Box sets » Public spending » Whole of Government Accounts and National accounts

The European System of National and Regional Accounts (ESA 10) changed the arrangements for funded defined benefit pension schemes. The new approach required that the net liabilities of these schemes for the future costs incurred from past activities were calculated using commercial accounting concepts. This box provided a summary of the effects that the new treatment would have, as well as its relevance to the Whole of Government Accounts (WGA).

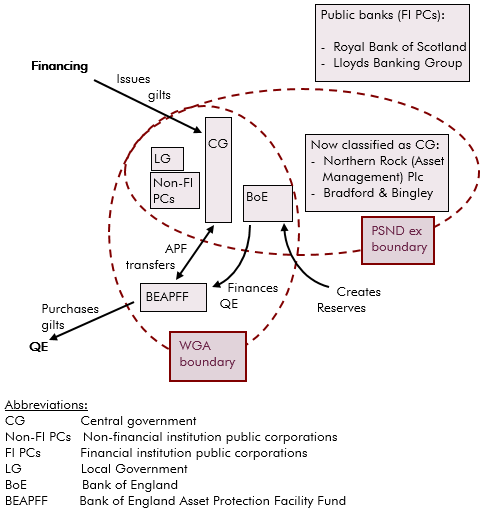

In 2013 the National Accounts measure of PSNB and PSND widened to include Bradford and Bingley and Northern Rock (Asset Management), and also included the APF transfers from the BEAPFF to central government. This box explained how the QE and APF transactions are treated in WGA and in the National Accounts, and the differences between them.

The Whole of Government Accounts (WGA) contains information on future fiscal liabilities that are relevant for our forecast. This box explained how we ensured that those future liabilities reported in the WGA were fully reflected in our forecasts, where those liabilities were expected to affect the public finances.

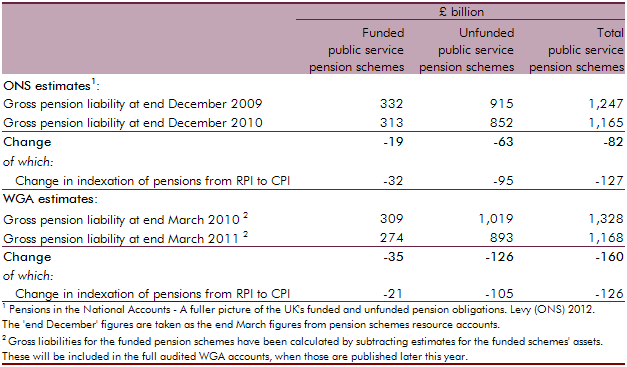

In April 2012, the Office for National Statistics (ONS) published the first set of new statistics on the total gross liabilities of UK pension providers, including the UK government. This box explored how the ONS’ pension liability estimates were calculated for public service pensions and state pensions, and compared the public service estimate to the Whole of Government Accounts (WGA) methodology.

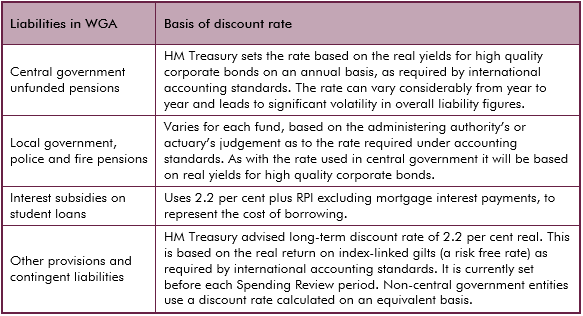

Discount rates are used to convert future cash flows into an equivalent one-off upfront sum or present value, allowing them to be presented alongside stock measures on a single balance sheet. But there is no single ‘correct’ discount rate and the use of discount rates presents some challenges in analysis of balance sheet movements over time. This box from our first Fiscal sustainability report in 2011 outlined the different discount rates used in the Treasury’s Whole of Government Accounts.

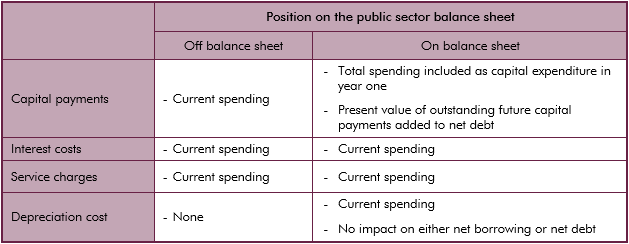

Depending on ONS classification assets relating to PFI contracts can be on the public sector or the private sector balance sheet. This box outlined the accounting of PFI contracts in the National Accounts and WGA.