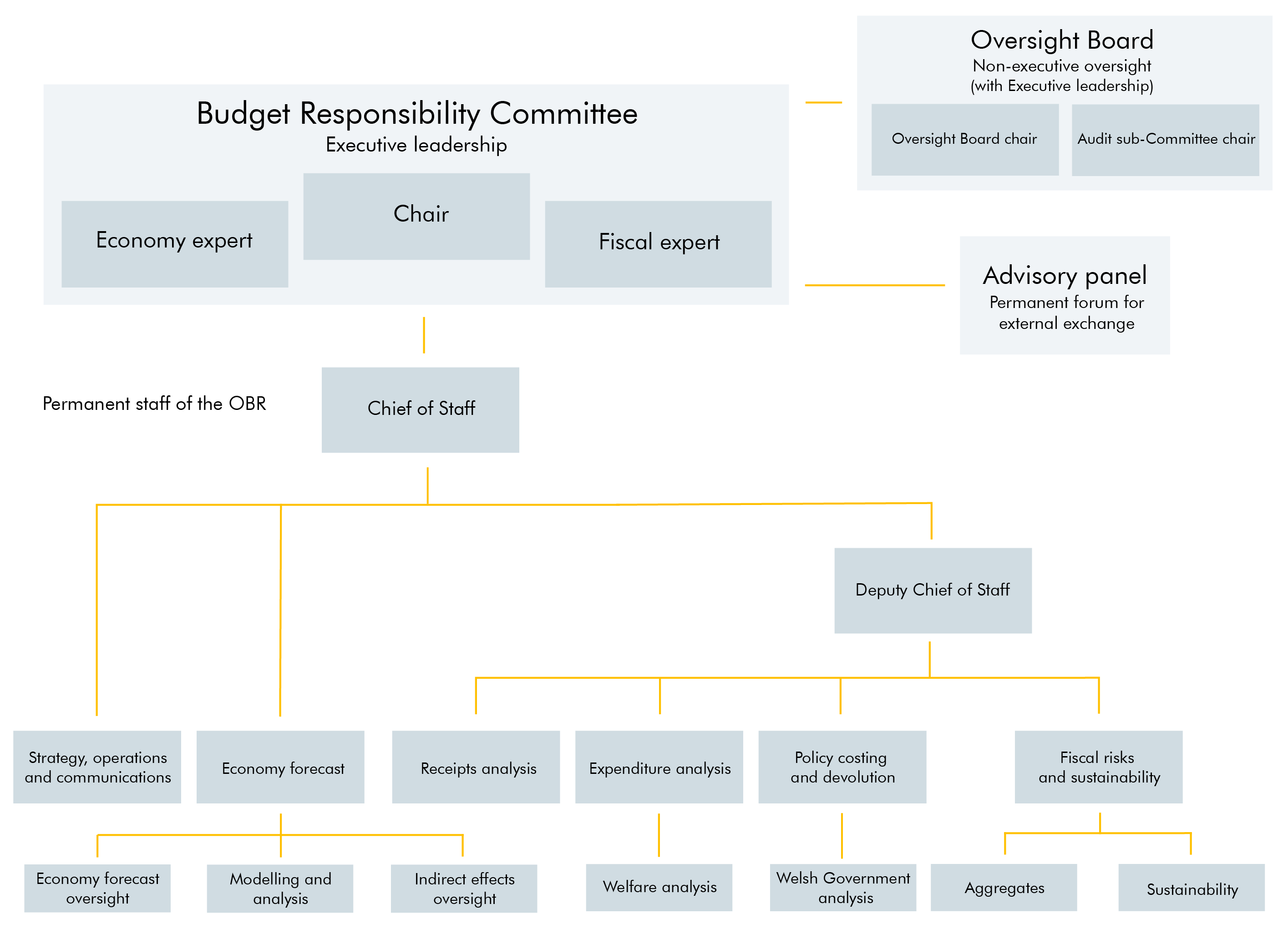

The OBR is led by the three members of the Budget Responsibility Committee (BRC). They have executive responsibility for the core functions of the OBR, including the judgements reached in its forecasts. They are:

The OBR’s Oversight Board ensures that effective arrangements are in place to provide assurance on risk management, governance and internal control. It consists of the three members of the BRC, plus two non-executive members, currently Bronwyn Curtis OBE, Dame Susan Rice and Baroness Hogg.

