Box sets » Fiscal risks and sustainability

Fiscal risks and sustainability - July 2025

To investigate the effect of an ageing population on asset demand and rates of return in the context of the wider pension system, we have used the UK Overlapping Generations model (UK OLG). This box explained why the UK OLG is uniquely useful for this kind of life cycle analysis, presented an outline of the model's structure, and gave an overview of the data sources we used to calibrate the model.

Unfunded pension liabilities represent the second-largest government liability after gilts, but are not included in the PSNFL measure of debt. In this box, we analysed the treatment of unfunded pensions in the National Accounts and the fiscal risks they create.

Public sector net debt (ex BoE) has risen substantially over the past 25 years, despite repeated government plans to get it falling. In this box, we examined the key drivers behind this upward trend, including the impact of major economic shocks, the persistent gap between forecasted and actual debt outcomes, and the increasing difficulty of stabilising debt due to structural fiscal pressures.

The 2025 Spending Review increased the envelope for departmental financial transactions relative to the assumptions in our March 2025 forecast. In this box, we explored how this funding has been allocated and how this may impact future OBR work.

The expected level of write-offs associated with different parts of the Government's loan book affects how they are recorded by the ONS in the public finances. In this box we reviewed the effect which the valuation methodology used by the ONS for different elements of the loan book has on PSNFL.

There is a large degree of uncertainty around the estimates of the fiscal costs from climate damage. In this box we considered the main sources of the risks and uncertainties to climate damage costs, which are skewed to the downside.

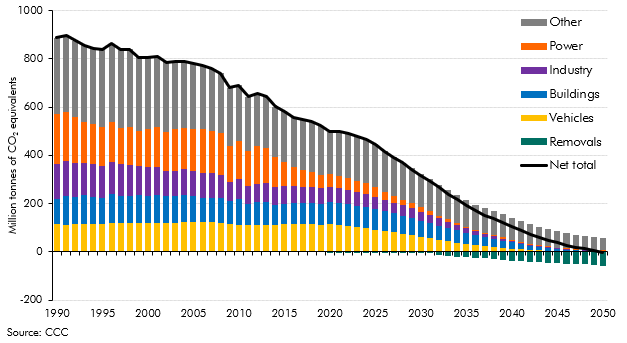

In June, the Government published the conclusions of the 2025 Spending Review, including allocations to net zero spending over the five years from 2025-26 to 2029-30. In this box we reviewed how the Government's Spending Review plans compare to the CCC's central scenario above for the public investment costs needed to achieve net zero emissions by 2050.

There is considerable uncertainty around the economic and fiscal costs associated with climate change mitigation. In this box we explored wider upside and downside risks around the CCC's central estimates of the whole-economy costs of the net zero transition and the impact the transition could have on the productive potential of the UK economy.

The UK’s fiscal position is increasingly vulnerable, by both historical and international standards. In this box, we considered the drivers of fiscal vulnerability, such as persistent large deficits, slower growth and higher interest rates, and the extent to which these may limit the Government's scope to respond to future economic shocks.

Fiscal risks and sustainability - September 2024

Adaptation measures can significantly reduce the economic impact of climate change, but come with additional costs that add to the fiscal pressure of climate change. This box discussed the current state of adaptation investment within the UK.

