The Government set out proposals in England for a basic threshold of tuition fees of £6,000 per annum as well as an absolute limit of £9,000 in exceptional circumstances for undergraduate courses with effect from the 2012-13 academic year. This box outlined the effect of this student loan policy on the public finances.

In November 2009 Lord Browne was asked to lead an Independent Panel to review the funding of higher education.a In response to his review, the Government set out proposals in England for a basic threshold of tuition fees of £6,000 per annum as well as an absolute limit of £9,000 in exceptional circumstances for undergraduate courses with effect from the 2012-13 academic year. A White Paper covering these issues will be published by the Government this winter and it is proposed that legislation will be brought forward in due course. However, sufficient detail has been provided of the policy to enable an estimate of the effects to be quantified for this forecast in England. The Devolved Administrations will need to consider their own response to the Browne review.

The Spending Review announced a £2.9 billion real terms cut in overall funding for higher education by 2014-15, with direct grants substituted for higher fees funded by increased loans to students. This proposal will therefore increase the value of the loans that the Government makes to students to fund tuition fees. Such loans are classified in the public finances as a financial transaction. The additional cash needed to fund the loans, net of repayments, increases the Government’s cash requirement (CGNCR) in any year and adds to the stock of public sector net debt (PSND), which is measured on a cash basis. However, financial transactions do not score directly in accrued measures of the deficit such as net borrowing, because the Government’s overall net liability position has not changed.

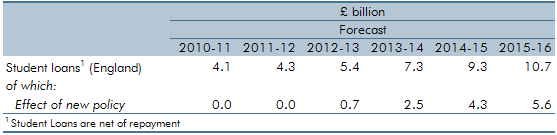

For the November forecast the OBR has scrutinised and certified estimates of the additional loans that have been produced by the Department for Business, Innovation and Skills (BIS) for England. As the table shows, the impact on the CGNCR is estimated to reach £5.6 billion by 2015-16, cumulatively adding £13 billion to PSND over the forecast period.

Table a: Effects of student loans on CGNCR

The key assumptions that drive these estimates are: the level of average fees charged; the loan take-up rate; and the growth in overall student numbers. For the purposes of these projections, BIS’s central estimate of the average fees charged by English universities as a result of the proposals is £7,500. The upper bound to this is a full increase in fees across the board to £9,000 per annum. However, it is possible that many universities will charge fees between the current levels and the proposed upper bound. BIS estimate that 90 per cent of students will take up loans to fund these fees, which is a slight rise on the current level reflecting the higher fee rates.

For these projections student numbers are assumed to be broadly flat. BIS analysed the effects of the introduction of variable tuition fees in 2006-07b and found little evidence of a sustained fall in HE participation. However, there are uncertainties as the counterfactual of participation rates in the absence of the reforms is unknown. Institute for Fiscal Studies researchc on the impact of variable tuition fees in 2006 found that increasing fees without increasing loans and/or grants by the same value or more will result in a negative impact on participation.

The proposed reforms to higher education tuition fees are also likely to have some effect on the rate of CPI inflation. This is discussed further in Chapter 3.