The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. Following sharp rises in interest rates in 2022 the APF has started to make large cash losses. This box looked at the causes of those losses and how they feed through to fiscal aggregates.

This box is based on OBR and ONS data from February 2023 and February 2023 .

Since quantitative easing (QE, the purchasing of government debt and other assets financed by the issuance of central bank reserves) was introduced in the wake of the 2008 financial crisis, central banks around the world have made large profits on these interventions. This is because the interest they pay on the reserves that finance QE asset purchases has been lower than the interest received on those assets for much of this period. In the UK, by March 2022 this had allowed the Bank of England to transfer £120 billion of cash profits on the APF to the Treasury (which both receives the profits from, and indemnifies the Bank against any losses on, the APF).

In recent months, as Bank Rate and other market interest rates have risen and so market prices for government debt held by the APF fallen, these profits have turned to losses from two sources:

- Interest losses, as the variable rate paid on central bank reserves exceeds the fixed rates paid on the assets purchased over the past 14 years (in the UK mainly gilts).

- Valuation losses as the market value of the roughly £820 billion in gilts still held in the APF has fallen below the purchase value by about £165 billion. These ‘mark-to-market’ losses only crystallise under the Treasury indemnity as and when gilts are sold.

Different central banks have different arrangements for sharing both past QE-related profits and future losses with their national treasuries and will account for these losses in a variety of ways and over different time periods. But, ultimately, the losses will end up on the books of their national governments who are the banks’ beneficial owners. In the UK, where we are used to accounting for the whole public sector including the central bank, both past profits and current and future losses feed into our forecasts for public borrowing and debt as they crystallise. The current losses on the APF affect fiscal aggregates in the following ways:

- Public sector net borrowing records the interest losses that occur when interest received on holdings of gilts and other assets is less than interest paid on central bank reserves.

- In public sector net debt, as stocks of APF assets are run down (either actively or passively), any differences between purchase price and sale price (for active sales) or redemption price (for passive run-offs) result in a realised cash loss. In debt, this is partially offset as any difference between the purchase and redemption price was recorded as public debt when the gilts were purchased. So, any further loss recorded in debt is any difference between redemption value and sale value. In addition, the net interest losses that increase annual borrowing also add to debt.

- Public sector net debt excluding the Bank of England is affected by APF losses at the point that the Bank’s APF calls on its Treasury indemnity, which (with lags) reflects the cash loss.

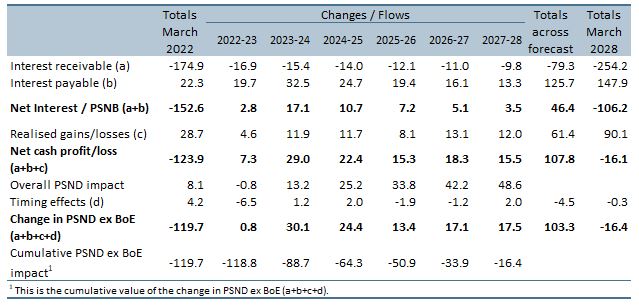

Table A summarises the starting and ending financial position of the APF over the current and next five years. It shows:

- Interest gains/losses. In the 13 years to the end of 2021-22, the APF had received £175 billion in interest on its assets and paid £22 billion in interest on the reserves issued to finance those assets, yielding a net profit of £153 billion for the public sector as a whole. From 2022-23 onwards, this reverses as the interest rate on reserves rises above that on gilts and other assets – yielding a net loss that peaks on an annual basis at £17 billion in 2023-24. The net loss then declines across the forecast as Bank Rate falls back and the volume of assets held in the APF decreases. Total interest losses, and so borrowing, sum to £46 billion between 2022-23 and 2027-28.

- Crystallised valuation gains/losses. In the 13 years to the end of 2021-22, £29 billion of valuation losses had crystallised in the APF. These losses increase across the forecast to a total of £61 billion, as gilt sales at prices below those at which those gilts were purchased add to losses crystallised on gilts that are redeemed at maturity.

Combining interest and valuation losses, total cash losses amount to £108 billion over the forecast, almost reversing the £124 billion cash profits to date. The APF is assumed to call on the Treasury for most of this loss within the forecast period, increasing debt excluding the Bank of England by £103 billion.

By the forecast horizon public sector net debt excluding the Bank of England (PSND ex BoE) remains £16 billion lower than it would have been in the absence of QE (in a narrow sense that ignores the support it provided to the economy). Headline PSND is £49 billion higher than it would otherwise have been, with the difference explained by £65 billion of valuation losses recorded within Bank of England debt as a result of gilts still held in the APF that were purchased at prices above their redemption value.

Table A: Forecast of APF stocks and flows

While this year has seen a reversal of net flows under the APF – from benefiting to costing the Exchequer – that has been dramatic in its speed and scale, it has always been expected that one day the direction of these flows would reverse. For example, when opting to withdraw the cash held by the APF, rather than leave it to build up in the facility, in November 2012,a the Government foresaw the likelihood of losses as Bank Rate rose or the scheme wound down – both of the mechanisms by which losses are now occurring. And we have been forecasting future losses (dependent on market expectations and QE policy assumptions) since our first forecast with APF related flows in December 2012. Indeed, in a world where the yields and prices of longer-dated government bonds reflect expectations of the future path of Bank Rate, it should be expected that the gain from building up and running down a portfolio of gilts financed at Bank Rate would, on average, net out to zero.

This box was originally published in Economic and fiscal outlook – March 2023