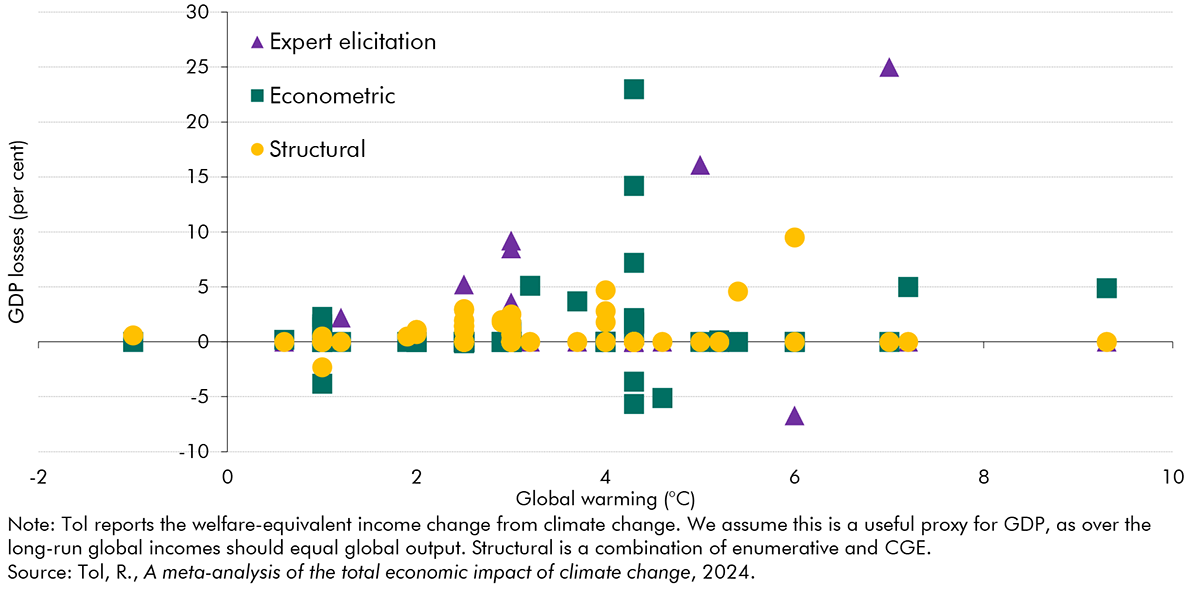

There is growing literature on the economic costs of climate change, where there is near-consensus on the negative impact on economic output but with a wide range of estimated losses. This box explored the the scale of, and reasons for, such differences and examined relevant UK studies in this context.

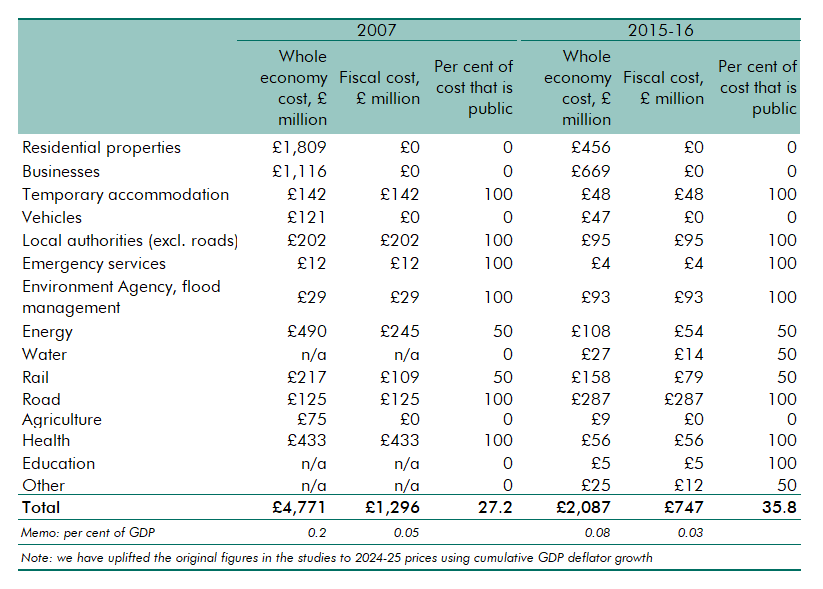

In 2010 and 2018, Defra and the Environment Agency produced reports exploring the costs of the 2007 summer floods and 2015-16 winter floods to the UK economy. In this box we used these numbers to estimate the direct fiscal costs of these flood events.

Our long-term fiscal projections focus on public spending on health, but private spending accounts for a significant share of health expenditure in the UK and particularly in other advanced economies. This box explored recent trends in private health spending in the UK and how this compares with other advanced economies.

Fiscal risks and sustainability - July 2023

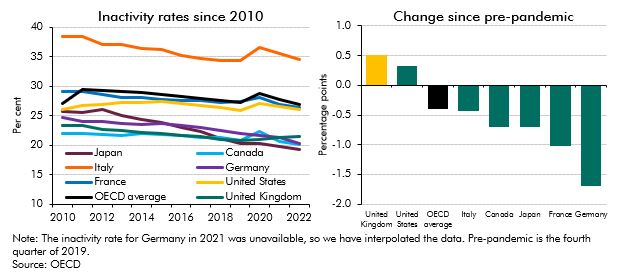

Inactivity fell across the G7 countries in the years prior to the onset of the pandemic and the UK consistently had one of the lowest inactivity rates. Since then inactivity has risen in the UK and US, but fallen across the rest of the G7 countries. This box detailed these changes and looked at ill-health as a driver of inactivity across the G7.

