The Government announced in March 2021 that the coronavirus job retention scheme (CJRS) would be phased out completely by the end of September 2021. In this box, we looked at the latest evidence on the number of people on the scheme and their concentration in certain industries, as well as the latest data on vacancy rates. We also discussed how these data related to our labour market assumptions from March 2021.

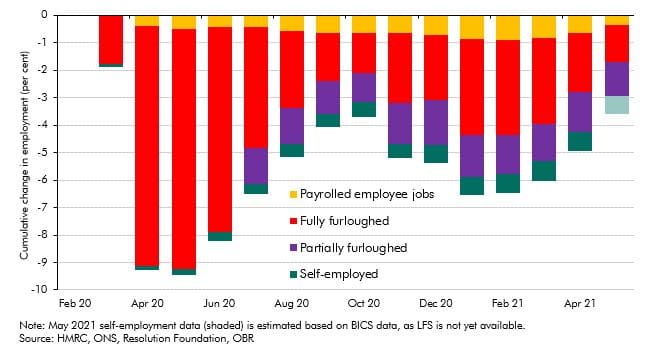

In the March 2021 Budget, the Chancellor announced that the CJRS will be fully withdrawn at the end of September, and that employer contributions will increase in monthly steps from July onwards. Our forecasts for GDP, unemployment, and other key fiscal determinants assume that the vast majority of those still on furlough will be able to return to their jobs or find alternative employment. The latest data show that there were still 2.6 million people on the CJRS in May 2021, with the number falling quickly in recent months as the economy has reopened and activity rebounded. Even so, jobs fully or partly furloughed still account for shortfall in labour utilisation relative to the month prior to the pandemic.

Chart A: Change in employment-related indicators during the pandemic

While the numbers furloughed are down by 5.1 million from the peak of 8.7 million at the height of the first lockdown in April 2020, it is still a very large programme, paying a large proportion of the wages of 9 per cent of all payrolled employees in the UK. The latest ONS BICS data suggest that this proportion has fallen a little further to 7 per cent by mid-June.

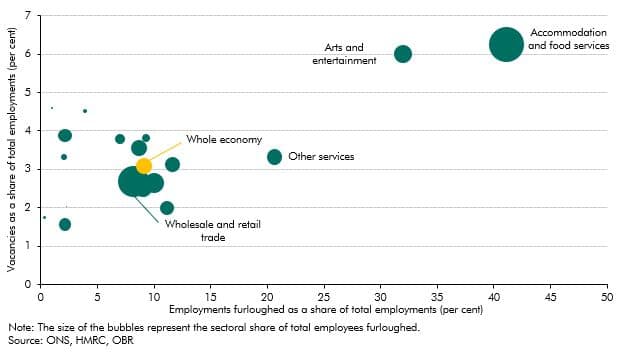

Given the large number of people still on the scheme, and their growing concentration in a few of the hardest hit sectors, there remains considerable uncertainty as to how many will be able to return to their previous roles or employers, and how many will need to look for other employment. Chart B shows the proportion of furloughed employees and the vacancy rate in each sector as of May 2021. It shows that furloughed employees are increasingly concentrated in a few sectors, with accommodation and food services and arts and entertainment being the most affected. Together, these two sectors accounted for over a third of the 2.6 million furloughed employments in May 2021, up from around a quarter during the first lockdown.

The capacity for these sectors to fully reabsorb furloughed workers over the next few months as the scheme is wound down will depend, in part, on how quickly the remaining public health restrictions affecting these sectors and international travel can be lifted. It will also depend on how sustainable the rebound in social consumption seen in the wake of the third lockdown proves. The rush to fill positions as these sectors reopened has led to them registering the highest vacancy rates at over 6 per cent, higher even than before the pandemic. This is encouraging, if tentative, support for our assumption that most furloughed employees will find work quite quickly, though considerable uncertainty remains.

As of May 2021, over 30 per cent of employees in both sectors remained on furlough, so a significant part of the reabsorption process has yet to occur. And economy-wide, the vacancy rate remains below the 3 per cent pre-pandemic average, while around 9 per cent of all payrolled employees were still furloughed in May 2021. All these indicators point to this still being a relatively early stage of the post-pandemic adjustment in the labour market.

Chart B: Sectoral breakdown of furloughed employees and vacancies (May 2021)

This box was originally published in Fiscal risks report – July 2021