The Office for Budget Responsibility established an advisory panel of leading economic and fiscal experts in 2011 to help develop and scrutinise its work programme and forecasting methods. Since then, we have held regular meetings in which we have discussed our work priorities, core publications, and analytical approaches. The panel was revised and expanded in 2023 to include a wider range of experts across six different aspects of our work. Since 2020, the OBR has also conducted periodic roundtables with a set of thinktanks with standing macroeconomic expertise to discuss recent economic and fiscal developments and issues that are relevant to our forecasts and analysis. The Institute for Fiscal Studies, Institute for Government, National Institute for Economic and Social Research, and Resolution Foundation have regularly participated in these discussions and shared their insights. Members of our advisory panel and the thinktank roundtable are not involved in the production of the OBR’s official economic and fiscal forecasts, do not have access to them prior to publication, and are not assumed to have endorsed their contents. Judgements on the medium-term forecasts will remain the sole responsibility of the three independent members of the BRC.

The BRC are supported in their work by the OBR’s permanent staff of 52 civil servants, led by Steve Farrington.

For more information, see our Who we are page.

The tasks the OBR has been given require us to have a close working relationship with officials in a number of Government departments – especially the Treasury, the Department for Work & Pensions and HM Revenue & Customs – in the run-up to Budgets and other fiscal events. We maintain our independence by being as transparent as we can after each forecast about our interactions with ministers and their key staff and about the reasons for the judgements we have reached. The formal ‘rules of the game’ for our working relationship with departments are set out in a Memorandum of Understanding (which you can find on our Legislation and related material page). For more details on how we interact with departments see our Working with Government page.

Limits of our remit

No. Paragraph 4.12 of the Charter for Budget Responsibility states that ‘the OBR should not provide normative commentary on the particular merits of government policies’. Our job is to assess the implications of current stated Government policy, not to assess whether that policy is likely to change or should change.

Our role is to assess the outlook for the public finances and whether they are sustainable, based on current Government policy. To that end we have to forecast how much the Government is likely to spend, but it is not our job to assess whether that money will be spent sensibly or efficiently – Parliament has specifically stipulated that ‘the OBR should not provide normative commentary on the particular merits of government policies’. The National Audit Office scrutinises public spending for Parliament, including value-for-money, but its focus is generally on how money has been spent in the past rather than how it is likely to be spent in the future.

No, that would require a change in the law. Subsection 5(iii)(b) of the The Budget Responsibility and National Audit Act 2011 states that the OBR must not consider alternative policies, which restricts us to assessing the likely impact of the current policies of the current Government. Official independent fiscal institutions do fulfil this role in some other countries, notably the CPB Bureau of Economic Policy Analysis in the Netherlands. Parliament did discuss whether the OBR should play this role in 2014 and we wrote to the Treasury Select Committee to set out some of the issues that would need to be addressed if ever we were to be asked to do so. The Treasury’s 2015 review of the OBR considered the issue again. It recommended that the law should not be changed to allow us to perform this role.

The OBR scrutinises the tax and non-departmental spending (e.g. welfare spending) measures that the Chancellor is thinking of including in the statement. First the Treasury shows us a draft ‘scorecard’ – an initial list of possible measures. We then discuss the scrutiny we think each measure would require with the Treasury and the responsible department, based on its complexity and similarity to previous measures. The Treasury will then send a ‘costing note’ to the OBR, setting out the details of the policy and estimating the amount of money it will raise or cost in each year of the forecast. The OBR discusses the analysis with the department and the Treasury, suggesting changes and iterating until we are happy to endorse the estimates as ‘reasonable and central’ or until the Treasury and we agree to disagree (which has not happened yet). In the case of tax measures, these discussions focus on identifying the relevant tax base and judging the potential behavioural impact of the measure from the experience of similar measures or from estimates of relevant elasticities. For further detail, see Briefing Paper No.6: Policy costings and our forecast.

