Box sets » Economic and fiscal outlook - March 2018

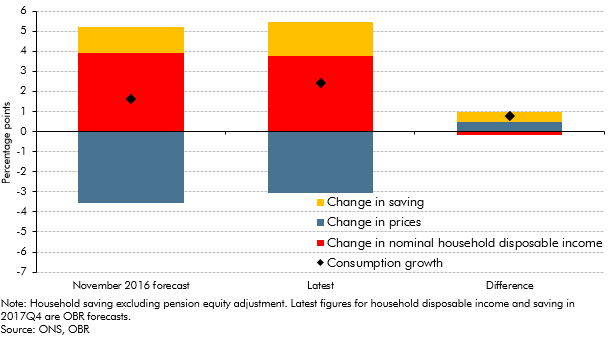

In the November 2016 EFO we made a number of judgements about how the vote to leave the EU would effect the economy in the near-term. This box from our March 2018 EFO compared these judgements against the outturn data that we had received since then, finding that most of these judgements were broadly on track.

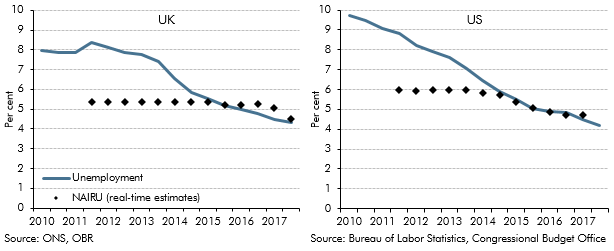

We revised down our estimate of the sustainable unemployment rate three times between 2015 and 2017, with unemployment falling faster than we had expected over that period but little evidence of rising wage pressure. This box from our March 2018 EFO compared the revisions we had made with those of the Congressional Budget Office in the US, which had faced similar issues when forecasting US unemployment.

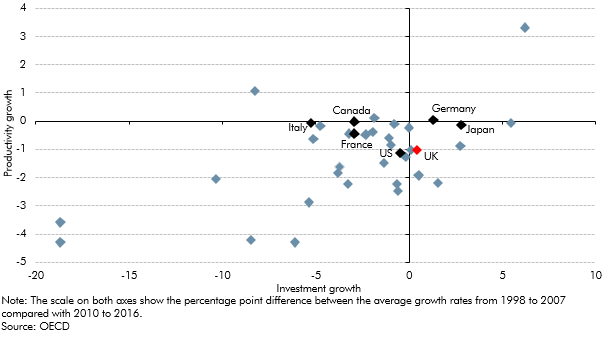

The outlook for productivity growth is one of the most important and yet uncertain areas of our economy forecast. In this box from our March 2018 EFO we looked at how actual productivity growth can be broken down into contributions from capital deepening and total factor productivity (TFP) growth and how differences in investment across countries could be related to post-crisis productivity performance.

Our first post-EU referendum forecast in November 2016 assumed that leaving the EU would result in a less open economy and lower productivity, but we did not incorporate an explicit link between the two over our medium-term forecast horizon. This box from our March 2018 EFO discusses why we did not include this link and what other forecasters have assumed.

The Pension Protection Fund is a significant part of the public sector, but as of March 2018 it did not appear in either outturn public finances data or in our forecasts. This box from our March 2018 EFO explained why that was the case, and why recent announcements from the Office for National Statistics meant that it represented a significant classification risk to our forecast.

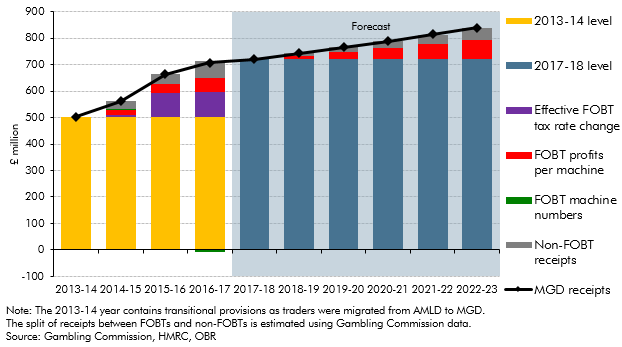

In 2017, the Government announced plans to reduce maximum permitted stakes on fixed-odds betting terminals (FOBTs) from £100 to between £50 and £2. This box from our March 2018 EFO explored recent trends in machine games duty (MGD) receipts and the contribution of FOBTs to them, illustrating the scale of receipts that might be affected by the planned policy change.

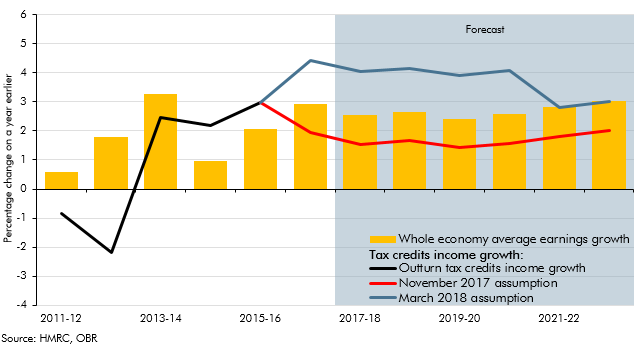

Spending on tax credits came in consistently lower than our forecasts from 2014-15 onwards. In our March 2018 EFO we increased our assumption for the growth in incomes of tax credits families relative to headline earnings growth, significantly lowering our tax spending forecast. This box set out the analysis that underpinned this change in forecasting assumption.

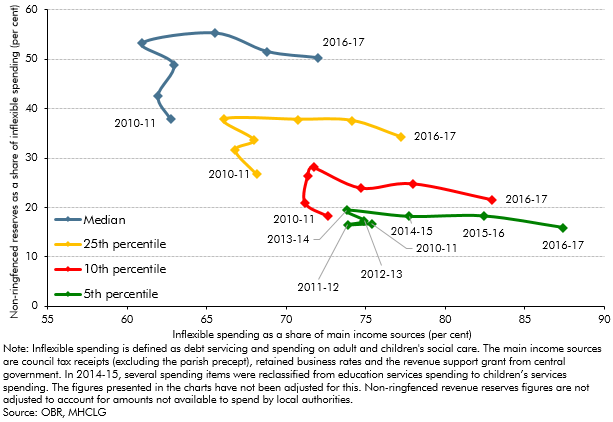

Local authorities’ net use of reserves (the amount they add to or drawdown from their stock of reserves) is a key judgement in our fiscal forecasts. This box from our March 2018 EFO examined two indicators of the general financial health of English local authorities over the period 2010-11 to 2016-17, assessing how these metrics might be used to inform our forecast judgements.

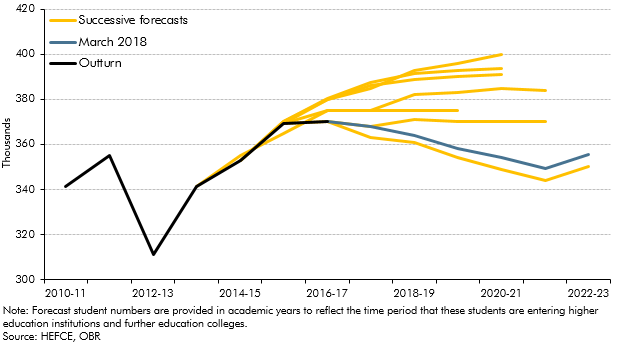

Student loans are the largest component of our financial transactions forecast, and even small changes to information about student numbers can have a significant impact on our public sector net debt forecast. This box from our March 2018 EFO discussed our previous and current student numbers forecasts and the factors that we take into account when producing them.