Box sets » Receipts » Vehicle excise duties

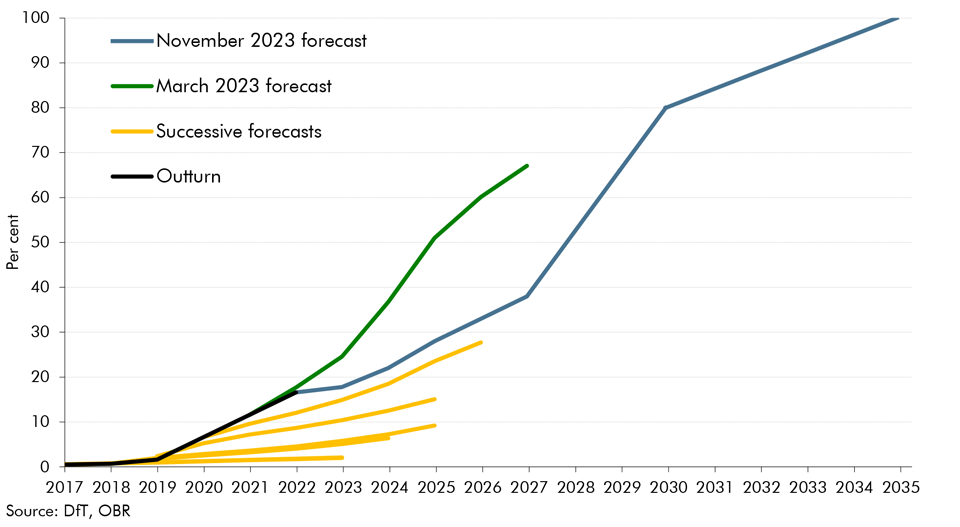

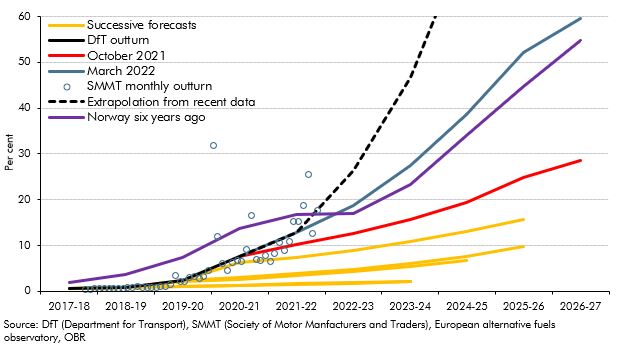

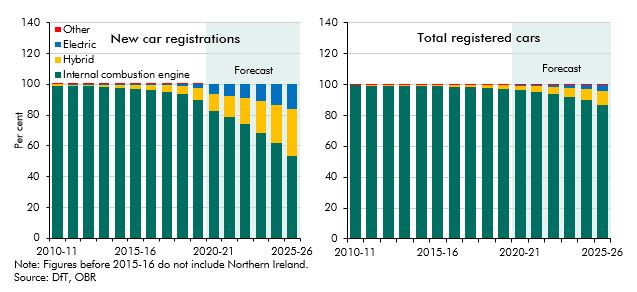

The transition to electric vehicles (EVs) has direct fiscal implications for fuel duty revenues (and, to a lesser extent, vehicle excise duty). In this box we explained why we have revised down our EV assumptions and the impact of this revision on fuel duty and VED revenues.

This box outlined the recent growth in electric vehicle sales and the fiscal implications of this and the role of policy in the transition.

