Box sets » March 2020

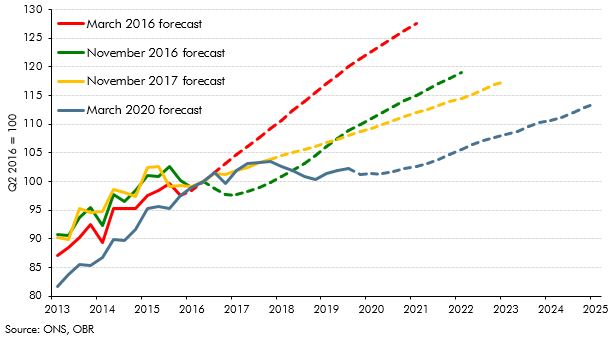

On 31 January 2020, the UK left the EU and the transition period was set to finish at the end of 2020. This box set out our estimate of the effect of the EU referendum result on productivity to date. It also outlined the effect that leaving the EU and trading under the terms of a typical free trade agreement - which we assumed in this forecast - will have on productivity in the long run.

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our March 2020 Economic and fiscal outlook, we adjusted our economy forecast to account for the material increase in departmental spending and tax policy changes on GDP and inflation. In addition to this, our business investment forecast incorporates the reversal of the planned cut in corporation tax, increases in the structures and buildings allowance and R&D tax credits.

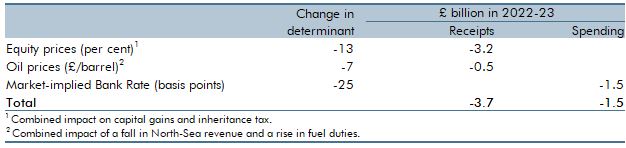

After we closed our March 2020 pre-measures forecast, it became clear that the spread of coronavirus would be far wider than assumed in our central forecast. This box described the effect we incorporated into the central forecast and explored the potential impacts the virus could have on the economy and public finances.

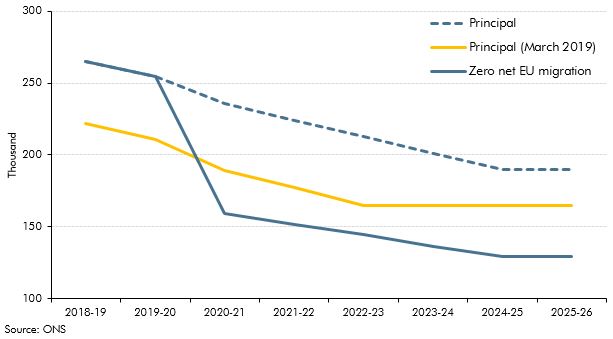

The Government announced plans for a new 'points based' immigration system set to come into place in 2021 that will align migration policy for EU and non-EU migrants. In this box, we considered the impacts of this new system on the outlook for potential output growth.

In March 2020, the Government introduced a new target for the National Living Wage (NLW) to reach two-thirds of median earnings (of the relevant population) by 2024, providing economic conditions allow. In this box we considered the effect of this policy change on the outlook for the economy and the public finances.

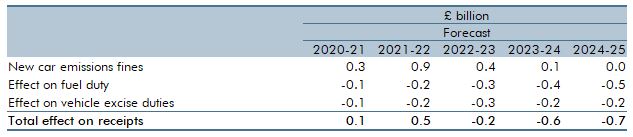

In April 2019, the European Parliament and Council adopted new regulations to set mandatory emissions targets for new cars. Ahead of our March 2020 EFO, the Government told us that all of these provisions transferred into UK law on 31 January 2020 under the terms of the EU Withdrawal Act. In this box we considered the effect of this change on the UK public finances.

