Box sets » Financial transactions » Asset Purchase Facility

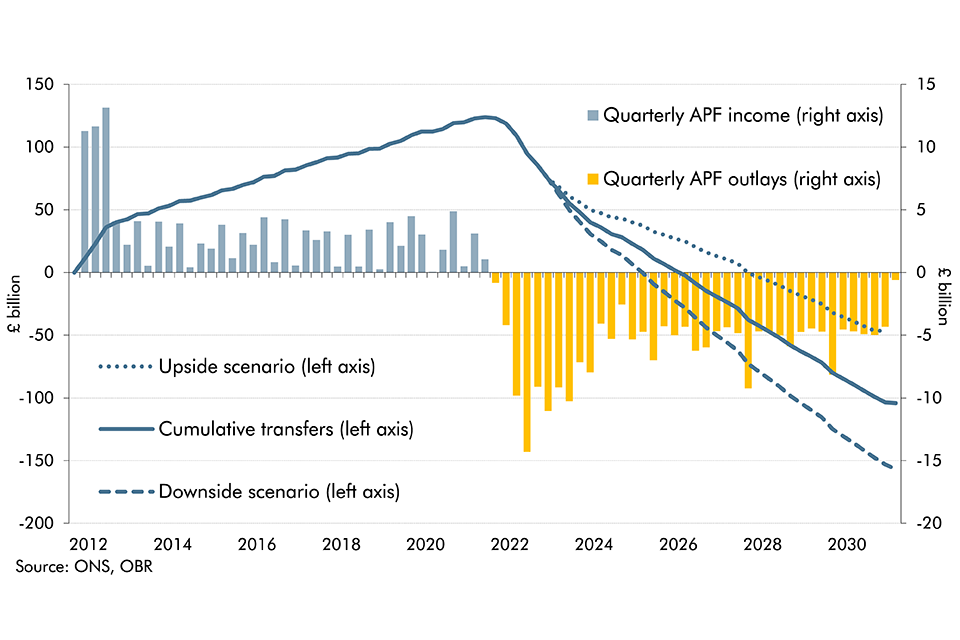

The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. In this box we updated our estimate of the lifetime direct costs of the APF and scenario analysis looked at the impact of changes in interest rates on this lifetime cost.

Up to July 2022 the Bank of England's quantitative easing (QE) activities had made large profits resulting in large transfers to the Treasury but since then flows have reversed. This box described what the whole lifetime direct costs of QE would be based on our March EFO assumptions.

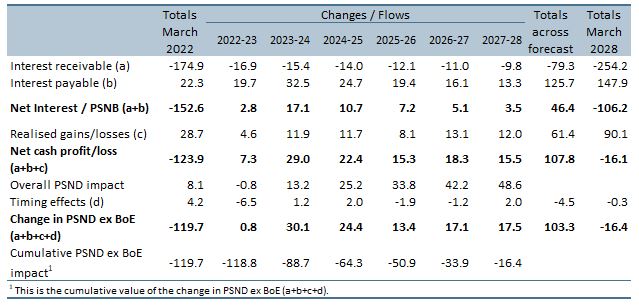

The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. Following sharp rises in interest rates in 2022 the APF has started to make large cash losses. This box looked at the causes of those losses and how they feed through to fiscal aggregates.

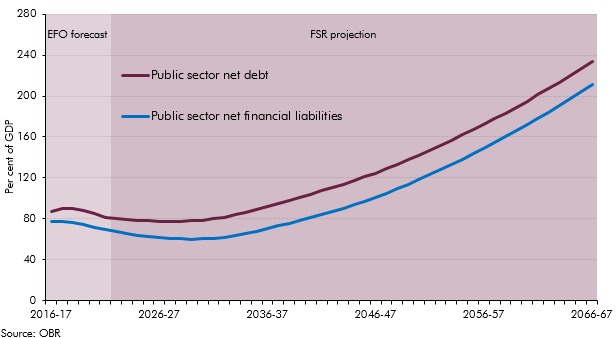

At Autumn Statement 2016 the Government asked us to forecast two new balance sheet metrics: PSND excluding the Bank of England and public sector net financial liabilities (PSNFL), a broader measure covering all the public sector’s financial assets and liabilities recorded in the National Accounts. This box presented our long-term projections for these two new balance sheet metrics with particular focus on PSNFL as PSND with and without the Bank of England tended to converge in our medium-term forecast and were expected to continue to do so over the long-term.

