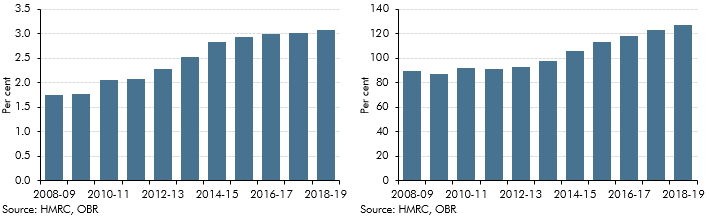

The charts below show capital gains tax receipts in both cash terms and as a share of national income (GDP), along with our November 2025 Economic and fiscal outlook (EFO) forecast.

Receipts measured in cash terms are a simple metric for analysing trends over time. But without putting the cash amount into context – by asking how much national income is available to be taxed – interpreting changes in cash receipts is difficult, particularly over long time periods.

Trends in receipts as a share of GDP are useful to understand how they move in line with the underlying economic activity that is being taxed. In cash terms, both receipts and GDP will tend to rise over time because of economic growth and inflation. Receipts as a share of GDP is the most relevant metric when considering the sustainability of the public finances. Movements in this ratio can be thought of in two parts – movements in the tax base relative to national income (i.e. whether asset prices have grown faster or slower than the whole economy) and changes in the effective tax rate (i.e. the amount of tax raised per unit of the tax base).

CGT receipts fell very sharply following the 2007-08 financial crisis, but more than doubled during the ten years following 2009-10 due to strong growth in asset prices. CGT is paid on the profit (gain) from the sale of an asset rather than the full disposal price, so is particularly geared to changes in equity prices. CGT receipts fell slightly in 2023-24, reflecting a return to the long-run trend in receipts after two years of unusually high-value disposals. CGT receipts then rise temporarily in 2025-26 due to people bringing forward asset disposals in advance of anticipated rate rises at the October 2024 Budget. In the long run receipts continue to rise in line with equity and property prices.

CGT receipts are received primarily in January as the tax is paid via self-assessment returns due on the last day of that month. Since some payments are typically received just after the deadline, some receipts score in February too. As returns for assets other than residential property are currently due 10 months after the end of the financial year, receipts are typically recorded in the financial year after an asset was sold generating the gain and accruing the tax liability.

Capital gains tax receipts: ONS (ID: MS62)

More detail can be found in paragraphs 4.31-4.33 of our November 2025 EFO.

Back to top