Producing forecasts

We published our latest estimates and more information on how we apply fiscal multipliers in the November 2020 Economic and fiscal outlook in Box 2.1, page 30. More information on the application of our multipliers can be found in our boxsets.

Yes. Parliament requires us to look back at our forecasts once a year. We do that in our Forecast evaluation reports. This involves breaking down the differences between our forecasts and subsequent outturns into those that can be attributed to changes in how the ONS records the data, subsequent Government policy changes, unexpected economic developments and other factors. The approach we use is described in a dedicated briefing paper on evaluating forecast accuracy. We recently undertook a comprehensive look at the OBR’s overall forecasting record since we were established in 2010 in Working paper No.19: The OBR’s forecast performance.

The OBR usually produces forecasts twice a year, to accompany each Autumn Budget and Spring Statement. These are published in our Economic and fiscal outlook (EFO), which is posted on our website as soon as the Chancellor of the Exchequer has finished their speech to Parliament.

No. We only produce a forecast when formally requested to by the Government to accompany a fiscal event. Between forecasts we produce other reports and analysis that are required of us by Parliament or which we consider would be useful to inform debate about the public finances or to explain how we do our work.

The Chancellor of the Exchequer decides the dates of our forecasts when they choose the date of the Autumn Budget (usually in late November or early December) or the Spring Statement (usually in mid-March). Under normal circumstances, the Chancellor is required to give us 10 weeks’ notice when requesting a forecast. The Treasury informs the Treasury Select Committee and Parliament of the date at the same time, or as soon as possible afterwards if Parliament is in recess. Please refer to the Treasury website for announcements.

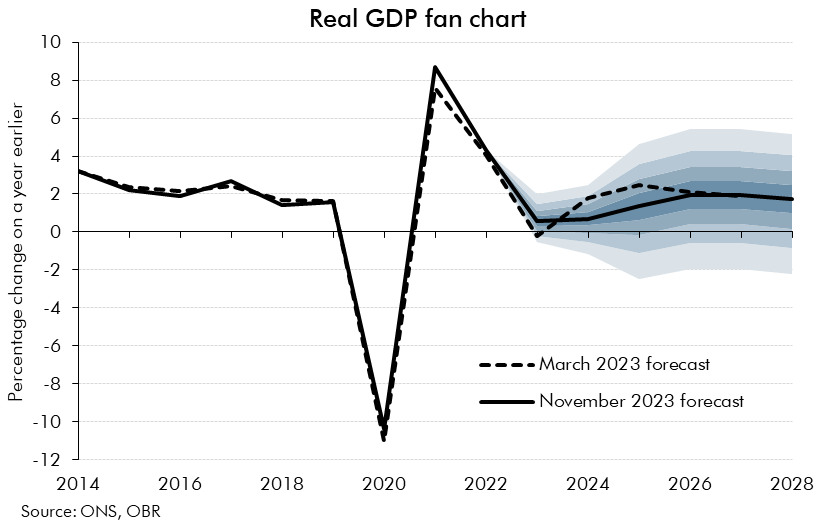

No. Given the requirement on us to judge whether the Government has a better than 50 per cent chance of achieving its fiscal targets on current policy, we aim to produce forecasts that are central, with risks equally weighted to the upside and downside. This means that, all else equal, there is a 50 per cent chance of the outturn coming in above our forecast and 50 per cent chance below.

One way we illustrate the uncertainty around our central forecasts is by using fan charts. The fan chart below shows the real GDP forecast in the November 2023 EFO. The solid black line is our central estimate. Each successive pairs of blue areas represents 20 per cent probability bands for different outcomes, based on the size and distribution of past official forecast errors.

Our latest ready reckoners can be found on the Data page.

When setting out its plans for public spending, the Government sets out cash ceilings in the form of Resource and Capital Departmental Expenditure Limits. The former (RDEL) largely comprises central government spending on public services and administration (mostly public sector pay, procurement and grants to local government); the latter (CDEL) largely comprises central government spending on capital investment and capital grants to local authorities and private sector organisations. RDELs and CDELs are specified department by department for the years covered by Spending Reviews and as aggregate numbers for subsequent years. For the purposes of our forecast, we need to predict how much money will be spent relative to these limits. We do this before reaching a judgement on the degree to which the aggregate RDELs and CDELs in each year will be under or overspent, drawing information from the Treasury, departmental forecasts and past performance. We do not produce a bottom-up forecast of DEL spending, department by department, and we do not scrutinise announcement of individual spending increases or cuts within the DEL totals.

