Box sets » Financial transactions » Student loans

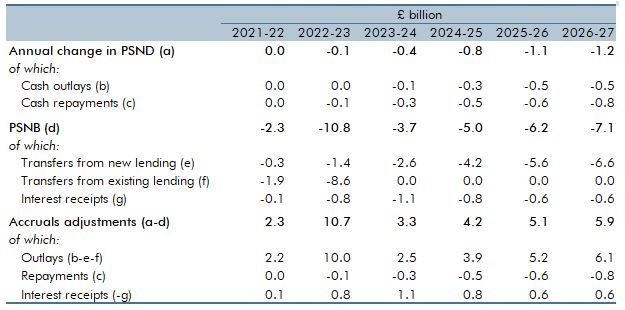

On 24 February 2022 the Government introduced a raft of changes to the working of the higher education student loans system in England. In this box we: summarised the reforms, explained their impacts on the complex accounting for student loans, and showed the overall impact on the latest forecast.

The accounting treatment for student loans changed dramatically in 2019 adding more than £10 billion to the deficit. This box summarised the history of this change and a review into the design of post-18 education financing.

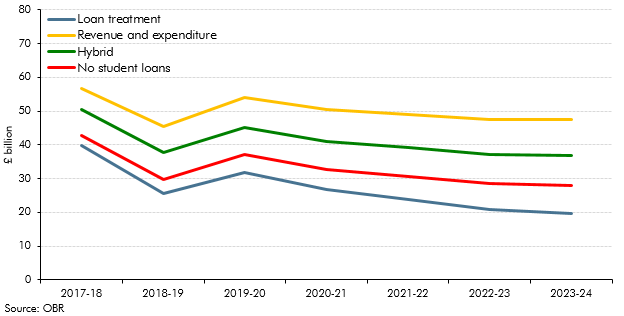

The accounting treatment applied to the burgeoning stock of student loans has been the subject of much interest over the past year, with reports from the House of Lords Economic Affairs Committee, the House of Commons Treasury Select Committee and the Office for National Statistics. In July, we published our own contribution in Working Paper No. 12: Student loans and fiscal illusions. In this box we analysed the possible impacts of different accounting treatments on our estimate of the deficit.

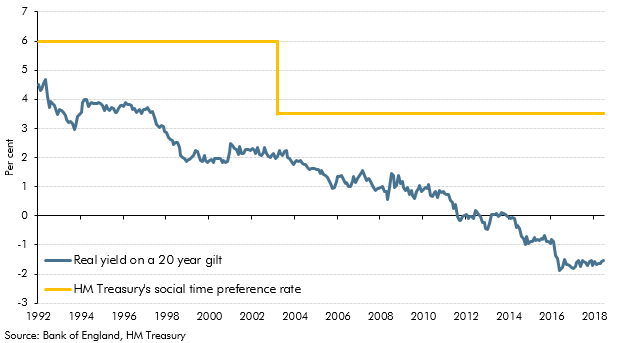

We incorporate sales of financial assets in our forecasts when firm details are available that allow the effects to be quantified with reasonable accuracy and allocated to a specific year. In the case of the sale of student loans the government also considers whether a sale offers value for money. This box looked at the way in which the Government uses discount rates to evaluate value for money, how this does not mean the sales strengthen the public finances and whether future sales are likely to proceed.

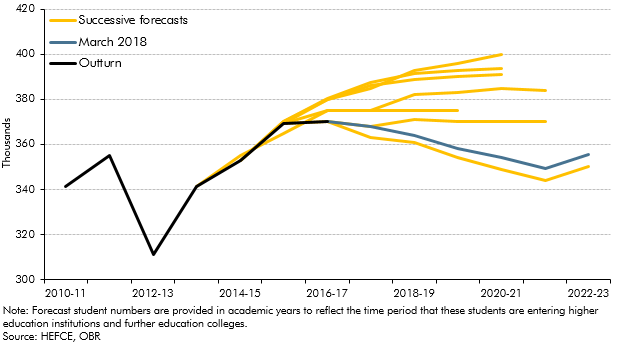

Student loans are the largest component of our financial transactions forecast, and even small changes to information about student numbers can have a significant impact on our public sector net debt forecast. This box from our March 2018 EFO discussed our previous and current student numbers forecasts and the factors that we take into account when producing them.

