Box sets » Fiscal risks report - July 2021

Fiscal space is an important consideration for how quickly and effectively a country's government can respond to a large shock. In this box, we explored different definitions of fiscal space over time, its multi-faceted nature and how the UK's position has evolved over the course of the coronavirus pandemic.

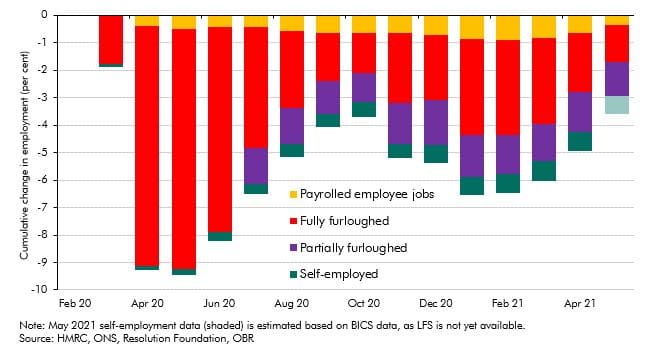

The Government announced in March 2021 that the coronavirus job retention scheme (CJRS) would be phased out completely by the end of September 2021. In this box, we looked at the latest evidence on the number of people on the scheme and their concentration in certain industries, as well as the latest data on vacancy rates. We also discussed how these data related to our labour market assumptions from March 2021.

Broader measures of the balance sheet are useful to consider when thinking about fiscal sustainability. However, under the national accounts framework even the broadest measures fail to recognise natural assets – the very assets affected by climate change. The box discussed the frameworks under which the ONS produces the environmental and natural capital accounts, and which bodies are working to address the gaps in these frameworks. The box also discussed key messages from the Dasgupta Review and Treasury’s response.

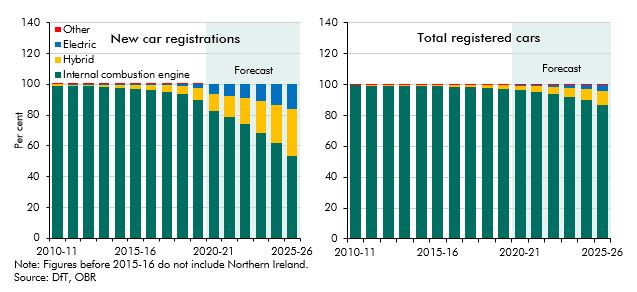

With the sale of new petrol and diesel cars to be banned from 2030, the transition to electric vehicles is a key element in the UK’s path to net zero emissions. This box outlined the recent growth in alternatively fuelled vehicle sales, the fiscal implications of this and the role of policy in the transition.

One of the greatest challenges in achieving net zero in terms of both cost and technical difficulty will be to decarbonise the more than 28 million homes in the UK that rely on fossil fuels for heating (typically gas central heating) and are, for the most part, poorly insulated. In this box we examined the similarities and differences between the future transition of domestic heating and one of the past, that of the switch to natural gas over the decade to 1977.

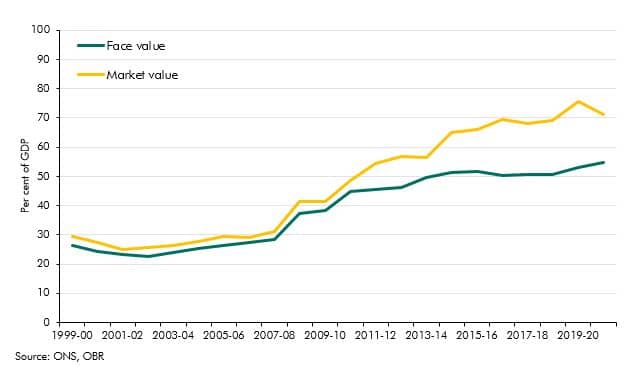

Government debt liabilities can be valued in various ways. In recent years market and face values have diverged sharply reaching 15% of GDP. In this box we explained why this has happened and why we use face value in our analysis.

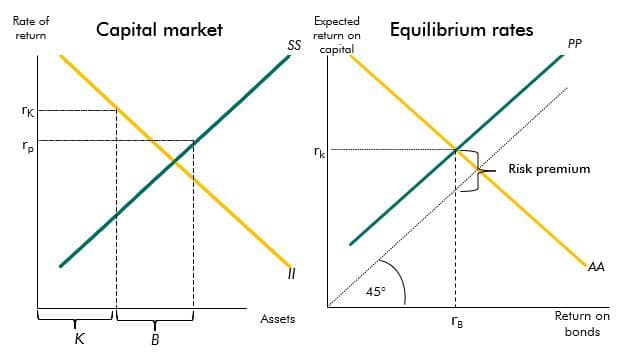

The yields on government debt have declined over recent decades. This box described a stylised model that provides a framework to explain the drivers of these changes.

