Discount rates are used to convert future cash flows into an equivalent one-off upfront sum or present value, allowing them to be presented alongside stock measures on a single balance sheet. But there is no single ‘correct’ discount rate and the use of discount rates presents some challenges in analysis of balance sheet movements over time. This box from our first Fiscal sustainability report in 2011 outlined the different discount rates used in the Treasury’s Whole of Government Accounts.

The discount rate is the interest rate used to convert future cash flows into an equivalent one-off upfront sum or present value. The higher the discount rate, the lower the present value of a given future amount. For a given future cash flow, the discount rate therefore has a significant impact on the present value of the liability.

There are many possible choices of discount rate. For example, in a separate context, outside of financial reporting, and following a recommendation from the Independent Public Service Commission (IPSPC), the Treasury ran a public consultation on which discount rate should be used to determine the levels of pension contributions required for unfunded public service pension schemes. This considered various plausible options outlined by the IPSPC, including a:

- rate consistent with the private sector and other funded schemes;

- rate based on the yield on index-linked gilts;

- rate in line with expected GDP growth; and

- social time preference rate – the value society places on current consumption as opposed to future consumption.

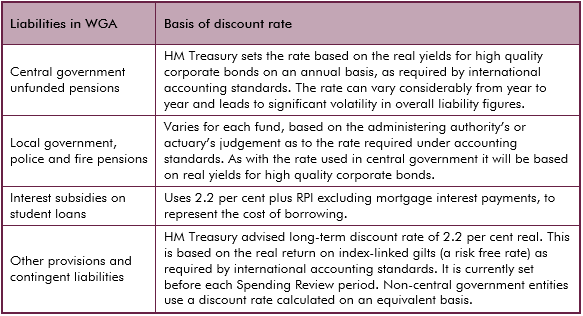

Following this consultation, the Treasury announced that it will use long-term expected GDP growth as the basis for this rate. For the purposes of shedding light on fiscal sustainability, a discount rate in line with expected GDP growth has the virtue of discounting future spending at the same rate that one might expect aggregate tax revenues to grow. That said, there is no single ‘correct’ discount rate and it is important to be aware of the impact that the choice of rate has on published liability estimates. As shown in Table A, WGA uses different discount rates in different parts of the accounts, depending on the relevant accounting conventions and standards.

Table A: Examples of different discount rates in the WGA