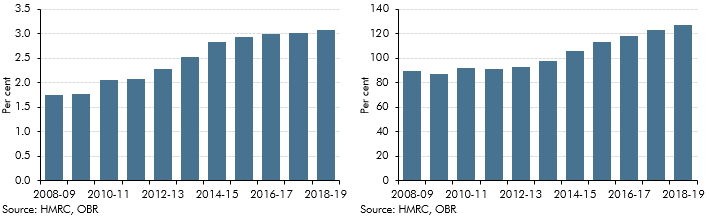

Capital gains tax (CGT) is levied on profits made from the sale of assets. CGT is paid by individuals and trusts. Gains made by companies are subject to corporation tax. In 2024-25 we estimate that CGT will raise £15.2 billion. This represents 1.3 per cent of all receipts and was equivalent to £530 per household and 0.5 per cent of national income.

The rate of CGT paid depends on the income of an individual and the type of asset being sold:

- Basic rate income taxpayers are typically subject to lower CGT rates: 10 per cent on gains from most assets and 18 per cent on residential property and ‘carried interest’ (performance-based rewards for investment managers). Primary residences (i.e. one’s main home) are exempt from CGT.

- For trusts, and for individuals whose combined income and gains are above the higher rate income tax threshold, higher rates of CGT apply (20 per cent for most assets, 24 per cent (from 6 April 2024) on residential property and 28 per cent on carried interest).

- Sole traders and partners selling their business may qualify for the lower Business Asset Disposal Relief rate of 10 per cent, up to a lifetime limit of £1 million.

- Tax is only paid on gains above a threshold (the Annual Exempt Amount), which is £6,000 for individuals and £3,000 for trusts in 2023-24 and is set to fall to £3,000 and £1,500 for individuals and trusts respectively from 2024-25 onwards.