Since 1970 the UK's energy sector has undergone significant shifts following the discovery of oil and gas in the North Sea and the energy shocks of the 1970s. In this box we summarised the historical events and changes that has led to the UK has become increasingly dependent on imported gas.

This box is based on DESNZ data from March 2023 .

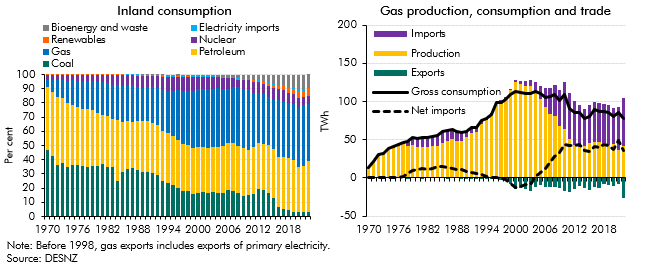

Since 1970, the UK’s energy sector has undergone significant shifts in response to domestic and international developments. In 1970 coal made up almost half of UK inland energy consumption. Coal was used heavily in what was then a much larger industrial sector, as well as in homes for heating and in the power sector as a primary fuel – accounting for 67 per cent of electricity generation.a By 2000, this had fallen to 35 per cent and in 2022 it fell to just 2 percent as coal was almost entirely phased out in the power sector. This was a result of a succession of major shifts in the composition of both energy production and consumption:

- In the 1970s, following the discovery of several large deposits of crude oil and natural gas in the North Sea in the 1960s, the UK started the shift to natural gas for heating, switching en masse from other fuel sources through a government-led programme, as discussed in detail in our 2021 Fiscal risks report.b Although the North Sea’s location and weather makes the cost of development and production higher than in Russia or the Middle East,c the 1973 oil crisis made extraction much more competitive as the price of oil nearly quadrupled, encouraging investment in the sector. From 1972 to 1977 capital investment in oil and gas increased 16-fold, leading to oil and gas production more than tripling by 1979.d

- In the 1980s, expanding North Sea oil and gas production saw the UK becoming a net exporter of energy in 1981. But, as shown in Chart A, the UK would increase its consumption of gas at a faster rate than production. Consumption from households rose by 18 per cent between 1980 and 1989 as gas central heating became more popular, meaning the UK has almost always been a net importer of gas.

- From the 1990s, natural gas accounted for a rising share of the UK’s energy mix. By 1993 gas made up a higher proportion of energy consumption than coal, driven by its replacement of coal in the electricity sector and a rise in gas central heating take-up in homes. By 1999, gas accounted for 40 per cent of UK total inland energy consumption. Meanwhile, as domestic production of coal fell 79 per cent between 1970 and 2000, domestic gas production in the North Sea rose by over 900 per cent in the same period.

- From the mid-2000s, North Sea gas and oil production fell significantly, with gas production falling from a peak of 126 TWh in 2000 to 42 TWh in 2022 as operating costs rose and investment in extraction and discovery of new oil and gas fields fell.e The UK’s proven North Sea gas reserves are now 19 per cent of what they were in 1997,f with European and domestic demand for gas expected to fall in the transition to net zero.

Chart A: Energy consumption and gas supply

Until the UK reduces its dependence on gas, the country is likely to remain heavily reliant on gas imports from abroad, given declining North Sea reserves. In the event of further gas price spikes similar to the scenario covered at the end of this chapter, the UK, as a large net importer of gas, would see further significant negative terms of trade shocks in the future. Households reliant on gas for both heating and electricity would be among the worst affected.

This box was originally published in Fiscal risks and sustainability – July 2023