The transition to electric vehicles (EVs) has direct fiscal implications for fuel duty revenues (and, to a lesser extent, vehicle excise duty). In this box we explained why we have revised down our EV assumptions and the impact of this revision on fuel duty and VED revenues.

This box is based on DfT and SMMT data from April 2023 .

As the share of electric vehicles (EVs) increases, receipts from fuel duty, and to a lesser extent Vehicle Excise Duty (VED), will decline. Fuel duty raised £25.1 billion (1.0 per cent of GDP) in 2022-23, has been falling as share of GDP since 1998-99, and is expected to fall to zero in cash terms as EVs replace petrol and diesel cars in line with the Government’s planned transition to net zero by 2050.a

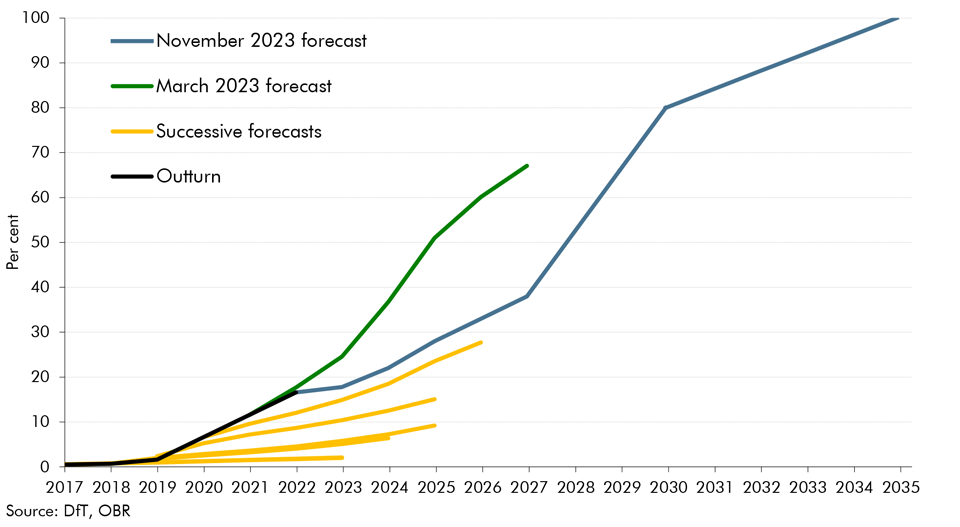

In previous forecasts the EV share of new car sales had repeatedly exceeded our expectations, increasing from 0.5 per cent of new car sales in 2017-18 to 13.6 per cent in 2021-22. To reflect this, in our March 2022 forecast, we made an upward revision to our assumption on the pace of EV take-up which we assumed would rise to 59.6 per cent of new car sales by 2026-27.b However, in 2022-23, growth in EV take-up slowed, accounting for just 16.5 per cent of new car sales, which was more than one percentage points below our March 2023 forecast of 17.7 per cent. Evidence points to a number of reasons for the slowdown:

- The decline in EV price gap at point of purchase relative to internal combustion engine vehicles (ICEVs) has begun to slow, with a 15 percentage point fall in the two years to March 2022 but only a 6 percentage points fall since.c The generally higher upfront costs of EVs relative to ICEVs will likely still be disincentivising many consumers, especially purchasers using car finance as interest rates are significantly higher than we had anticipated in 2022. In the absence of low cost EVs, the steep sales growth of the past years, boosted by (usually high-income) early adopters, is expected to slow.d

- EVs have lower running costs for consumers who can charge vehicles at home. However, the cost advantage of EVs charged away from home is significantly less and can become negative, and the availability of public charging points seems to be a concern for many drivers.e f Moreover, petrol and diesel prices have declined from the spike in 2022, due to a combination of both wholesale price falls and fuel duty cuts, though are still high relative to the past.

The main policy driver for EV uptake is now the Zero Emission Vehicle (ZEV) mandate which takes effect in January 2024. We have therefore revised our EV assumption to match the path of the mandate over the forecast horizon. The mandate sets a minimum share of cars and vans sold by each manufacturer to be zero emission. We judge sales are unlikely to materially exceed this across the forecast horizon due to flexibilities that allow trading of allowances and borrowing against future allowances in the first three years of the mandate.g Furthermore, the Government recently announced a 5-year delay on the ban of new ICEV sales, from 2030 to 2035, which may result in some consumers delaying a switch to EVs.

The announced ZEV mandate reduces our forecast of EV uptake (compared to March 2023) from 25 per cent to 18 per cent in 2023, and from 67 per cent to 38 per cent in 2027 (Chart C). This has increased the fuel duty forecast on average by £0.7 billion a year and the VED forecast by £0.1 billion a year since March.

Chart C: Electric vehicle share of new car sales

This box was originally published in Economic and fiscal outlook – November 2023