The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. In this box we updated our estimate of the lifetime direct costs of the APF and scenario analysis looked at the impact of changes in interest rates on this lifetime cost.

This box is based on ONS and OBR data from March 2024 .

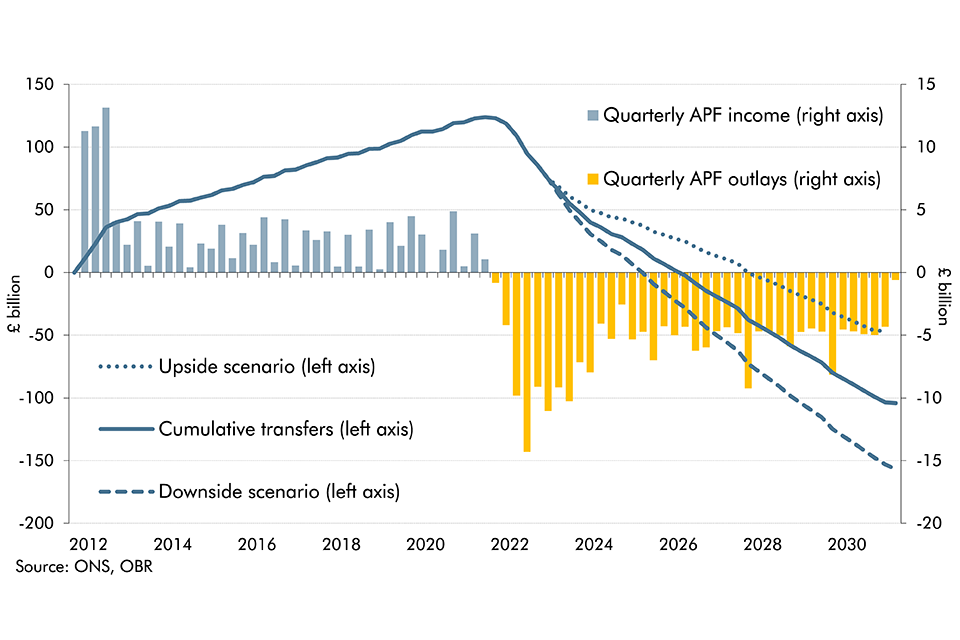

Since Bank Rate and gilt yields rose from their record lows in the second half of 2022, the Bank of England’s Asset Purchase Facility (APF) has gone from making a profit to making a loss. Having transferred £123.9 billion of cash profits to the Treasury between January 2013 and October 2022, a total of £49.4 billion has been transferred from the Treasury to cover losses incurred by the APF since then. Our latest estimate of the lifetime cost of the APF is a net loss of £104.2 billion. This is £21.9 billion less than we forecast in November due to Bank Rate and gilt yields being 0.8 and 0.6 percentage points lower from 2024-25 onwards, respectively.

This reduction underscores the sensitivity of this calculation to market conditions (in Box 4.3 we discuss the wider volatility of the debt interest forecast). Alongside our central estimate, in Chart G we present upside and downside scenarios that assume Bank Rate and gilt yields are 100 basis points higher and lower from 2024-25:

- With lower interest rates the lifetime cost is £46.6 billion, which is £57.6 billion lower than the central scenario, comprising a £28.1 billion reduction in interest losses and £29.6 billion reduction in valuation losses.

- With higher interest rates the lifetime cost is £156.9 billion, which is £52.7 billion higher than the central scenario, comprising a £28.0 billion increase in interest losses and £24.7 billion in valuation losses.

Chart G: Forecast of quarterly and cumulative flows to and from the APF

This is not a comprehensive assessment of the overall fiscal impact of the Quantitative Easing programme, which supported the economy, asset prices, and financial markets at various points of stress over the past 15 years. The wider economic and fiscal benefits of these interventions would need to be considered in any comprehensive assessment of the impact of QE.

This box was originally published in Economic and fiscal outlook – March 2024