Our forecasts for excise and environmental duties assume that rates are indexed in line with default parameters. These parameters are set by the Government and are detailed at each Budget in the Treasury’s Policy costings document. The assumptions represent a source of economy and

policy-related uncertainty in our forecast. In this box, we looked back at how a selection of duty rates moved over the Parliament relative to the default uprating assumptions assumed in the OBR’s first forecast in June 2010.

Our forecasts for excise and environmental duties assume that rates are indexed in line with default parameters. These parameters are set by the Government and detailed at each Budget in the Treasury’s Policy costings document. The assumptions represent a source of economy and policy-related uncertainties in our forecast. In this box, we look back at how a selection of duty rates have moved over the last Parliament relative to the default uprating assumptions assumed in the OBR’s first forecast in June 2010.

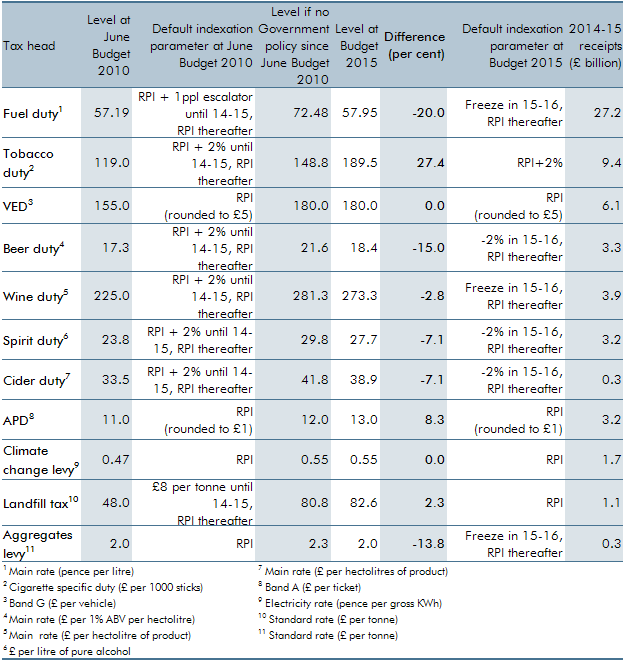

Table B sets out the level of selected duties at the June 2010 Budget, the default indexation parameters underpinning that forecast, what the rates would have been today in the absence of Government policy (abstracting from differences between actual inflation and our forecasts) and the actual level of rates now.

The table shows that several duties (fuel, alcohol, aggregates levy) have been reduced relative to the default uprating assumptions underpinning the June 2010 forecast. One source of potential difference between actual rates now and the level that would have been assumed had they been uprated in line with default assumptions is errors in our inflation forecasts. For example, relative to the June 2010 forecast, the level of the Retail Prices Index by the end of 2014 was 0.6 per cent lower than we forecast.

But a major source of difference has been policy changes at various Budgets and Autumn Statements that have delayed, frozen or cut rates. The main fuel duty rate has been cut once and frozen four times over this Parliament – and has been again in this Budget – leaving the rate around 20 per cent lower than it would have been if default uprating had proceeded in line with the June 2010 forecast and 19 per cent lower than if it had followed actual RPI inflation. This contrasts with the Budget 2011 fair fuel stabiliser measure, which proposed to raise fuel duty by RPI plus 1 per cent in the event of oil prices reaching $75 a barrel (later specified in regulations as £45 a barrel). The oil price is now £38 a barrel, but the fair fuel stabiliser was abolished in Autumn Statement 2014 (when the oil price stood at £50 a barrel).

The biggest exception to this is the specific duty on cigarettes, which has risen much faster than we would otherwise have assumed. In part that reflects the Budget 2011 policy measures that raised the specific duty by around £36 per thousand cigarettes, while at the same time cutting the ad valorem rate from 24 per cent to 16.5 per cent of the retail price. The main rates for vehicle excise duty (VED), air passenger duty (APD) and the climate change levy (CCL) have risen in line with the default indexation parameters.

Table B: Indexation parameters