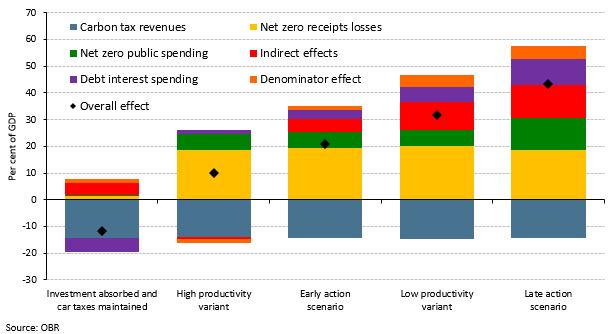

Our 2021 Fiscal risks report explored the fiscal risks posed by climate change and the Government’s commitment to reduce the UK’s net carbon emissions to zero by 2050. This box examined the policies announced in the Budget, Spending Review, and Net Zero Strategy in October 2021, and the significant rises in market prices for hydrocarbons since we completed our Fiscal risks report, and how they had changed the risks associated with climate change and decarbonisation.

With the sale of new petrol and diesel cars to be banned from 2030, the transition to electric vehicles is a key element in the UK’s path to net zero emissions. This box outlined the recent growth in alternatively fuelled vehicle sales, the fiscal implications of this and the role of policy in the transition.

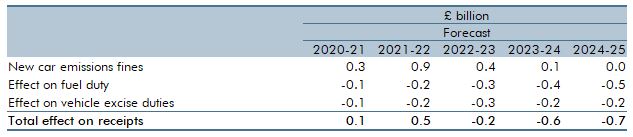

In April 2019, the European Parliament and Council adopted new regulations to set mandatory emissions targets for new cars. Ahead of our March 2020 EFO, the Government told us that all of these provisions transferred into UK law on 31 January 2020 under the terms of the EU Withdrawal Act. In this box we considered the effect of this change on the UK public finances.

We always try to forecast the public finances consistent with how the ONS will measure them once it has implemented its classification decisions, so that our forecasts will be consistent with that eventual treatment. This box outlined the items included in our November 2015 forecast which the ONS had announced, but had yet to implement.

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In the July 2015 Economic and fiscal outlook, we made a number of adjustments to real and nominal GDP, the labour market, inflation, business and residential investment, and the housing market.

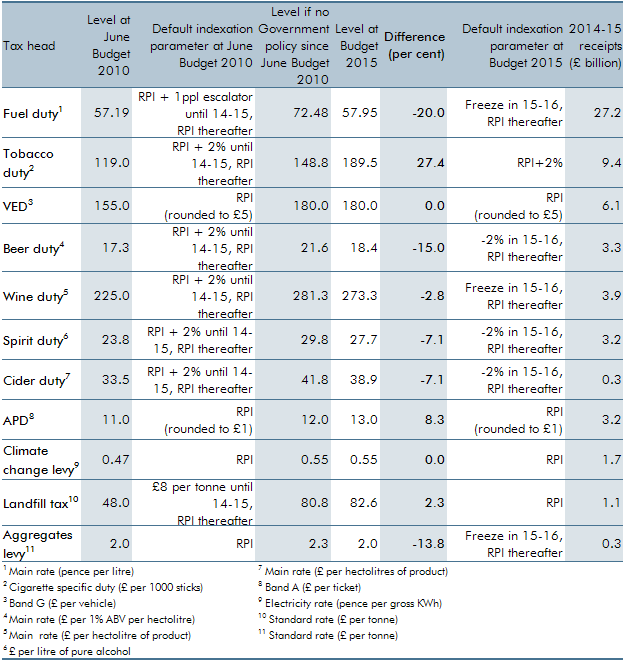

Our forecasts for excise and environmental duties assume that rates are indexed in line with default parameters. These parameters are set by the Government and are detailed at each Budget in the Treasury’s Policy costings document. The assumptions represent a source of economy and

policy-related uncertainty in our forecast. In this box, we looked back at how a selection of duty rates moved over the Parliament relative to the default uprating assumptions assumed in the OBR’s first forecast in June 2010.

policy-related uncertainty in our forecast. In this box, we looked back at how a selection of duty rates moved over the Parliament relative to the default uprating assumptions assumed in the OBR’s first forecast in June 2010.