Box sets » Fiscal sustainability report - July 2014

The European System of National and Regional Accounts (ESA 10) changed the arrangements for funded defined benefit pension schemes. The new approach required that the net liabilities of these schemes for the future costs incurred from past activities were calculated using commercial accounting concepts. This box provided a summary of the effects that the new treatment would have, as well as its relevance to the Whole of Government Accounts (WGA).

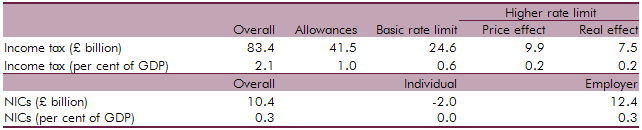

At Budget 2014, the Government announced a number of tax measures that increase the flexibility with which individuals can access their defined contribution (DC) pension assets. This box considered the effect of two possible sensitivities. First, the possibility that there would be more money flowing into the housing market, and second, that people could spend their pension pots relatively early in retirement, leading to greater reliance on income-related benefits.

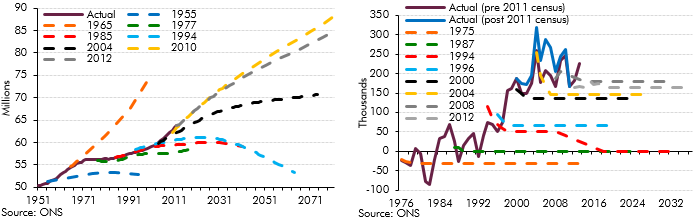

Population projections are subject to significant uncertainty, particularly over very long time horizons. This box outlined the error in successive population projections and the sources of error.

In Annex A of our 2013 Fiscal sustainability report, we reviewed the assumptions that we make about the fiscal effects of net migration. In this box from our 2014 Fiscal sustainability report we summarised the migration-related issues that we consider explicitly in our long-term projections, those that are implicit in the material we use to produce them, and, importantly, those issues we do not consider – either because of our modelling techniques or because they fall outside the remit that Parliament has set the OBR.

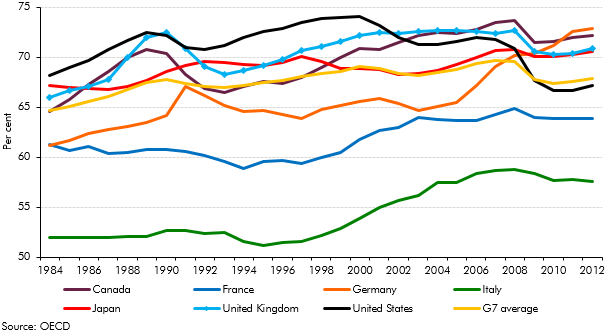

Earlier in the year, the Chancellor expressed an ambition “to have more people working than any of the other countries in the G7 group". This box compared countries employment rates and demonstrated the scope for labour market outcomes to differ substantially.