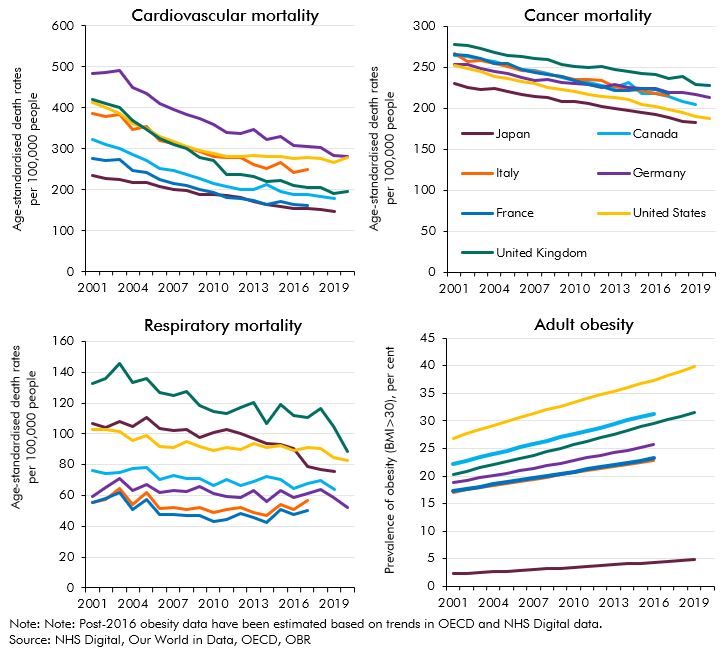

The improvements seen in life expectancy and a variety of other health indicators in the UK over a period of several decades have slowed down and - in some cases - partially reversed. This box detailed these changes and compares them to trends in other G7 countries.

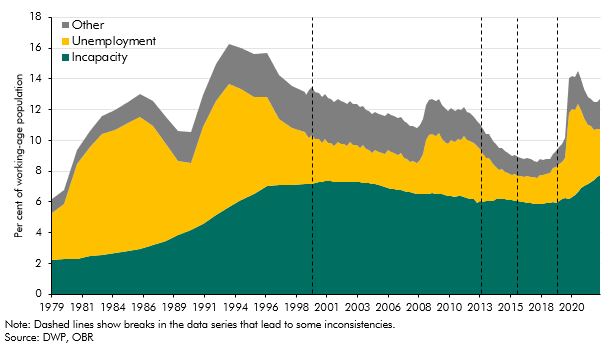

Benefits for working-age claimants with health problems have changed significantly over the last thirty years through the introduction of new benefits and assessments. This box described how the UK welfare system operates for working age claimants with and without health problems, and how this has changed over time.

