Our March 2015 Economic and fiscal outlook forecast highlighted that CGNCR ex outturn were significantly lower than what implied by our fiscal forecast. This box decomposed the revisions to CGNCR ex since our March 2015 forecast and it explained the factors that contributed to the divergence between our CGNCR ex forecast and the outturn.

CGNCR ex is the measure of borrowing that feeds directly into the Government’s gilt issuance plans. It differs from PSNB – the proposed fiscal target measure – in terms of coverage (it is narrower) and timing (it records cash flows as they happen). We forecast CGNCR ex by adding to, adjusting or removing various items from our PSNB forecast.

We noted in March that after making these adjustments, a large unexplained residual remained and that we would be working with the Treasury to identify and resolve sources of this difference. In essence, CGNCR ex outturns were significantly lower than seemed consistent with the rest of our fiscal forecast. That work has led to a number of changes in our latest forecast, which in total mean CGNCR ex has been revised down significantly in all years despite upward revisions to PSNB in some years.

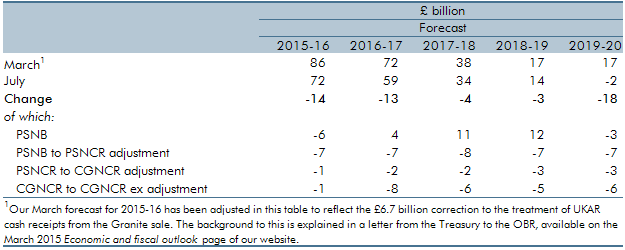

Table C decomposes the revisions to CGNCR ex since March into changes in PSNB and the subsequent adjustments to get to PSNCR, to CGNCR and finally to CGNCR ex. (The last two transitions do not affect public sector net debt.) It shows that:

- we have revised PSNB down in 2015-16 and 2019-20, and up in the intervening years, for reasons detailed in the rest of this chapter;

- we have revised the PSNCR down relative to a given path of PSNB. The analysis we have undertaken with the Treasury since March identified a number of issues that have led to corrections to various accruals adjustments that affect all years (including student loans interest and debt interest payments related to some PFI loans). These have reduced the PSNCR relative to PSNB in every year. Having made those corrections, we have reduced the 2015-16 alignment adjustment from £6 billion to £2 billion, and pushed that adjustment through to the rest of the forecast. That raised PSNCR relative to PSNB in 2015-16, but reduced it thereafter. Finally, we have revised up our forecast of asset sale receipts in each year of the forecast, which lowers PSNCR relative to PSNB;

- CGNCR has been revised down further relative to PSNCR. This essentially unwinds upward revisions to local authorities and public corporations net borrowing, which increase the public sector but not central government net cash requirement; and

- CGNCR ex has been revised down relative to CGNCR, mainly reflecting a correction to the treatment of Network Rail grants, which had incorrectly been added back to CGNCR ex in previous forecasts. That adjustment had been equal to around £4 billion a year. We have also revised up the speed at which UKAR repays its government loans.

Table C: Revisions to CGNCR ex since March

We have not been able to resolve all the differences between our forecast and outturns, so have retained a £2 billion a year downward alignment adjustment in the reconciliation from PSNB to PSNCR. We suspect that may be related to the many sources of small amounts of income to the Exchequer – for example, court fines or fees charged by smaller public sector bodies including public corporations – and will continue to explore the issue with Treasury and ONS officials.

This box was originally published in Economic and fiscal outlook – July 2015