Our two biennial reports on the long-term sustainability of the public finances (Fiscal sustainability report) and fiscal risks facing the UK (Fiscal risks report) will be combined into a single annual report for the first time this summer. Our first report on Fiscal risks and sustainability will be published on Thursday 7 July. Learn more about this upcoming report.

Commissioned by Parliament in 2015, the report identifies and analyses risks to the medium-term outlook for the public finances and to long-term fiscal sustainability.

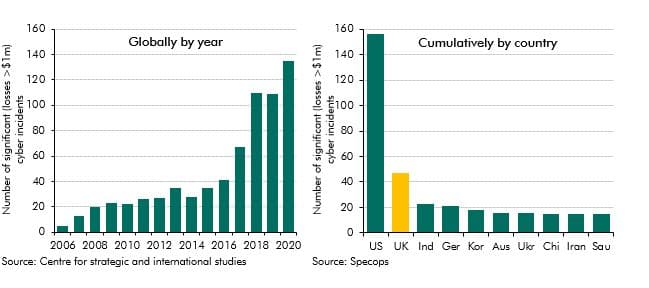

This year we cover three large, and potentially catastrophic risks, in depth:

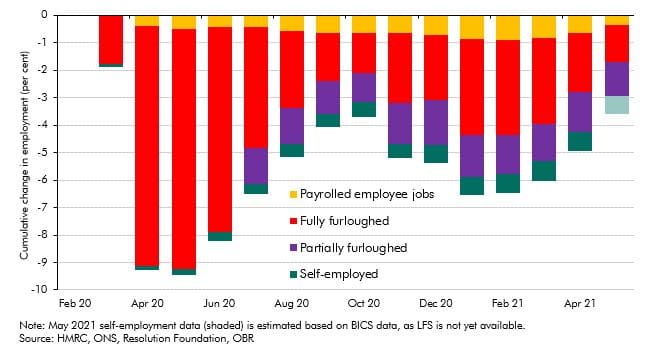

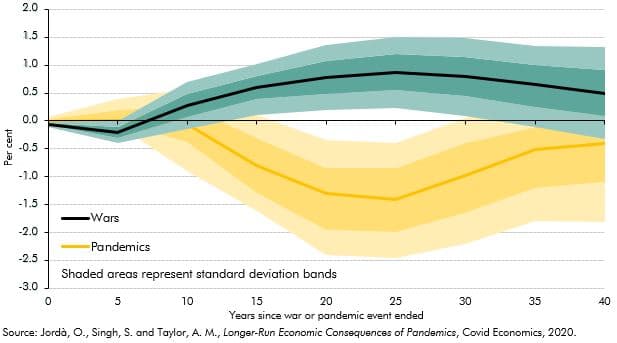

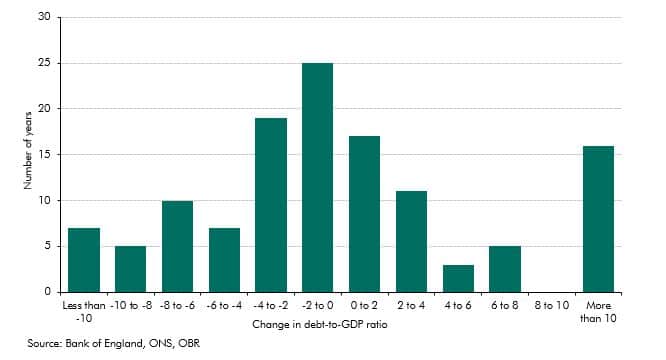

- The economic and fiscal impact of the coronavirus pandemic over the past year and its potential medium- and long-term legacy for the public finances.

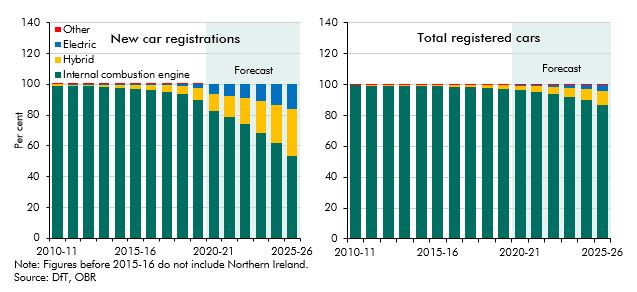

- The risks to the public finances presented by climate change including a range of scenarios illustrating the fiscal impact of different ways to get to net zero by 2050.

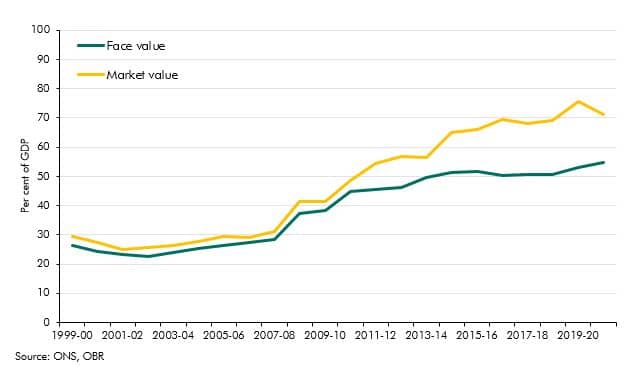

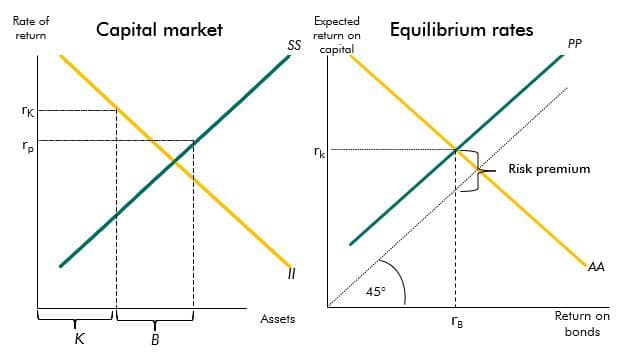

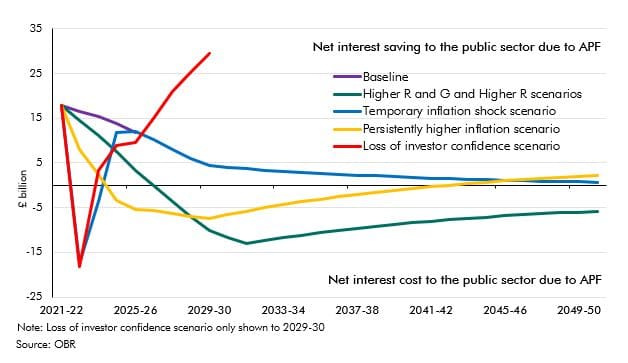

- The risks posed by changes in the cost of debt and the sensitivity of the public finances to global interest rates, inflation and an extreme case of a loss of investor confidence.