In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our November 2023 Economic and fiscal outlook, we adjusted our forecast to account for permanent full expensing and fiscal loosening. And, we considered the effects of policy to boost employment on our potential output forecast.

This box is based on OBR data from November 2023 .

Our economy forecast accounts for the economic impacts of the latest announced government policies. This includes the demand-side impacts of the package as a whole, calculated using a set of fiscal ‘multipliers’ drawn from the empirical literature. We also account for the supply side impact of selected policy measures where credible evidence suggests they are likely to have a material, additional, and durable impact on potential output, as discussed in our recent article.a

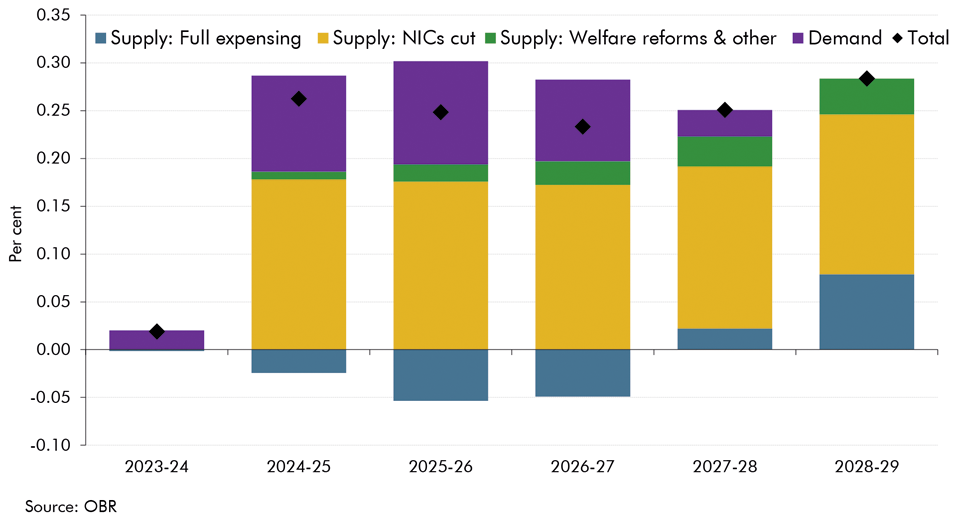

Policies announced in this Autumn Statement are expected to add around £17 billion a year on average to public sector net borrowing between 2024-25 and 2025-26, picking up to £23 billion in 2027-28 before falling back to around £17 billion by 2028-29. As shown by the diamonds in Chart A, these policies raise GDP by an average of just under 0.3 per cent between 2024-25 and 2028-29 through a combination of impacts on demand and supply.

Temporary impacts on demand

The Autumn Statement policy package boosts aggregate demand relative to supply (purple bars) by 0.1 per cent at the peak of its impact in 2025-26. This effect is mainly calculated using fiscal multipliers drawn from the empirical literature,b though also takes into account a small partly offsetting effect (described below) from the changes to the ‘full expensing’ policy. As usual, we assume the demand impact of the policies tapers to zero over the forecast period, as the Bank of England acts to bring aggregate demand in line with potential output.

Impacts on supply

Several items within the Autumn Statement policy package are expected to have lasting supply-side effects, raising the level of real GDP by 0.3 per cent in 2028-29 (Chart A):

- Cuts to NICs (yellow bars) are estimated to raise employment by 28,000 (under 0.1 per cent) in 2028-29. The increase in post-tax income is also likely to boost the hours worked by existing employees. The total increase in hours worked from new and existing employees is estimated to be 0.3 per cent or 94,000 in full-time equivalent terms.c

- A package of welfare and other measures (green bars) that we estimate will raise employment by 50,000 (over 0.1 per cent) in 2028-29. There is a small positive impact on GDP of only 0.04 per cent as we assume entrants are likely to join on lower-than-average hours and earnings. These measures are described in more detail in Chapter 3.

- The move from temporary to permanent 100 per cent capital allowances – known as ‘full expensing’ – (blue bars) generates a net additional £13.9 billion of cumulative real business investment over the forecast period (further discussed in Box 2.4). In contrast to the previous temporary policy, this raises the capital stock by 0.2 per cent in 2028-29 and potential output by 0.1 per cent. However, as it removes the incentive to bring forward investment in the near-term relative to the temporary policy, a mildly negative and temporary demand effect reduces real GDP by 0.1 per cent in 2024-25 compared to our March forecast.

Chart A: Real GDP impacts

Longer-term impacts on supply beyond 2028-29

Some Autumn Statement policies might also be expected to have significant effects beyond our five-year forecast. The impact of permanent full expensing on potential output will continue to build, from 0.1 per cent in 2028-29 to slightly below 0.2 per cent in the long run, as the economy gradually moves to a larger long-run capital stock. By contrast, the decision to hold capital departmental spending flat in cash terms for one additional year, means public sector fixed capital formation falls as a share of GDP. It now falls from 3.6 per cent this year to 3.1 per cent in 2028-29, reducing the public capital stock as a share of GDP. If sustained, this would likely also have a material, negative impact on potential output beyond the forecast horizon, relative to maintaining the public capital stock as share of GDP.

Other measures could also boost business investment particularly over the longer-term, including the proposals announced in the Chancellor’s Mansion House speech, changes to the implementation of the Solvency II regime, and measures affecting electricity grids and planning, and the regulated utilities. For instance, were the Government to achieve its ambition to accelerate the consolidation of pension schemes, so enabling them to achieve greater economies of scale, this could incentivise additional investment in infrastructure. It is also possible that some measures could provide a further boost to labour supply, such as proposed changes to fit notes. We have not explicitly adjusted our forecast for these changes, because of the significant uncertainties surrounding these impacts and the difficulty in assessing the extent to which regulatory changes are already implicit in our projections.

Impacts on inflation

The combined effect of changes to alcohol and hand-rolling tobacco duty reduces inflation slightly in 2024-25 and then increases it slightly in 2025-26. The small boost to aggregate demand from the government’s policy package, raises inflation in the near-term incrementally, increasing consumer prices by 0.1 per cent at our forecast horizon.

This box was originally published in Economic and fiscal outlook – November 2023

a OBR, Dynamic scoring of policy measures in OBR forecasts, November 2023.

b We review these estimates periodically. See our 2019 Forecast evaluation report and November 2020 Economic and fiscal outlook.

c This figure is informed by estimates and insights from a range of studies, including those outlined in Meghir, C., and D. Phillips, Labour Supply and Taxes in Dimensions of Tax Design: Volume 1 of The Mirrlees Review, 2010, those in Adam, S., and D. Phillips., An ex-ante analysis of the effects of the UK Government’s welfare reforms on labour supply in Wales, 2013, and Attanasio, O., P. Levell, H. Low, and V. Sanchez-Marcos, Aggregating Elasticities: Intensive and Extensive Margins of Female Labour Supply, 2015. Professor Hamish Low provided useful guidance on this empirical literature.