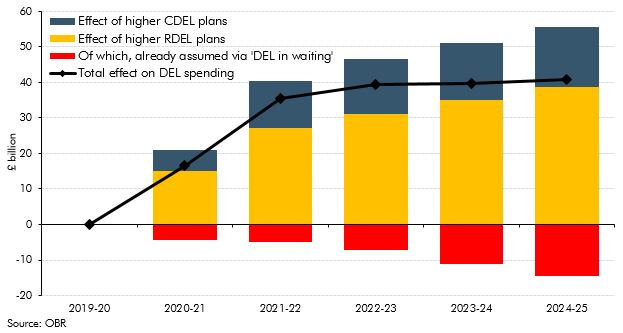

The Government announced significant increases in departmental expenditure limits for capital spending. In this box we compared previous capital spending plans with outturn and our own capital underspend assumptions.

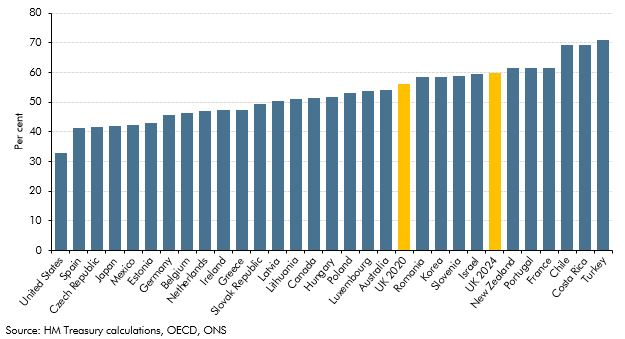

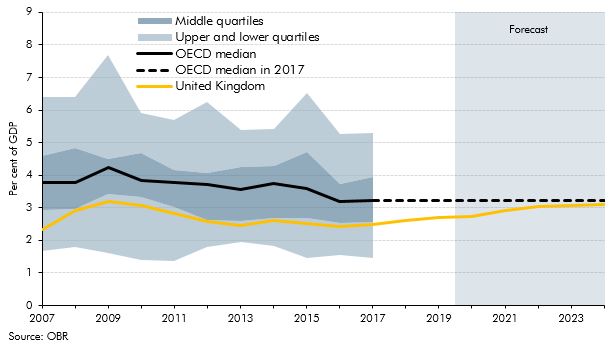

The Government committed to a significant boost to the path of capital spending. This box explored how UK government investment as a share of GDP has compared to other OECD countries and how our March 2020 forecast affects this picture.

The transition to universal credit (UC) from legacy systems is a key component of our welfare spending forecast, as UC spending will represent 27% of total welfare spending by 2024-25. As detailed in our 2018 Welfare Trends report (WTR), we construct UC spending by forecasting the legacy system as though UC did not exist and then incorporate an estimate of the marginal cost of UC. This allows us to base as much of the forecast on as much administrative data as possible, but it does not directly reflect the real-world change in spending on legacy benefits as spending on UC rises. This approach is unavoidable at present but generates inevitable difficulties for our forecast. This box explored the challenges associated with this approach.

The UK’s exit from the EU presented fiscal savings to the Government in the form of transfers to EU institutions that featured in spending and retained customs duties. We assumed these would be fully recycled into substitute UK spending in previous forecasts. This box explained how we treated these flows as ‘DEL in waiting’ and how this related to the large increases in departmental spending.

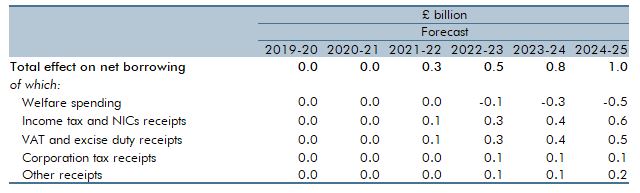

In February 2020, the Government announced its intention to introduce a ‘points-based’ migration system from January 2021 that will align migration policy for EU and non-EU migrants. In this box we looked at the effect of the new migration regime on our borrowing forecast.

The Government used new fiscal rules to guide the policy decisions at this Budget. This box discussed the composition of two of these rules which had not previously been used in the UK.