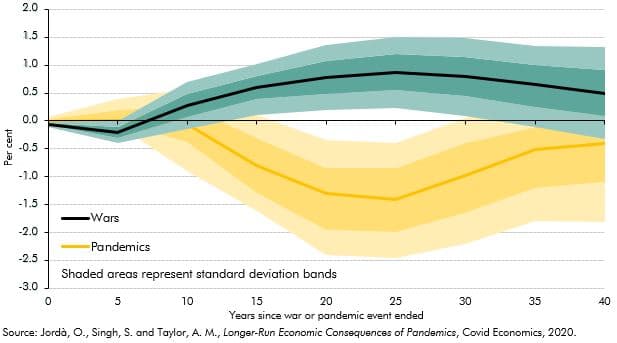

Past pandemics have had long-run impacts on real interest rates. A recent paper found that 20 years after a pandemic real rates fell by, on average, 1.5 percentage points (though less in the UK). This box examined the evidence for the current pandemic and suggested why this time it may be different.

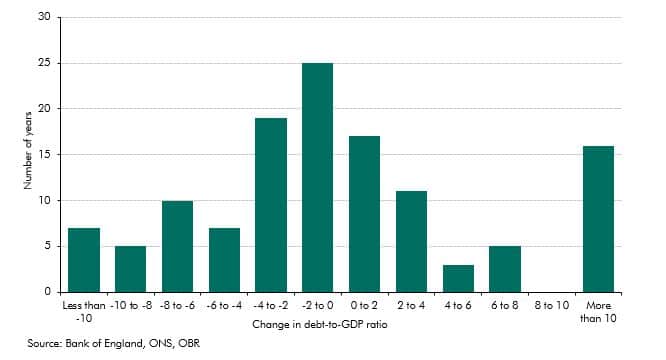

The history of UK government debt can be characterised as one of ‘punctuated equilibria’ in which long periods where the debt-to-GDP ratio is broadly stable or gradually falling are interspersed with occasional large increases in response to major shocks. This box looked at the instances of parge rises since 1900 and the long period of debt reduction after the second world war.

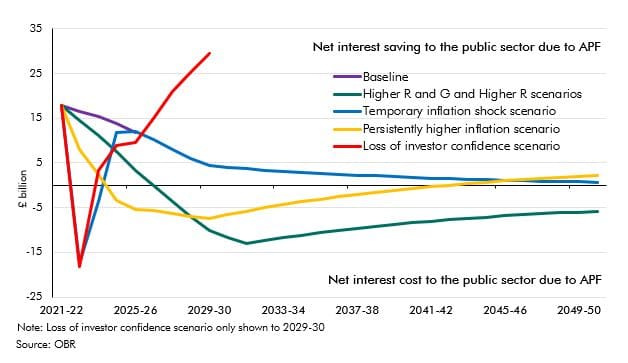

The Asset Purchase Facility (APF) houses the assets purchased by the Bank of England as part of its programme of quantitative easing. This box explained how this lowered interest rates benefitting the Treasury by £113 billion to date but it also increased the sensitivity of interest payments to future rate rises. The box showed how the cash flows to and from the APF change under various scenarios.

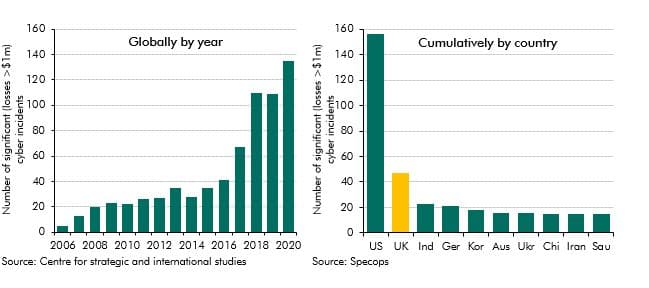

Cyberattacks are a growing global threat that, at the time of writing, had yet to cause sufficient disruption to national infrastructures to generate material economic and fiscal harm. We had not yet quantified the potential fiscal cost from cyberattacks, but included it in our Fiscal risk register for the first time. The box covered some of the potential types of cyberattack, their increasing prevalence and the mechanisms through which they might generate direct and indirect fiscal costs.