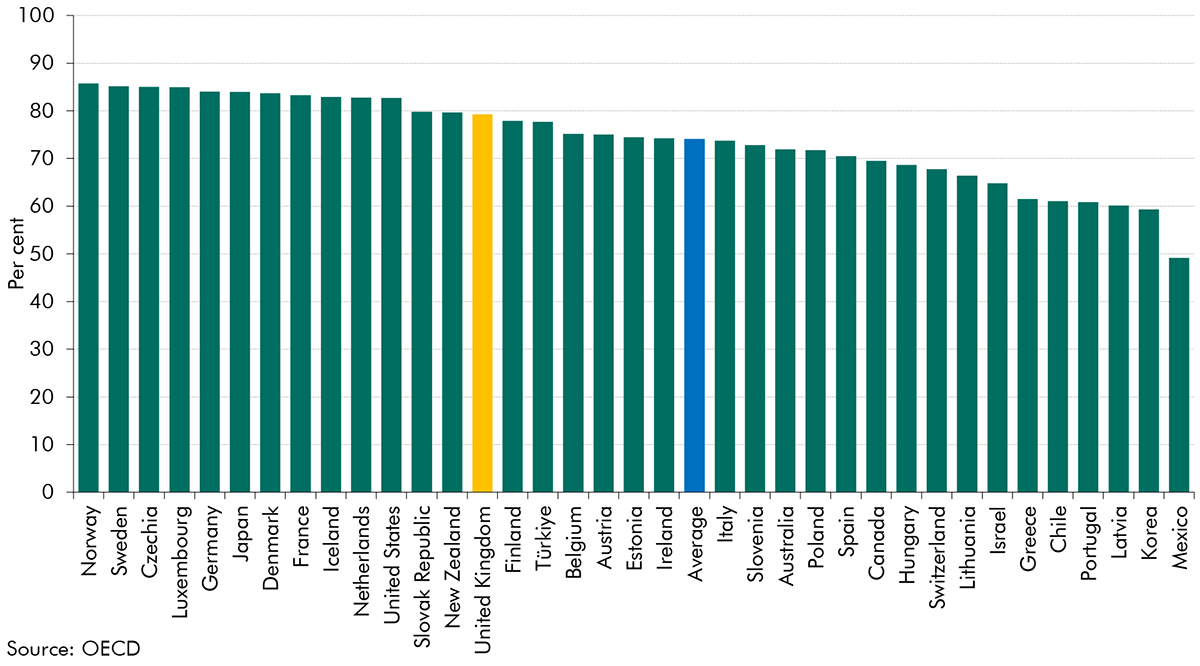

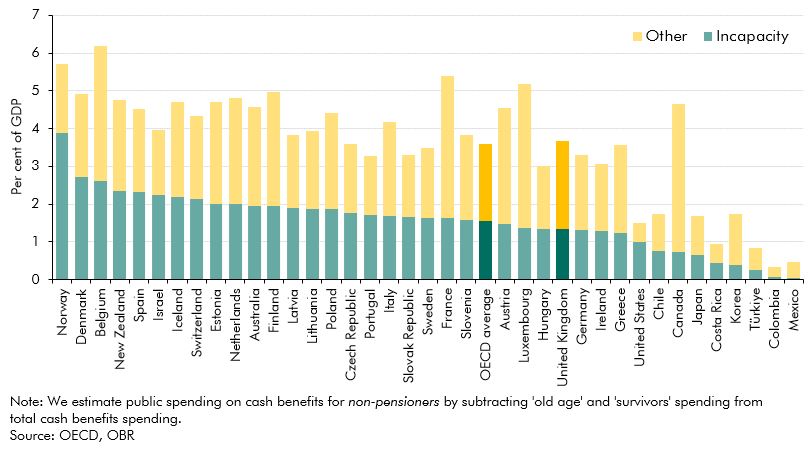

The UK spent close to the OECD average on non-pensioner cash benefits in 2019. This box compared the provision and generosity of health-related welfare across countries, drawing on several international studies.

The referral to elective treatment waiting list in England has risen steadily since the onset of the pandemic, to 7.4 million treatments in April 2023. This box used waiting list and LFS data to estimate the effect on employment and inactivity of halving the waiting list by 2027-28.

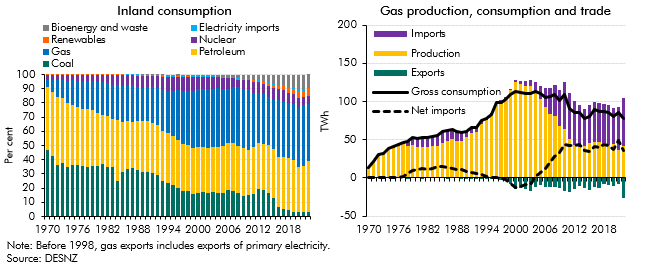

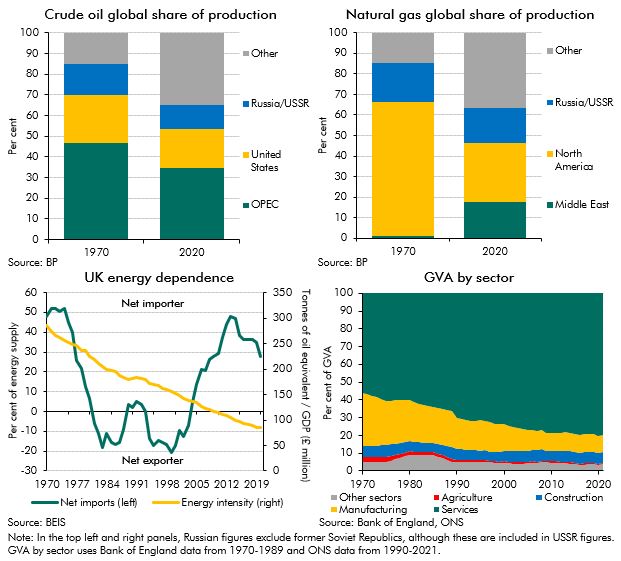

Since 1970 the UK's energy sector has undergone significant shifts following the discovery of oil and gas in the North Sea and the energy shocks of the 1970s. In this box we summarised the historical events and changes that has led to the UK has become increasingly dependent on imported gas.

