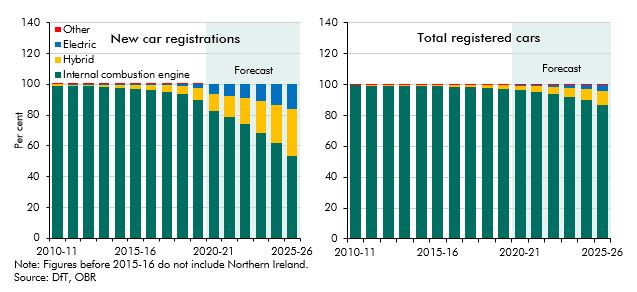

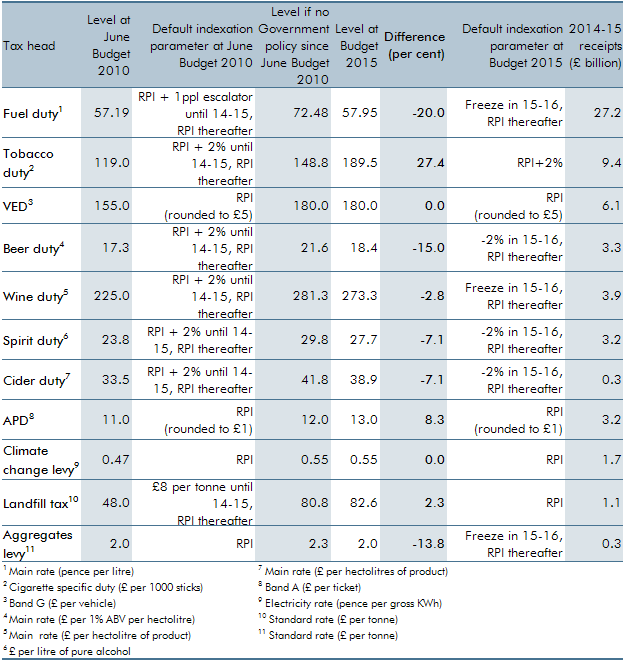

Vehicle excise duty (VED) is a tax levied on every vehicle using public roads in the UK and is collected by the Driver and Vehicle Licensing Agency (DVLA). For most cars registered prior to April 2017, the amount of VED due depended primarily on the car’s official CO2 emissions. For cars registered from April 2017 onwards, first-year VED payments are related to CO2 emissions, but subsequent payments are not.

Drivers of relatively fuel-efficient petrol or diesel cars (up to 50g/km CO2) typically pay up to £30 for the year when they first register the vehicle, depending on the car’s official CO2 emissions. Drivers of less fuel-efficient cars pay more, up to a maximum of £2,605. More information can be found online.

For the second-year payment onwards, most drivers pay a fixed rate of £180 regardless of the CO2 emissions of their vehicle. Some drivers may also have to pay a luxury supplement if they drive a car with a ‘list price’ of more than £40,000.

Electric vehicles (EVs) are currently exempt and drivers of EVs pay no VED, but from 2025, EVs first registered on or after 1 April 2017 will be liable to pay the lower rate in the first year (that which currently applies to vehicles with CO2 emissions of 1-50g/km) and the standard rate from the second year of registration onwards. A similar change applies to zero-emissions vans and motorcycles. The luxury supplement exemption for EVs is also due to end in 2025.

We forecast that VED will raise £8.3 billion in 2024-25. That represents 0.7 per cent of all receipts and is equivalent to around £290 per household and 0.3 per cent of national income.