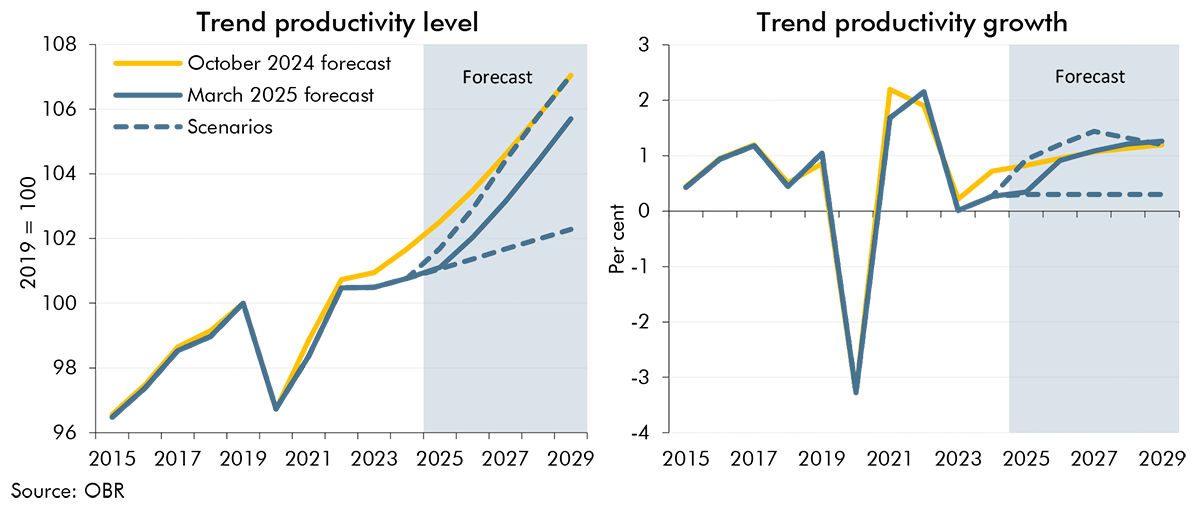

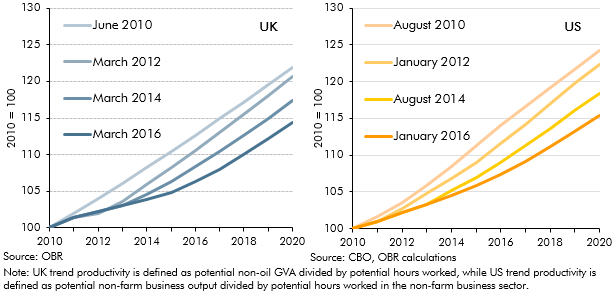

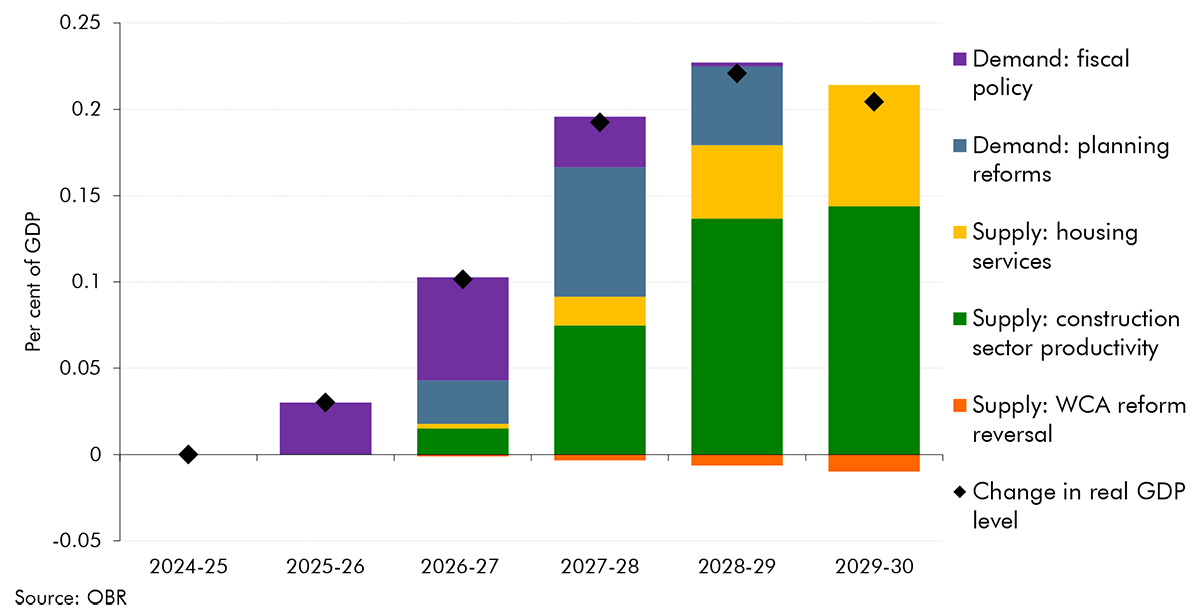

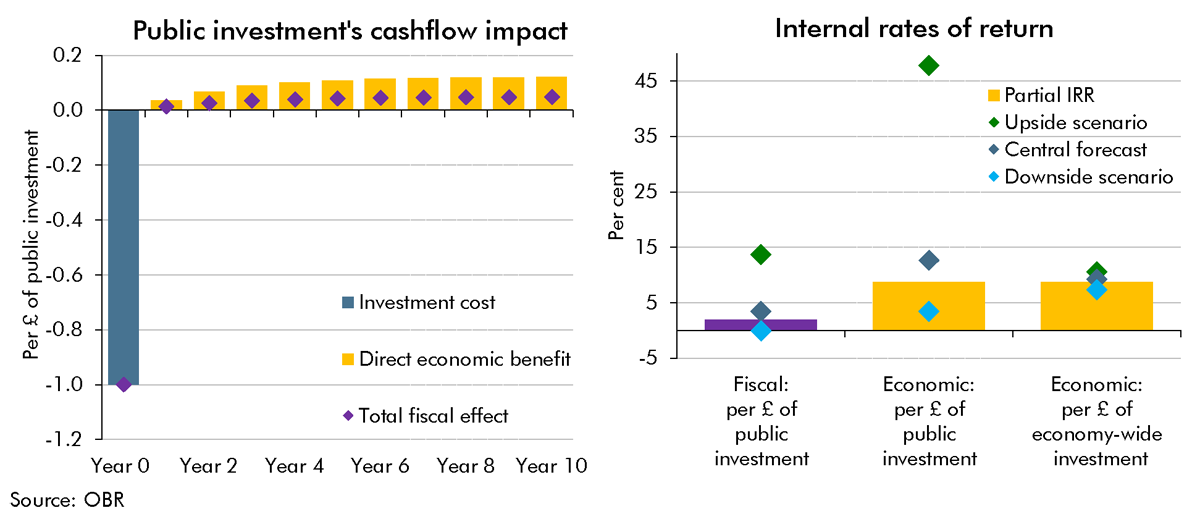

GDP growth is an important driver of trends in the overall budget deficit and the path of public sector debt. Over our 5-year forecast, GDP growth is largely determined by the growth rate of potential output, so it is necessary – implicitly or explicitly – to make judgements about the economy’s underlying growth potential. We also need to make a judgement about the margin by which economic activity currently exceeds or falls short of its potential or sustainable level (the ‘output gap’). This is because we generally assume that the Monetary Policy Committee at the Bank of England sets monetary policy so that activity will return to its underlying potential level and therefore the size of the output gap will determine whether GDP is expected to grow faster or slower than potential output over the forecast period. We set out those judgements explicitly, in order to be transparent and because they play a role in our fiscal forecasts. Neither potential output nor the gap between it and actual output are directly observable, so estimating them is necessarily challenging. Moreover, neither can be verified, even with the benefit of hindsight.

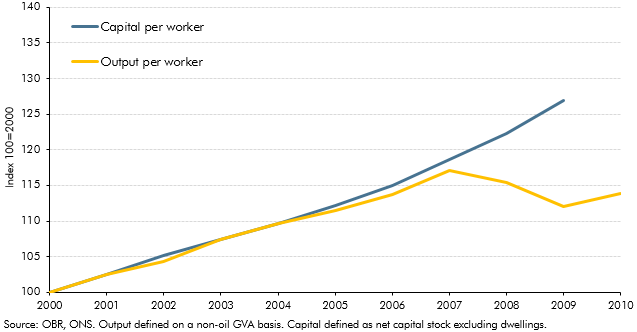

In economic terms, potential output is the starting point for thinking about how fast an economy can grow over the medium term. To that, one would add or subtract an estimate of the output gap to find the level of actual GDP at present and over the forecast period. In terms of our forecast process, the ordering is reversed. We start