For the first time in any Economic and fiscal outlook, our March 2017 forecast showed post-measures borrowing rising year-on-year in one year of the forecast – 2017-18. This box explored the factors that explained why borrowing was expected to rise in that year, when our November 2016 forecast had assumed it would continue to fall.

In our November EFO, we expected PSNB to fall by £9.2 billion between 2016-17 and 2017-18. Restating that forecast on the new CT methodology reduces that year-on-year fall to £7.2 billion, due to the April 2017 CT rate cut having a bigger effect in 2017-18 on the new basis. However, on a like-for-like basis we have now revised that year-on-year fall to a rise of £6.5 billion. Excluding the effect of the transfer of the Royal Mail pension fund in 2012-13, this is the first time we have forecast a rise in PSNB in any year of any post-measures forecast. (Pre-measures forecasts have shown rises before, but they have been offset by policy decisions. That is true in this forecast for 2020-21, which would have risen slightly in cash terms absent policy changes.)

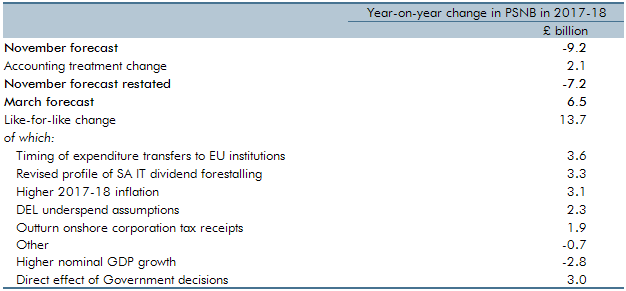

Table E shows that the £13.7 billion like-for-like swing from a fall in borrowing in 2017-18 to a rise reflects six key factors:

- changes to the timing of expenditure transfers to EU institutions within calendar year 2017 move spending from the end of 2016-17 into 2017-18. On its own, that contributes £3.6 billion to the change in borrowing;

- more dividend income brought forward ahead of the rise in dividend tax in April 2016. This implies lower dividend tax receipts in 2017-18, from where the income was shifted (see Box 4.3), contributing £3.3 billion to the change. The weakness in cash receipts will only come in during the early part of 2018 (as tax on this income is largely paid via self-assessment in the following January), so all else equal the path of deficit reduction over the first three-quarters of 2017-18 will be stronger than our full-year forecast;

- our forecast for higher RPI inflation next year (partly knock-on effects from Government decisions) boosts accrued debt interest spending on index-linked gilts. This is only partly offset by higher excise duty rates next year, as the fuel duty rate is frozen again. The net effect contributes £3.1 billion to the change;

- we have increased our estimate of departmental underspending in 2016-17, which we assume will not be repeated in 2017-18. This contributes £2.3 billion to the change;

- higher onshore CT payments this year have boosted our 2016-17 forecast by £4.4 billion. We have pushed roughly half that sum into next year, as we assume the other half reflects changes in the timing of instalment payments. That reduces year-on-year growth in receipts, contributing £1.9 billion to the change in borrowing profile; and

- the direct effect of Government decisions at this Budget pushes the year-on-year rise in PSNB next year up by £3.0 billion. That includes the money set aside to help meet the costs to the public sector of having reduced the personal injury discount rate and the additional grants to local authorities for adult social care spending.

Partly offsetting those factors, the upward revision to our nominal GDP growth forecast has boosted year-on-year tax receipts growth by around £2.8 billion. That reflects upward revisions to growth in wages and salaries, nominal household consumption and company profits.

Table E: Revisions to the profile of PSNB in 2017-18

This box was originally published in Economic and fiscal outlook – March 2017