The Bank of England's Asset Purchase Facility (APF) conducts the Bank's operations for quantitative easing and tightening. Since the sharp rise in interest rates in 2022, historic profits from the APF have turned to losses. This box looked at the impact of these losses on fiscal aggregates and the lifetime direct cost of QE.

This box is based on ONS data from October 2023 .

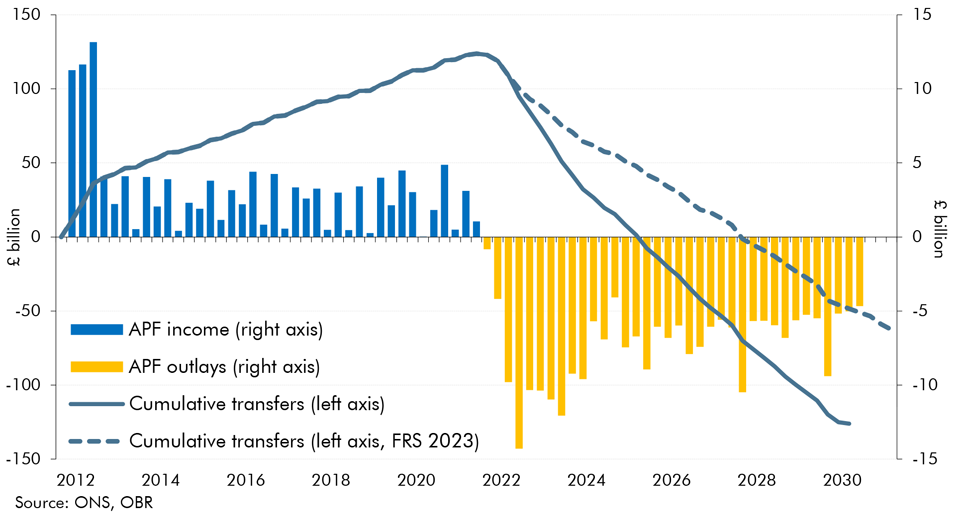

The Asset Purchase Facility (APF) houses the assets purchased by the Bank of England as part of its programme of quantitative easing initiated in 2009. The Treasury receives the profits from the APF and also indemnifies the Bank against any losses from it. Excess cash held in the APF started to be transferred to the Treasury in January 2013. Between then and July 2022, when interest rates were at historically low levels, the Bank of England transferred £123.9 billion of cash profits on the APF to the Treasury. Since October 2022, as interest rates have risen and so the APF has started to incur losses, £29.1 billion has been transferred from the Treasury to the APF. We expect continued losses into the future. These result from both interest losses and the crystallisation of valuation changes. These hit fiscal aggregates in different ways:

- Public sector net borrowing records the interest losses that occur when the interest received on holdings of gilts and other assets is less than the interest paid on central bank reserves.

- Public sector net debt also records the interest losses. In addition, as stocks of APF assets are sold, any differences between the redemption price at which they are booked in the public finances and the sale price results in a change in the recorded level of debt.

- Public sector net debt excluding the Bank of England is impacted as the APF calls on the Treasury to make good on losses. These include both losses from interest and the difference between original purchase price and the eventual sale or redemption price.

Chart A shows how we expect the costs associated with the APF to evolve over its lifetime. Our updated estimate reflects the rise in Bank Rate and gilt rates since March as well as a change in our APF runoff assumption. Our March forecast assumed a constant £80 billion decline in its size each year. We now assume a £100 billion decline between October 2023 and September 2024 reflecting the Monetary Policy Committee’s stated intention. a This is followed by an assumption of a constant pace of active sales of £48 billion a year, so that the overall pace of APF reduction varies year-to-year in line with the uneven profile for redemptions across the forecast period.b This follows guidance issued by the MPC in August 2023 that ‘sales must be conducted in a relatively gradual and predictable manner over a period of time. The focus of the MPC is on total gilt stock reduction, comprising both maturing gilts and sales, such that natural variation in maturities may also lead to variation in the pace of sales over time. Notwithstanding that, the Committee places some weight on continuity in sales’.c

Current market expectations for Bank Rate and gilt rate, combined with the latest runoff path, imply a cumulative net lifetime loss of £126.0 billion, which is £63.4 billion higher than we estimated in our July Fiscal Risks and Sustainability 2023 report (based on our assumptions from March) due to the higher path for Bank Rate and gilt rates. Our new runoff assumption concentrates these losses over a shorter period, meaning the APF also reaches its lifetime cost one year earlier than we assumed in July.

Chart E: Forecast of cumulative flows to and from the APF

These estimates of the lifetime cash flow of the APF are highly uncertain and highly sensitive to the assumptions made in the calculations, differing from previous Bank of England estimates of this value. It is also important to stress that this narrow summary of the lifetime cashflows associated with QE and quantitative tightening (QT) is not an assessment of the overall fiscal (let alone economic) impact of the QE programme, which supported the economy, asset prices, and financial markets at various points of stress over the past 15 years. The wider economic and fiscal benefits of these interventions would need to be taken into account in any comprehensive assessment of the impact of QE.

This box was originally published in Economic and fiscal outlook – November 2023