For more information on the Treasury’s DEL assumptions, see our forecast-in-depth page.

The economy forecast ultimately reflects the judgements made by the members of the Budget Responsibility Committee, following lengthy discussions with our staff and informed by the work of outside experts and other forecasters. In putting together the forecast, we use a large-scale macroeconomic model of the economy jointly maintained and developed by the OBR and the Treasury. This does not drive the results of the forecast, but rather provides a framework to ensure that the judgements we make are mutually consistent and comprehensive and that they reflect the way in which different economic variables have behaved and interacted in the past. A framework for the joint governance, management and development of the macroeconomic model is set out in a Memorandum of Understanding – the macroeconomic model.

Read more about our economy forecast in Briefing paper No.3: Forecasting the economy and on our forecast-in-depth pages. Read more about our macroeconomic model in Briefing paper No.5: The macroeconomic model.

Data

We publish all our forecasts in the Economic and fiscal outlook (EFO). The best place to find the data is in the EFO charts and tables and detailed forecast tables on the Economic and fiscal outlook page.

Economy forecasts

Our latest economy forecasts are published in Chapter 2 of the Economic and fiscal outlook (EFO). All data in the charts and tables can be found in the EFO charts and tables spreadsheets. We also publish forecasts in our detailed economy forecast tables in quarterly, calendar and financial years.

The main economic determinants of the fiscal forecast can be found in Annex A of the Economic and fiscal outlook.

Fiscal forecasts

Our latest fiscal forecasts are published in Chapters 3 to 7 of the Economic and fiscal outlook (EFO). All data in the charts and tables can be found in the EFO charts and tables spreadsheets. We also produce extra detail in our detailed fiscal forecast tables.

If you can’t find what you’re looking for please email the relevant analyst on our Contact us page or email [email protected].

Most commonly searched forecasts

GDP

Table 1.1-1.2, Detailed forecast tables: economy

Also in Annex A of the EFO

| October 2024 forecast | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Real GDP growth | 1.1 | 2.0 | 1.8 | 1.5 | 1.5 | 1.6 |

| Nominal GDP growth | 4.0 | 4.6 | 3.9 | 3.5 | 3.5 | 3.6 |

RPI, CPI and other inflation measurements

Table 1.7, Detailed forecast tables: economy

Also in Annex A of the EFO

| October 2024 forecast | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| RPI | 3.6 | 3.5 | 3.3 | 3.1 | 2.9 | 2.9 |

| CPI | 2.5 | 2.6 | 2.3 | 2.1 | 2.1 | 2.0 |

Output gap

In Chapter 2 of the EFO

Table 1.18, Detailed forecast tables: economy

| October 2024 forecast | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Output gap | -0.2 | 0.1 | 0.4 | 0.3 | 0.1 | 0.0 |

Budget deficit/public sector net borrowing

Annex A, Charts and tables

| October 2024 forecast | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 |

| PSNB (per cent of GDP) | 4.5 | 3.6 | 2.9 | 2.3 | 2.2 | 2.1 |

| PSNB (£ billion) | 127.5 | 105.6 | 88.5 | 72.2 | 71.9 | 70.6 |

Government debt/public sector net debt

Annex A, Charts and tables

| October 2024 forecast | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 |

| PSND (per cent of GDP) | 98.4 | 96.9 | 97.0 | 97.2 | 97.3 | 97.1 |

| PSND (£ billion) | 2836 | 2913 | 3018 | 3133 | 3248 | 3361 |

Our historical forecast database includes successive forecasts and recent outturn data for almost 100 variables – including all the main lines of tax and public spending, plus the major fiscal aggregates (such as public sector borrowing and debt) – from our forecasts since 2010. The database also includes most of the economic and fiscal forecasts published by the Treasury prior to 2010 and in some cases back as far as 1970.

