Scotland

Legislation since 2012 related to Scottish devolved taxes and evidence to the Scottish Parliament Finance committee.

Legislation since 2012 related to Scottish devolved taxes and evidence to the Scottish Parliament Finance committee.

Wales Bill 2014 in which we were requested to produce Welsh forecasts for devolved taxes and evidence to the Welsh Assembly Finance Committee.

Information related to plans to devolve corporation tax to Northern Ireland.

Alongside each EFO, we publish our forecast for fully devolved taxes and devolved elements of income tax. We cover our methodology, our latest forecasts, illustrative forecasts for taxes not yet devolved and inputs into the block grant calculations.

We are commissioned by the Welsh Government to produce independent forecasts for the devolved Welsh taxes. These include devolved aspects of income tax, land transaction tax and landfill disposal tax. We also provide a summary of the forecasts required for the block grant adjustments.

This paper took a comprehensive look at the evolution of the significant and widening gap in the amount of income tax paid per person in Scotland and Wales relative to the UK as a whole. It explored the drivers behind these changes in order to identify trends that should be factored into our devolved income tax forecast.

Following the fiscal framework agreed between the UK and Welsh Governments in December 2016, we are required to forecast income tax by bands. This paper set out how we intended to adapt our methodology to perform this task.

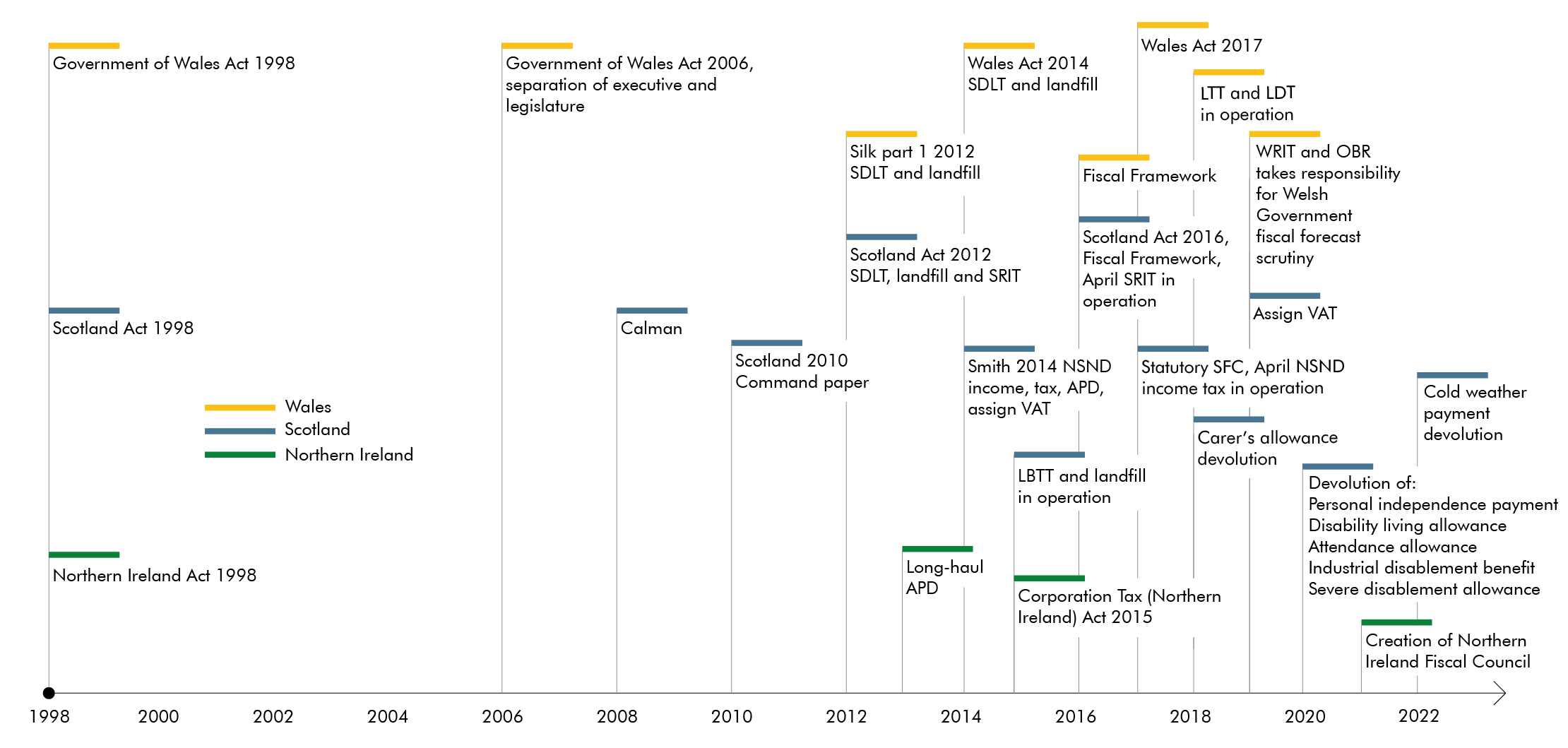

The process of fiscal devolution to Scotland, Wales and Northern Ireland began in 1998 with the passing of a Scotland Act, a Government of Wales Act and a Northern Ireland Act. These set up the Scottish Parliament, the National Assembly for Wales and the Northern Ireland Assembly. The timeline below shows of some of the key devolution milestones since then, including some significant recent and forthcoming changes.