Our March 2015 Economic and fiscal outlook forecast highlighted large changes in our debt interest forecast since previous fiscal events and the added complexity that debt interest was expressed net of the effect of gilts held by the Bank of England Asset Purchase Facility (APF) associated with past quantitative easing. This box described how we produced the debt interest forecast and illustrated some of the sensitivities to which it was subject.

Given the large changes in our recent debt interest forecasts – and the added complexity that debt interest is now expressed net of the effect of gilts held by the Bank of England Asset Purchase Facility (APF) associated with past quantitative easing – this box describes how we produce the debt interest forecast and illustrates some of the sensitivities to which it is subject.

We start with an estimate of the stock of different types of debt on which government must pay some form of debt service. These include:

- conventional gilts (net of the amount held by the APF);

- index-linked gilts;

- the liabilities of the APF; and

- other financing products (such as NS&I).

We forecast changes to these stocks by adding the net cash requirement each year to the total stock of debt, projecting redemptions of gilts and other liabilities, and making assumptions about the composition of gross financing each year to cover the cash deficit and redemptions.

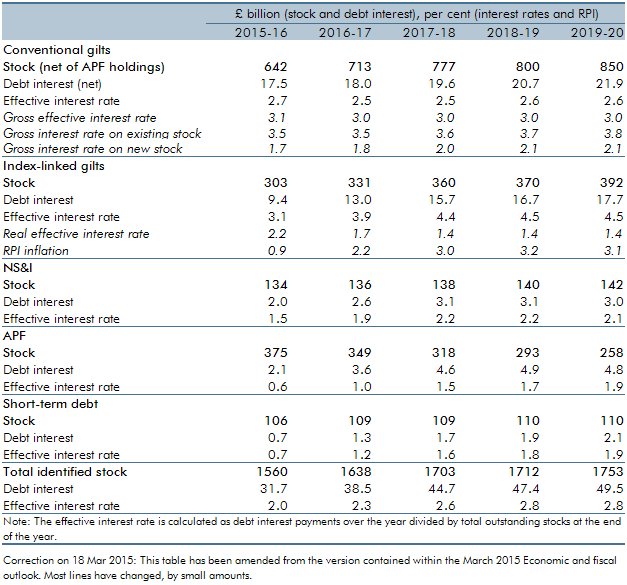

Spending on debt interest is then determined by the effective interest rate paid on the stock of each type of debt. Table D shows the amount of stock outstanding, the debt interest payments and the effective interest rates for different types of debt. There are different drivers of our forecasts for these effective interest rates, most of which are derived from financial market prices:

- debt servicing on conventional gilts is distinguished between debt interest on conventional gilts for new and existing debt. Payments on the existing stock of conventional gilts are fixed for the lifetime of those gilts. Payments on new conventional gilts reflect current and future market conditions, as summarised in the weighted average conventional yield curve and the level of new borrowing. The stock of old conventionals declines over the forecast period due to redemptions, whereas the stock of new conventionals rises due to new gross issuance. The effective interest rate on conventional gilts is projected to be broadly flat over the forecast period, reflecting two offsetting factors: refinancing old debt at the lower prevailing rates pushes down debt interest costs; but financing new debt becomes relatively more expensive over time;

- index-linked gilts (ILGs) differ from conventionals in that the coupon payments and principal are adjusted in line with the RPI. The debt interest accrued each month therefore reflects a fixed component – the real interest rate set when gilts are sold – and a variable component – inflation. Most of the payment relates to the inflation component. Indeed real rates are currently projected to be negative over the forecast period, which means the effective rate on new index-linked gilts would continue to be less than the rate of RPI inflation;

- the APF receives coupon income on the gilts it holds and pays Bank Rate on its loan from the Bank of England. (The Bank charges the same rate on the reserves it has created to finance the loan to the APF.) The coupon payments cancel out within the public sector, so this debt is in effect financed at Bank Rate. We assume that gilts held by the APF will not be sold actively during the forecast period, and will only be run down through redemptions once Bank Rate begins to rise;

- the government also finances other short-term debt (mainly Treasury bills) and issues savings products through NS&I. We use short-term market interest rates to project forward payments on Treasury bills, and these also inform our forecasts for payments on most NS&I products (‘pensioner’ bonds are a notable exception); and

- our central government debt interest forecast includes interest payments made by UK Asset Resolution (UKAR) and Network Rail, which are both classified within the central government sector, as well as other smaller payments, such as interest on finance leases.

Table D: Total outstanding stocks, debt interest payments and effective interest rates over the forecast period

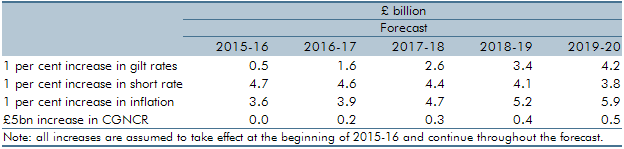

The large revisions in recent forecasts illustrate the sensitivity of debt interest payments to changes in market interest rates, inflation and borrowing. Alongside each EFO, we publish a table of debt interest ready reckoners on our website that quantify these sensitivities. Table E contains the ready reckoners consistent with this forecast. It shows that:

- the effect of a persistent increase in conventional gilt rates would only gradually build over time, as higher rates only apply to new debt issuance, and UK conventional gilts have a relatively long average maturity;

- higher short-term rates would quickly lead to higher debt interest costs, through the APF holdings and as short-term debt rolls over;

- an increase in RPI inflation would also have an immediate impact, as it increases accrued payments on both old and new index-linked debt. The table shows the consequences of a succession of shocks to annual inflation, with the higher impact over time mainly reflecting a rising stock of gilts; and

- assuming interest rates were to remain unchanged, an increase in the central government net cash requirement would have a more modest effect over the forecast period.

Table E: Debt interest ready reckoners

The structure of the UK’s debt and the effect of the APF gilt holdings also have some important implications for our forecast:

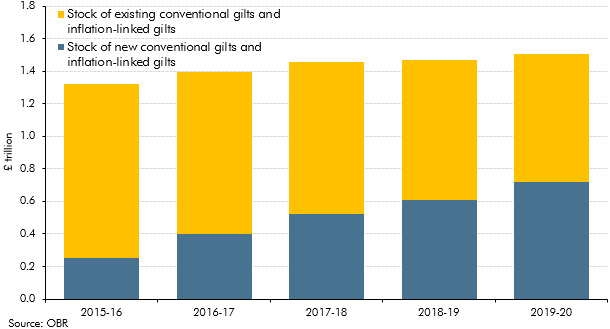

- a relatively long average maturity of existing debt means that changes in interest rates only gradually affect our medium-term forecast. More than half of the projected gilts at the end of the forecast period have already been issued (see chart A);

- the assumed skew of future debt issuance also has a bearing on our forecast, as longer-term debt tends to be relatively more expensive to finance, reflecting term premia, and conventional and index-linked gilts attract different rates; and

- the APF currently holds around a quarter of outstanding gilts. As a result, the debt interest forecast is less sensitive to changes in gilt rates than would otherwise be the case, but more sensitive to changes in Bank Rate. An additional uncertainty is also created as to how and when the APF will be run down, as the effective rate will eventually revert back to gilt rates, rather than the typically lower Bank Rate.

Chart A: Outstanding stocks of conventional and index-linked gilts