If the series you are looking for isn’t listed, please email [email protected].

Our Databank, published monthly after the ONS public sector finances release, lists headline public finances series from 1950 along with the latest forecasts.

Other publications and releases

Please refer to the list of upcoming publication dates on our home page. We publish a commentary on the day of the ONS public sector finances (PSF) release. The only exception is if the PSF release is close to publication of a new forecast in an Economic and fiscal outlook. The aim of the commentary is to explain the data published for the latest month and any revisions to earlier months, and to put them in the context of our latest forecast. This can be important because revenue and spending flow unevenly and comparing the budget deficit over the fiscal year to date with the same period in the previous year is rarely a good guide to what the full year’s data will look like.

We aim to update the brief guide as soon as possible after each forecast.

We aim to update all content on the Tax by tax, spend by spend and The economy forecast pages after each forecast.

Please email [email protected]. If we have the information you’re seeking we will endeavour to publish it on our website on the next appropriate release date. Our weekly release dates will coincide with whichever day the Office for National Statistics (ONS) issues its monthly Public Sector Finances (PSF) release. In the weeks between ONS PSF releases, we will publish information on Thursdays. Releases will be published at 11am. As far as resources, the process and, where necessary, the time it takes to gather information from other departments allows, the OBR will endeavour to respond to enquiries and publish information on the next supplementary release date. Where that is not possible, information will be published as soon as is practicable.

For further information on our supplementary releases, please refer to our release policy.

Yes, if we have published the relevant report since. Once we receive a request and publish the additional information, we will continue to publish updated versions in our supplementary tables.

For further information on our supplementary releases, please refer to our release policy.

External engagement

We engage actively with this international community, sharing experience with our counterparts and with governments and parliaments that are creating new institutions or enhancing fiscal transparency.

A number of these IFIs – including the OBR – participate in the OECD’s network of parliamentary budget offices and independent fiscal institutions. This holds an annual meeting and publishes the agendas and documents. The OBR is also a member of a voluntary network created by European Union IFIs.

Yes. On occasion we host experts from overseas IFIs, governments and parliaments who are keen to find out about our work. If you would like to visit us, please email [email protected] and we would be happy to organise a meeting at a convenient time.

We do not have the resources to provide technical assistance on a regular basis, but occasionally OBR staff have been involved in technical assistance missions organised by the International Monetary Fund (IMF).

The OBR has no formal relationship with the Bank of England, although we meet regularly with Bank staff to discuss forecasting issues of mutual interest.

Press

Anyone from the press can attend. If you’d like to receive an invitation to our next press conference, email [email protected].

Office management

The OBR is located in the Ministry of Justice. The address is 14T, 102 Petty France, London, SWIH 9AJ.

Our original delegated budget, set at the 2021 Spending Review, was £4,316,000 for 2023-24. This was uplifted by £250,000 in our annual delegation letter to £4,566,000 to provide additional resources for a new supply side analysis unit. The delegation letter also committed to funding the cost of transferring the OBR’s IT function to HM Treasury’s TrIS network. Our budget was increased by £1,000,000 in supplementary estimates to cover the new analytical unit, our IT migration costs, and a number of one-off in-year pay-related pressures, including the civil service-wide in-year pay uplift of £1,500. The statement of comprehensive net expenditure in this year’s accounts puts our total spending for the year at £5,442,000.

Our IT support is outsourced under a contract managed by HM Treasury.

Other topics

We list upcoming publication dates on the home page.

From time to time the OBR has vacancies that are advertised on the Civil Service Jobs portal. We also hire placement students via the GES Sandwich Student Placement Scheme.

Including the chair, the three members of the Budget Responsibility Committee (BRC) are appointed by the Chancellor of the Exchequer with the consent of the Treasury Select Committee. Appointments are for 5 years and no member can serve more than two terms.

For more information, please refer to section (1) to (6) of Schedule 1 of the Budget Responsibility and National Audit Act.

Richard Hughes (chair), Prof. David Miles CBE and Tom Josephs are serving their first terms. Their letters of appointment can be found on our Governance and reporting page.