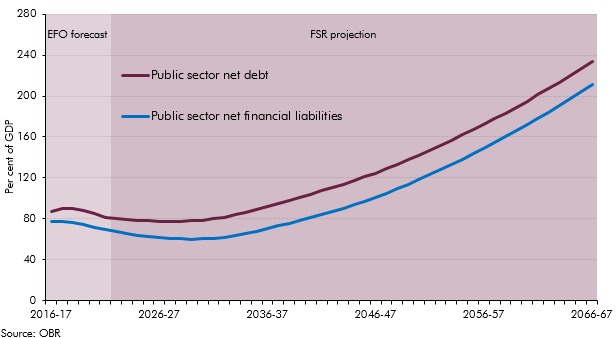

At Autumn Statement 2016 the Government asked us to forecast two new balance sheet metrics: PSND excluding the Bank of England and public sector net financial liabilities (PSNFL), a broader measure covering all the public sector’s financial assets and liabilities recorded in the National Accounts. This box presented our long-term projections for these two new balance sheet metrics with particular focus on PSNFL as PSND with and without the Bank of England tended to converge in our medium-term forecast and were expected to continue to do so over the long-term.

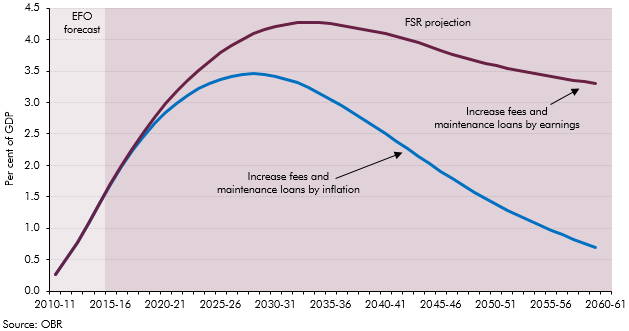

The Government carried out a number of reforms to the student finance support system, shifting funding from direct grants to loans to students. This box looked at the impact of student loans on public sector net debt.

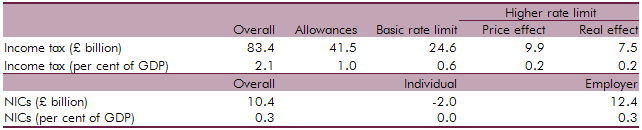

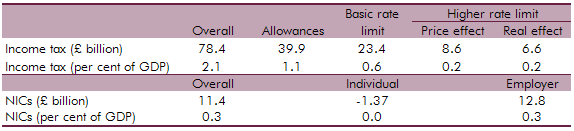

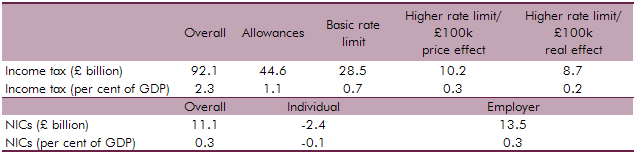

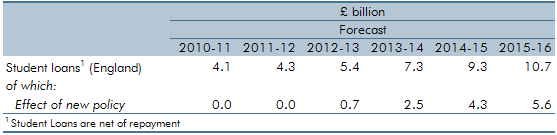

The Government set out proposals in England for a basic threshold of tuition fees of £6,000 per annum as well as an absolute limit of £9,000 in exceptional circumstances for undergraduate courses with effect from the 2012-13 academic year. This box outlined the effect of this student loan policy on the public finances.