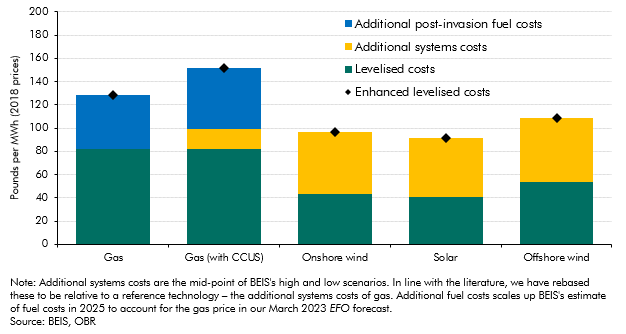

An estimate of the full cost of different energy sources to the power system needs to reflect more than just the construction and operating costs of energy generators that are captured in the levelised cost of electricity (LCOE). In this box we explored enhanced measures of levelised costs of energy.

Since our 2021 Fiscal risks report - which showed that reaching net zero carbon emissions will have significant impacts on the public finances in the UK - estimates of the fiscal impacts of reducing emissions in other countries have begun to be produced. In this box we recapped our 2021 work and discussed how IMF and French analysis compared to it.

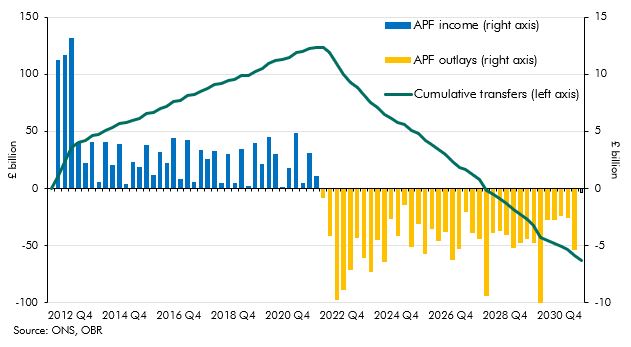

Up to July 2022 the Bank of England's quantitative easing (QE) activities had made large profits resulting in large transfers to the Treasury but since then flows have reversed. This box described what the whole lifetime direct costs of QE would be based on our March EFO assumptions.

As the stock of foreign holdings of UK debt has risen this century, so have questions about the risks of increasing, relatively high, levels of these holdings. This box looked at the why holdings of debt by foreign investors may lead to greater market volatility.

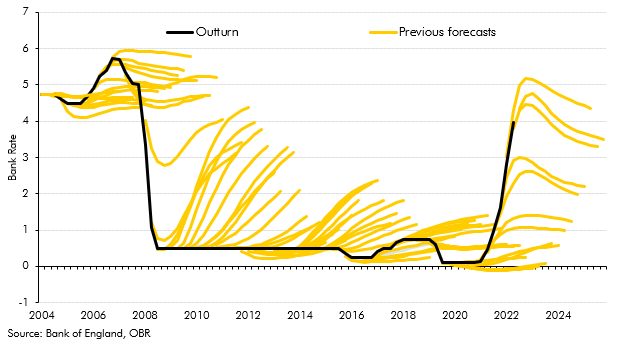

There has been a notable shift in the environment of interest rates over the past 18 months in the UK. This box looked at the extent of surprise for rate rises relative to market implied expectations and the increase in capital adequacy ratios of UK banks since the global financial crisis.

Fiscal risks and sustainability - July 2022

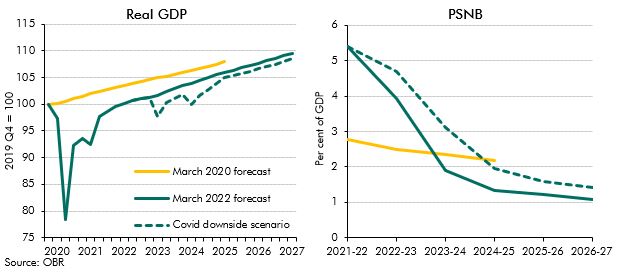

The possibility of a new vaccine-escaping Coronavirus variant cannot be ruled out. In this box we explored the possibility of such an escape and investigated the potential economic and fiscal consequences.

