Past pandemics have had long-run impacts on real interest rates. A recent paper found that 20 years after a pandemic real rates fell by, on average, 1.5 percentage points (though less in the UK). This box examined the evidence for the current pandemic and suggested why this time it may be different.

This box is based on Capital economics data from April 2020 .

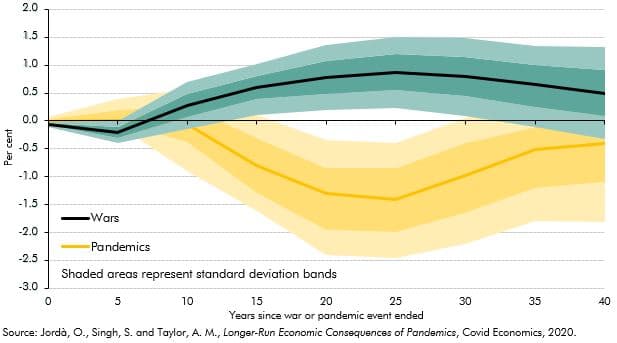

Will the shock to the economy and public finances associated with the coronavirus pandemic have any long-run impact on real interest rates? Jordà, Singh and Taylor (2020)a find that past pandemics have indeed had long-lasting effects. Using Europeanb data stretching back to the fourteenth century, they find that 20 years after a pandemic, the real interest rate was on average around 1.5 percentage points lower (Chart B) and took around four decades to return to pre-pandemic levels. However, the impact of pandemics on the real interest rate in the UK was rather less (a decline of just 0.25 percentage points after 20 years).

The likely source of this effect is the fall in the labour force as a result of a higher number of deaths, leaving a higher capital-labour ratio and a lower incentive to invest. That could be augmented by increased savings by survivors.

This contrasts with the impact of wars, after which real interest rates have typically risen. That most probably reflects the destruction of capital that typically occurs (especially in the wars of the twentieth century) generating a post-war need to rebuild. In addition, governments have often borrowed in order to fight wars, putting further upward pressure on interest rates.

Chart B: The impact of past pandemics and wars on interest rates

There are, however, reasons to think that the consequences of the coronavirus pandemic could be different to previous pandemics. First, this pandemic has had only a limited effect on the labour force, with total deaths being lower and more concentrated among the elderly. Second, the large rise in borrowing accompanying this pandemic has been more like past wartime episodes. That said, the response to the pandemic has largely filled the hole left by the contraction in private sector spending, which is different from a war when fiscal expansions for war spending and subsequent reconstruction place more pressure on available resources.c

This box was originally published in Fiscal risks report – July 2021