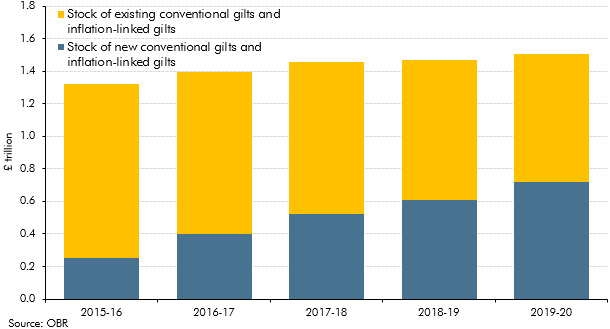

Our March 2015 Economic and fiscal outlook forecast highlighted large changes in our debt interest forecast since previous fiscal events and the added complexity that debt interest was expressed net of the effect of gilts held by the Bank of England Asset Purchase Facility (APF) associated with past quantitative easing. This box described how we produced the debt interest forecast and illustrated some of the sensitivities to which it was subject.

Public finances data are subject to regular classification and methodological changes. This box outlined the classification changes associated with the implementation of the new 2010 European System of Accounts (ESA10). Annex B of our March 2014 EFO explained these changes in more detail.

This box explored the implications of the new 2010 European System of Accounts (ESA10) on our public finances forecast, ahead of its incorporation in our December 2014 EFO. Annex B of our March 2014 EFO explained these changes in more detail.

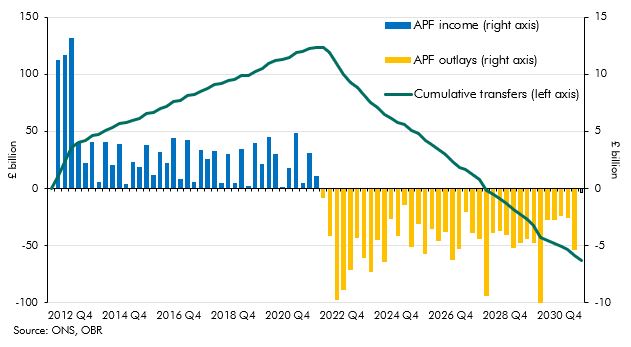

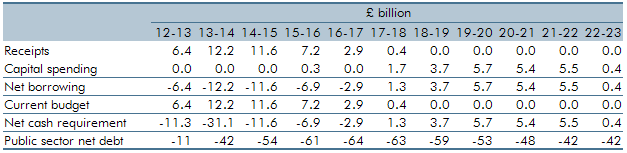

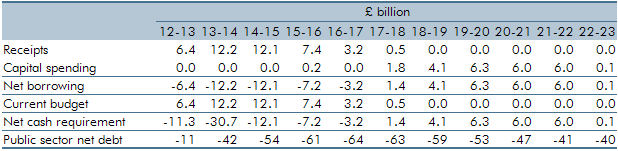

The Bank of England’s purchases of gilts under its quantitative easing (QE) programme are undertaken by its subsidiary, the Asset Purchase Facility (APF). Since late 2012-13, the Exchequer received excess cash held in the APF on an ongoing basis. This box summarised the approach used to estimate the fiscal impact of projected APF flows and the changes in these projections since our December 2013 Economic and fiscal outlook forecast. It also highlighted the large uncertainty about the timing and pace of quantitative easing (QE) unwinding.

In 2012-13, excess cash held in the Bank of England’s Asset Purchase Facility (APF) has been transferred to the Exchequer on an ongoing basis requiring us to forecast future flows. This box outlined the forecasted APF flows and the changes in these estimates since March.

Public finances data are subject to regular classification and methodological changes. This box outlined potential classification changes ahead of the PSF review. Annex B of our March 2014 EFO explained these changes in more detail.

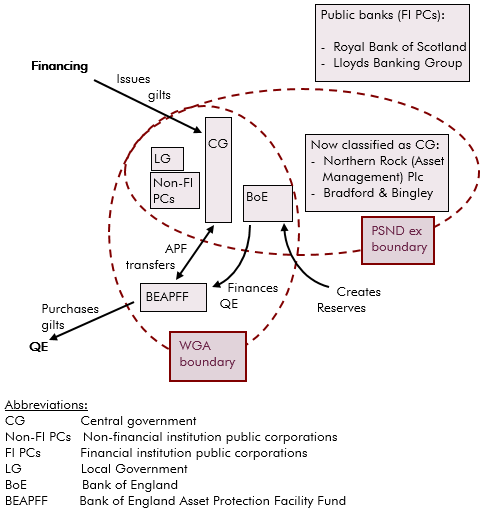

In 2013 the National Accounts measure of PSNB and PSND widened to include Bradford and Bingley and Northern Rock (Asset Management), and also included the APF transfers from the BEAPFF to central government. This box explained how the QE and APF transactions are treated in WGA and in the National Accounts, and the differences between them.