Landfill tax applies to all waste disposed of by way of landfill at a licensed site, unless the waste is specifically exempt. Landfill tax has been devolved to Scotland and Wales, meaning there are three different regimes within the UK. The UK Government’s landfill tax applies in England and Northern Ireland, Scottish landfill tax came into effect in April 2015 while landfill disposals tax (LDT) has been in operation in Wales since April 2018.

Devolved landfill taxes

This Forecast in-depth page has been updated with information available at the time of the March 2024 Devolved tax and spending forecast.

Rates

The three tax systems are very similar because the devolved administrations have so far set tax rates to match those in the rest of the UK:

- The lower rate is set at £3.30 per tonne in 2024-25 and applies to waste that is ‘inert’ – i.e. less hazardous or less polluting materials such as bricks, concrete and sand.

- The standard rate is set at £103.70 in 2024-25 and applies to all other waste that is not exempt. Standard rated waste accounts for the vast majority of revenue from each tax.

Exemptions are similar too, including for disposals of waste which has been dredged from inland waterways and of waste arising from mining and quarrying operations. There are some minor differences relating to the treatment of payments to respective landfill communities’ funds, but these have a very small fiscal impact.

The Welsh Government has also introduced a third ‘unauthorised disposals’ rate that applies to all disposals that are made outside of authorised landfill sites, regardless of whether they would have qualified for the standard or lower rates. The 2024-25 rate for such disposals has been set at £155.55 per tonne of waste.

The Scottish Government has legislated to ban biodegradable municipal waste (BMW) going to landfill from 31 December 2025. This will prevent any biodegradable household (or similar) waste from entering landfill. Based on our forecast for the composition of waste arising, we expect this to reduce Scottish receipts from 2025-26.

Methodology

The three main steps involved in producing our forecasts for Scottish landfill tax and LDT are:

- first, we establish an in-year estimate using the latest administrative data;

- second, the forecast models produce our pre-measures forecast, using the quarterly in-year estimates for Scotland and Wales as their starting point; and

- third, we add the effects of any new UK Government policy measures.

In-year estimate

For Scottish landfill tax, we construct an in-year estimate using the latest data on the volume of both lower and standard-rated waste arising, as well as data on predicted incineration capacity for the remaining quarters of the year. This allows us to forecast the volume of both lower and standard-rated waste arising for the year, which we then multiply by the relevant tax rates.

The approach is slightly different for LDT, where the in-year estimate is produced by uprating the receipts outturn data for the current year, using the profile of quarterly receipts from previous years.

Pre-measures forecast

We use a model for Scottish landfill tax developed by the Scottish Fiscal Commission (SFC). The model grows the in-year estimate for the volume of landfilled waste in line with the forecast growth in waste arising, before making reductions for recycling, incineration and other non-landfill waste treatment infrastructure. The revenue forecast is generated by applying effective tax rates to the remaining tonnage, which is assumed to enter landfill.

The LDT forecast model is operated for us by Welsh Government analysts. This model does not take into account trends in waste arising or recycling – implicitly assuming the net level of each remains constant across the forecast – but is able to explicitly account for changes in infrastructure, such as changes in incineration capacity, and its effect on the tax base.

Policy

The final step is to add the effects of any UK Government policies announced since our previous forecast that affect receipts from the devolved landfill taxes. For example, the UK Government’s Budget 2020 ‘plastic packaging tax’ was expected to reduce the amount of waste sent to landfill, lowering receipts for each UK landfill tax.

Latest forecast

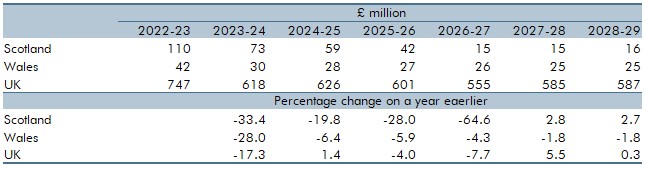

Our latest forecasts for Scottish landfill tax and LDT were published in March 2024 and are shown in the table below. The declining path for both largely reflects expected increases in incineration capacity resulting in lower volumes of waste being sent to landfill in each year of the forecast. Along with the BMW ban resulting in a sharp fall in Scotland from 2025-26. This continues the trend seen in the outturn data over recent years.

Table 1: Scottish landfill and LDT forecasts