Box sets » Economic and fiscal outlook - March 2013

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our March 2013 Economic and Fiscal Outlook, we made adjustments to our forecasts of real GDP, business investment and inflation

In early OBR forecasts we estimated a significant negative output gap following the late-2000s recession, which we did not expect to have closed by the end of the forecast horizon. Our March 2013 forecast implied that potential output would be 14.6 per cent below an extrapolation of its pre-crisis trend after five years, with actual output a further 2.3 per cent below that. This box examined the implications of that forecast, as well as the fiscal implications of some possible alternative assumptions.

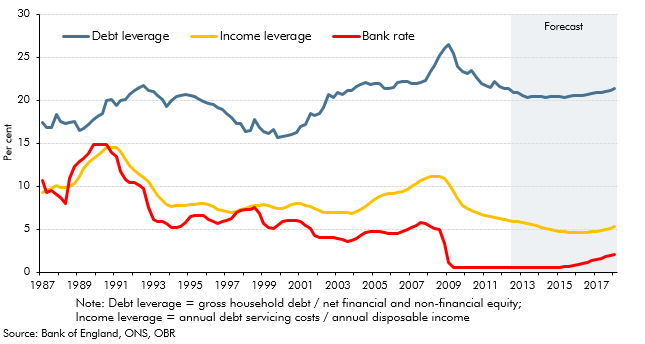

The household saving ratio continued to rise in 2012. This box explored the possible reasons for this, considering evidence from the latest available NMG household survey. The box also discussed the implications for household balance sheets, noting that in aggregate households appeared to have used higher saving to finance accumulation of more financial assets, rather than paying down debt.

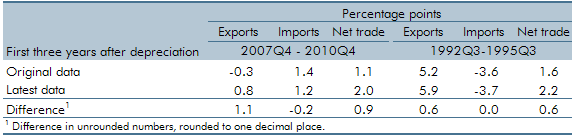

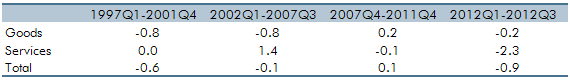

Exports fell during 2012, partly reflecting lower growth in UK export markets and a rise in sterling, although part of that fall was unexplained. This box looked at some past trends in the composition of exports to offer some explanation for that weakness, highlighting in particular the fall in financial services exports, and compared this against trends seen in the US.

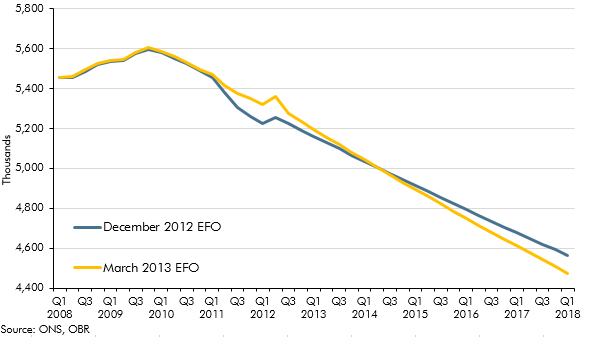

Our general government employment (GGE) forecast is based on projections of the growth of the total government paybill and paybill per head, which is in turn based on the Government's latest spending plans. In this box we compared our GGE forecast against the outturn data since the start of the 2010 Spending Review period. This allowed some assessment of how public sector employers were progressing with their intended workforce reduction and how much adjustment would still be required.

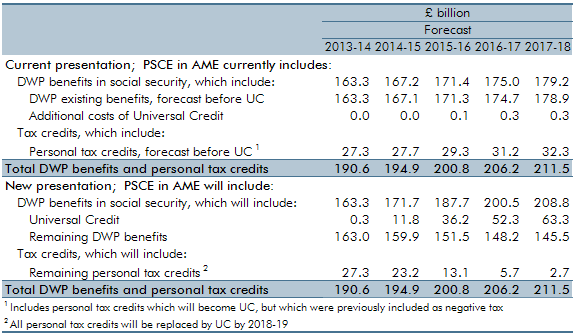

In Chapter 4 of our March 2013 EFO, we discussed the fiscal outlook for 2013-14 to 2017-18. In this box, we introduced a new marginal cost presentation of the universal credit forecast and also outlined contributing factors to changes in the forecast. These factors included policies announced at the 2012 Autumn Statement and changes to a number of the universal credit policy parameters as well as refinements to the methodology and assumptions used to forecast universal credit. The analysis in this box has since been superseded by developments in the universal credit forecast.

The Government undertook a number of interventions in the financial sector in response to the financial crisis and subsequent recession of the late 2000s. This box provided an update of the estimated net effect of them on the public finances as of March 2013.

The Whole of Government Accounts (WGA) contains information on future fiscal liabilities that are relevant for our forecast. This box explained how we ensured that those future liabilities reported in the WGA were fully reflected in our forecasts, where those liabilities were expected to affect the public finances.