In the November 2016 EFO we made a number of judgements about how the vote to leave the EU would effect the economy in the near-term. This box from our March 2018 EFO compared these judgements against the outturn data that we had received since then, finding that most of these judgements were broadly on track.

This box is based on ONS data from February 2018 .

We expected the vote to leave the EU to be associated with lower net inward migration, partly due to weaker ‘pull factors’, such as a fall in the value of UK wages in prospective immigrants’ home currencies due to the depreciation of the pound. The latest data show that net migration slowed from 336,000 in the year to June 2016 to 244,000 in the year to September 2017. This was more than accounted for by net migration from the EU dropping from 189,000 to 90,000.

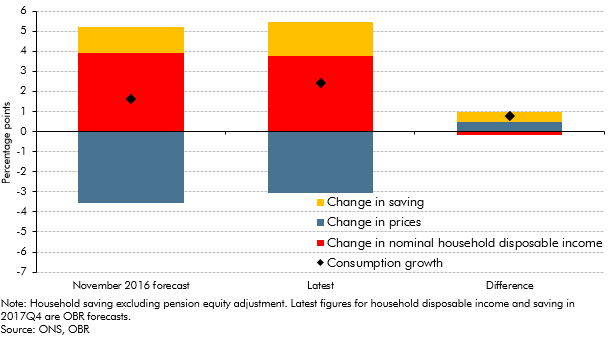

We also thought that the fall in the pound prompted by the vote would raise inflation, squeezing real incomes and real consumer spending. This judgement seems broadly on track, with CPI inflation well above our March 2016 forecast. Private consumption has held up a little better than we assumed in our November 2016 forecast, as household saving (excluding the pension equity adjustment) dropped more sharply than expected and as consumer prices (as measured in the National Accounts) rose by less than anticipated (Chart A).

Chart A: Contributions to real consumption growth: 2016Q2 to 2017Q4

We assumed that greater uncertainty surrounding future demand conditions, especially in internationally tradable sectors, would see some investment projects being postponed or cancelled. By the end of 2017, business investment was almost 6 per cent lower than our March 2016 forecast and the Bank of England has estimated that Brexit uncertainty has directly lowered business investment by 3 to 4 per cent.a But business investment has also held up better than we expected in our November 2016 forecast. It is worth remembering that there are large lags in some categories of investment between the decision to invest and when investment is carried out (e.g. from ordering to taking delivery of an aircraft); and the strengthening of the global economy may have boosted investment by some exporting firms. More generally, the business investment data are both highly volatile and liable to revision, so it is unwise to place too much weight on the precise quarterly path shown in any particular vintage of data.

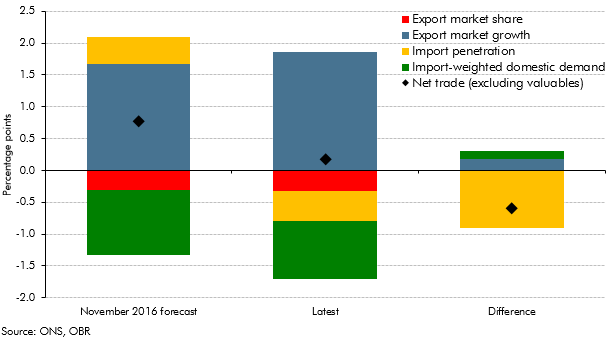

Finally, we forecast that the fall in sterling would boost net trade relative to our March 2016 forecast. The net trade contribution to growth over the past year and a half has been smaller than we forecast in November 2016.b Export and import growth have both been higher than expected, but import growth by a much greater margin. On the export side, this reflects stronger growth in the UK’s export markets – which we estimate has directly added around 0.2 percentage points to GDP growth. On the import side, this reflects a greater share of domestic demand being met by imports – where we had expected import intensity to ease slightly after the fall in sterling (Chart B).

Chart B: Net trade contributions to GDP growth between 2016Q2 and 2017Q4

Overall, the small positive contribution from net trade since the referendum has been insufficient to offset the slowdown in domestic demand, so real GDP growth from second quarter of 2016 to the final quarter of 2017 has been 0.6 percentage points weaker than our final pre-referendum forecast in March 2016. However, growth has been more resilient than our initial post-referendum forecast in November 2016, exceeding it by 0.6 percentage points as domestic demand has held up better than expected (thanks in part to consumers saving less). But some of the extra domestic demand appears to have been spent on imports, reducing the extent to which net trade has supported GDP growth.

This box was originally published in Economic and fiscal outlook – March 2018