We produce forecasts for land and buildings transactions tax (LBTT) in Scotland and land transaction tax (LTT) in Wales. These are the replacements for stamp duty land tax (SDLT), which now operates in just England and Northern Ireland. Taken together, these make up our LBTT began in April 2015, while LTT has been in operation since April 2018.

Devolved property taxes

This Forecast in-depth page has been updated with information available at the time of the March 2024 Devolved tax and spending forecast.

Rates and thresholds

The devolved taxes share many similarities with SDLT – for example, the distinction between residential and commercial transactions and similar systems of reliefs, exemptions and surcharges. The differences between the three tax systems include:

- LBTT and LTT are both more progressive than SDLT for both residential and commercial property, with lower rates on lower-value transactions and higher rates on more expensive ones;

- The two devolved taxes apply a higher surcharge on additional dwellings – 6 per cent for LBTT and 4 per cent for LTT compared to SDLT’s 3 per cent;

- SDLT and LBTT both feature a first-time buyers’ relief but with different thresholds. There is no first-time buyers’ relief for LTT

- LBTT and LTT are collected and administered by Revenue Scotland and the Welsh Revenue Authority (WRA) respectively, whereas SDLT is administered by HMRC.

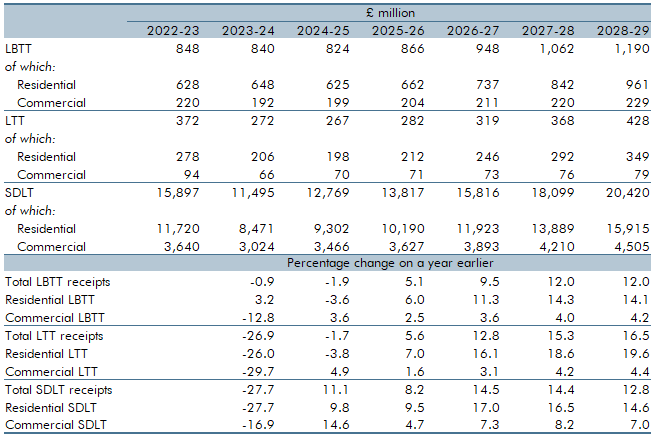

The charts below show the current marginal rates and thresholds under the three different regimes. For residential transactions:

- The three tax regimes have different nil rate bands – the threshold below which transactions are exempt. For LBTT it is £145,000, it is £225,000 for LTT and £250,000 for SDLT (though this is due to revert to £125,000 from 1 April 2025).

- The nil-rate band for LTT exempts 60 per cent of all Welsh residential property transactions from LTT, which is higher than the 37 per cent of Scottish transactions that are exempt from LBTT and the 48 per cent of SDLT-exempt transactions (based on the £250,000 threshold).

- The starting rates are 2 per cent for LBTT, 5 per cent for SDLT, and 6 per cent for LTT.

- There is a top rate of 12 per cent for each tax, applying to the portion of a transaction with a value over £750,000 for LBTT and over £1.5 million for both LTT and SDLT.

- The top rate applies to 0.95 per cent of eligible SDLT transactions, compared to 0.85 per cent for LBTT, and just 0.04 per cent for LTT.

Chart 1: Residential property marginal tax rates: main rates and thresholds

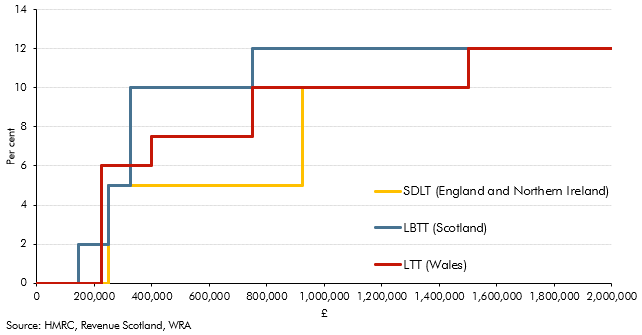

Each tax regime applies higher rates for the purchase of second and additional residential properties. These are shown in the chart below.