the forecast knowing the latest ONS data on the level of GDP and with survey and other indicators (e.g. about companies’ capacity utilisation or recruitment difficulties) that allow us to estimate the size of the output gap. From those two pieces of information, we infer the current level of potential output and its components, from where we apply our judgements about the rate of potential output growth.

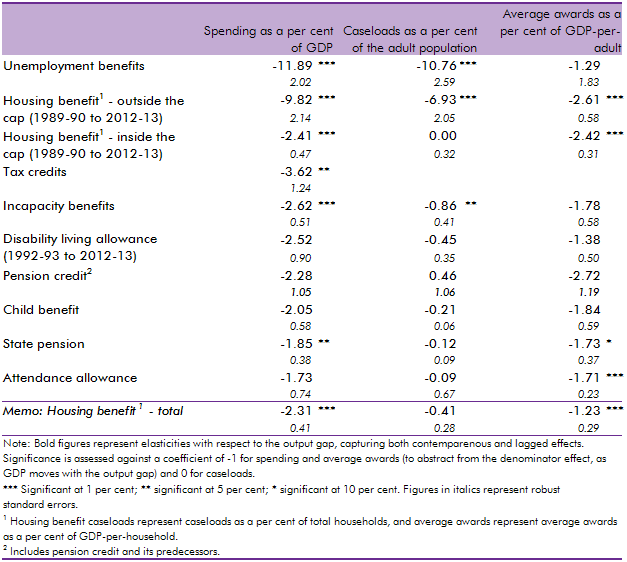

Estimating the output gap allows us to judge the size of the structural budget deficit – in other words, the deficit that would be observed if the economy were operating at its sustainable level. When the economy is running below potential, part of the headline deficit will be cyclical (and would therefore be expected to diminish as above-trend growth boosts revenues and reduces spending). If the economy is running above potential, the structural deficit will be larger than the headline deficit as a period of below-trend growth would be expected to depress receipts and push up spending as the output gap returns to zero.

Our estimates of potential output and the output gap are based on whole-economy output. Prior to the November 2022 forecast, we excluded the small and volatile oil and gas sector and then added on a forecast for oil and gas production to complete our GDP forecast. We have stopped stripping out North Sea output from our potential output figures, given the waning influence of North Sea production on output levels in recent decades.

Further information on the concept of potential output and our approach to forecasting it is set out in Briefing paper No. 8: Forecasting potential output – the supply side of the economy.