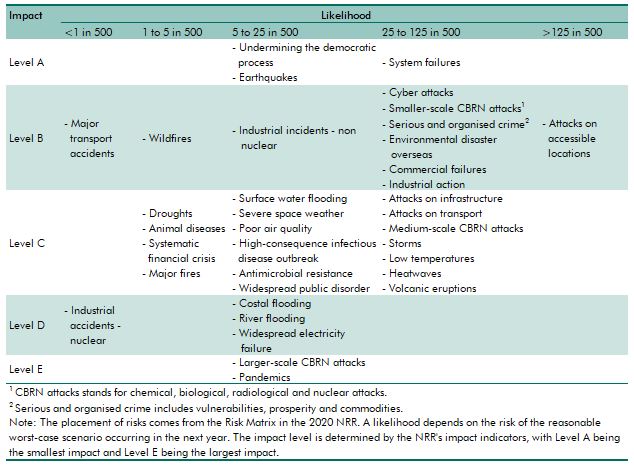

The National Risk Register (NRR) provides the Government's assessment of the likelihood and potential impacts of a range of risks to the safety and security of the UK. In this box box we compared the topics covered by the NRR and those we have focussed on in our risk analysis.

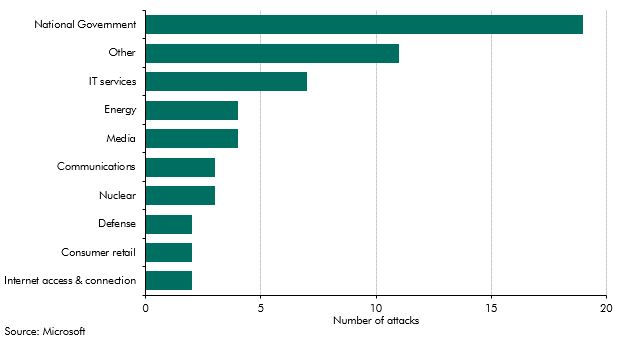

The Russian invasion of Ukraine in February 2022 led to questions over the impact that cyber attacks were likely to have during the conflict. This box looked at the history of cyber-related activity in the region, and the evidence available for cyber impacts of the conflict to date.

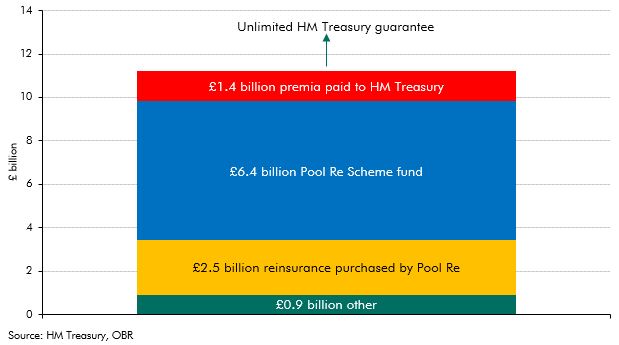

Given signs of pressure in the cyber insurance market, this box considered previous precedent of government intervention to help private insurers provide cover for large and uncertain risks. This included a detailed look at Pool Re, one of the longest running government-guaranteed reinsurance schemes, for terrorism risk.

There are signs that global economic integration has stalled in recent years on some measures and reversed on others. This box discussed the implications of integration for the economy and public finances.

The recent surge in energy prices and its associated effects on inflation has led to comparisons with the last major global energy crisis in the 1970s. This box examined the ways in which the shocks are similar and how they are different, with a focus on how the UK economy in some ways has become more resistent to energy price shocks.

Persistently higher energy prices can reduce the supply capacity of the economy. In this box, we use a production function to estimate the impact of higher fossil fuel prices on potential output.

In May 2022, the Government announced a package of measures to support households with the cost of living. In this box, we explained how we had adjusted our March 2022 Economic and fiscal outlook forecast for these policies.

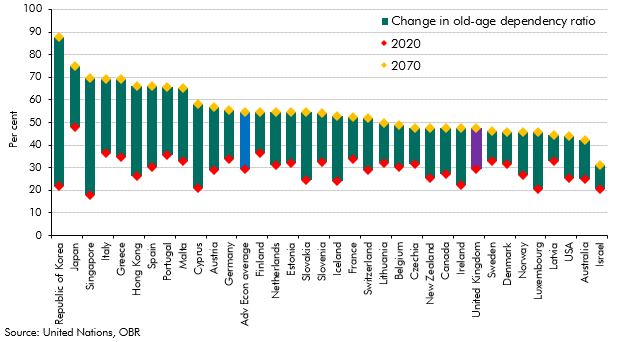

The populations of most advanced economies are ageing, placing new demands on these countries' public finances. This box explored why the UK population is forecast to age slower than most advanced economies over the next fifty years.