Chart 2: Residential property marginal tax rates: rates and thresholds for additional properties

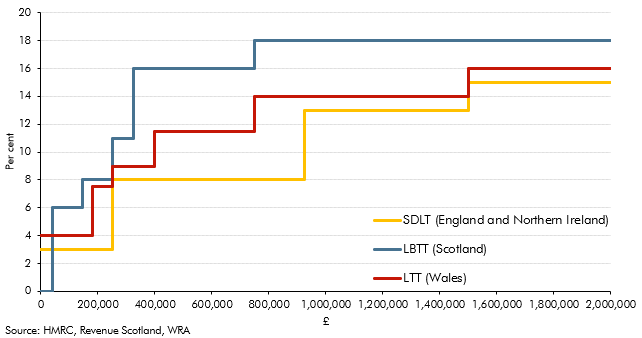

There is more commonality between the three tax regimes when it comes to commercial property transactions, the rates for which are shown in the chart below.

Chart 3: Commercial property marginal tax rates and thresholds

Methodology

The three main steps involved in producing our forecasts for LBTT and LTT are;

- first, we establish an in-year estimate for residential and commercial rates;

- second, the forecast models produce our pre-measures forecast, using the in-year estimates as their starting point; and

- third, we add the effects of any new UK Government policy measures.

In-year estimate

Our in-year estimate draws on monthly receipts data published by Revenue Scotland and the WRA, as well as the latest movements in property market indicators. We typically place more weight on grossing up receipts outturn from the year-to-date, though we might take a different approach if we believed receipts earlier in the year were not representative of full-year activity, or if we had fewer data points because of an earlier forecast than usual.

We normally produce an initial monthly profile by assuming that current-year receipts will follow a similar pattern to previous years, adjusted where necessary for things that can be anticipated. These include the usual seasonality in property market transactions, with fewer sales taking place in the final months of the fiscal year, and typically more completions on Fridays and ahead of public holidays.

Pre-measures forecast

To produce our pre-measures forecast we take the in-year estimate and use the relevant forecast model to project that forward over the forecast period. These models are operated on our behalf by the Scottish Fiscal Commission (SFC) and the Welsh Government, though the forecast assumptions and judgements are our own.

Both forecasts rely on a ‘price bin’ model that aggregates transactions within relatively small bands. The models calculate the tax due on the average price within each ‘bin’ and then projects that forward in line with our forecasts for property prices and transactions.

Why do our devolved forecasts use UK-wide property market determinants?

All our forecasts for property transaction taxes use UK-wide property market determinants, as we assume that Scottish and Welsh prices and transactions will generally rise in line with those for the UK as a whole. We do make occasional exceptions to this rule, if the latest available data suggests there has been some divergence. For example, in our October 2021 LBTT and LTT forecasts we reflected uneven property market developments since the start of the pandemic, resulting in faster growth in transactions in 2021-22 in both Scotland and Wales relative to the UK as a whole.

We continue to assume, in the absence of data to the contrary, that house prices in Scotland and Wales move with those for the UK over a longer horizon. Meen (1999) describes the spatial dynamics of house prices in different regions of the UK over time, suggesting that periods in which some regions experience faster house price inflation than others will tend to be transitory, and lower-inflation regions will tend to catch up over time. In the long term this limits divergence between regions. The charts below show that since 1975 this has broadly been the case.

Post-measures forecast

To produce our post-measures forecast we add the effects of any UK Government policies announced since our previous forecast that affect either LBTT or LTT receipts. For example, the Budget 2020 measure reducing lifetime gains eligible for business asset disposal relief on capital gains tax was expected to reduce property transactions and lower receipts for all UK property transactions taxes.

Latest forecast

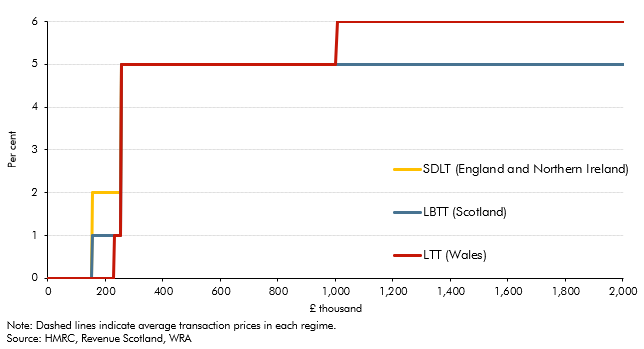

Our latest forecasts for LBTT and LTT were published in March 2024 and are shown in the table below. Receipts fall sharply in both 2022-23 and 2023-24, due to a recent squeeze in real incomes and a sharp rise in interest rates. We expect a peak-to-trough decline from 2022-23 to 2024-25 of 2.8 per cent for LBTT and 28.1 per cent for LTT, with receipts for both recovering in the later years of the forecast.

Table 1: Latest forecasts for LBTT, LTT and SDLT