After we closed our March 2020 pre-measures forecast, it became clear that the spread of coronavirus would be far wider than assumed in our central forecast. This box described the effect we incorporated into the central forecast and explored the potential impacts the virus could have on the economy and public finances.

Our global forecast was closed for new data on 14 February. At that point, the coronavirus (Covid-19) outbreak was mostly concentrated in China with only limited spread to other countries. For our central forecast, we assumed that the associated economic disruption would be relatively short-lived and concentrated in China, with some transmission through supply chains to other parts of Asia and Europe. This implied a temporary impact on global GDP and trade, weighing modestly on UK activity in the first part of this year – a mild ‘V-shaped’ shock.

In calibrating the size of the effect, we were guided by the impact of the 2003 SARS outbreak, which is estimated to have knocked around 1 percentage point off Chinese GDP growth that year.a The associated impact on world GDP and trade was, though, quite limited. Since then, the share of China in world GDP and world trade has more than doubled. For that reason, we expected the impact on world GDP and world trade to be somewhat greater.

Bearing this in mind, we lowered our forecast for Chinese GDP growth in 2020 by 1 percentage point (to 5 per cent), with smaller adjustments in other parts of Asia, the US and the euro area, that together reduced world GDP growth by 0.3 percentage points. On this basis we lowered our forecasts for the growth of world trade and UK export markets by 0.5 and 0.2 percentage points respectively. This was expected to knock 0.1 percentage points off UK GDP growth this year.

Since we closed our pre-measures forecast (which serves as a stable basis for the Chancellor’s Budget policy decisions), it has become clear that the spread of coronavirus will be far wider than assumed in our central forecast, pointing to a deeper – and possibly more prolonged – slowdown. While the number of confirmed cases in the UK is still relatively small at the time of writing, the Chief Medical Officer, Professor Chris Whitty, has already declared that an epidemic is now “likely” here and the Government has announced plans as to how it would respond.b

The intensification of the outbreak overseas will affect the UK through a variety of channels: a more pronounced slowdown in export markets; potential shortages of inputs as supply chains are disrupted; disruption of travel plans and international transport; and the general impact of heightened uncertainty on spending by businesses and households. In addition, a widespread outbreak in the UK would directly impact both supply, as businesses have to operate with a substantially reduced workforce as individuals are placed under quarantine, and demand, as consumers stay at home in order to avoid contact with others.c

This is a fast-moving situation and forecasts necessarily become speculative. The OECD’s Interim Economic Outlook – released after we closed our forecast – has a ‘baseline’ scenario that assumes the outbreak is contained and largely centred in China (though much more severe than in our central forecast). In that scenario, world GDP growth slows to 2.4 per cent this year and world trade falls by 0.9 per cent. In its more severe ‘domino’ scenario, with broad contagion around the globe, the corresponding figures are 1.5 per cent and 3.8 per cent. The implications of slower growth for the public finances, abstracting from any discretionary measures, leads the median advanced economy to experience an increase in the budget deficit of 0.1 per cent of GDP in 2020 in the baseline scenario but more than 0.5 per cent in the more severe one.d

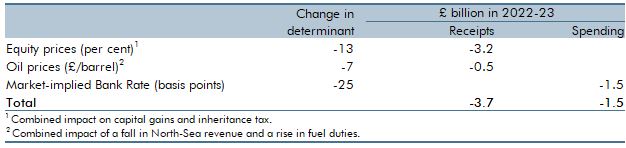

At this stage, it is too early to identify any economic impact in ONS data for the UK, but asset prices have moved sharply since we closed the window for financial market data on 11 February These movements alone would change our fiscal forecast. By the time London markets had closed on 6 March, equity prices had fallen 13 per cent; oil prices by about £7 a barrel; and the market implied path for Bank Rate over the coming years by around 25 basis points (Table B). Plugging these determinants into the main fiscal forecast models that use them would lower receipts in 2022-23 by £3.7 billion (dominated by the effect of lower equity prices on capital gains tax), but also lower spending by £1.5 billion (as the debt interest saving associated with the APF would be greater). So, other things being equal, borrowing would be £2.2 billion higher.

Table B: Indicative fiscal effects of changes in market determinants

In the Budget, the Chancellor announced measures intended to mitigate the effects of the more severe potential scenarios. Unavoidably, these were finalised after we closed our economic and fiscal forecasts. It is impossible at this point to give a reliable estimate of their fiscal consequences, as the take-up and implementation will depend on how the outbreak unfolds.

This box was originally published in Economic and fiscal outlook – March 2020