In response to the largest rise in energy prices in around 50 years, an immediate reduction in energy demand, and more gradual change in the composition of energy supply, might be expected. In this box we look at how the sharp rise in the household price of gas has changed households consumption of gas this winter as well as how the Russian invasion of Ukraine and the rise in wholesale gas prices has changed the UK's energy supply over the last year and how it may change further in the future. We then briefly outline how we forecast gas prices and why we do so.

This box is based on BEIS and National Grid data from February 2023 .

In response to the largest rise in energy prices in around 50 years, an immediate reduction in energy demand, and more gradual change in the composition of energy supply, might be expected. Our initial analysis of household gas demand up to February 2023 supports our November forecast assumption that for every 10 per cent rise in households’ energy costs, energy demand would fall by 1 per cent (i.e. a price elasticity of demand of -0.1).a

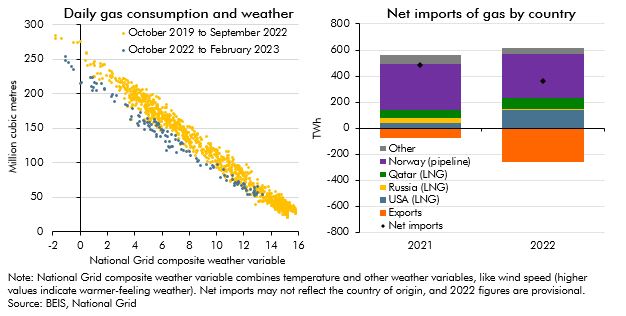

After adjusting for weather (removing the effects of the warm winter reducing central heating usage and therefore gas consumption), demand this winter is around 15 per cent lower than the two years preceding the Russian invasion of Ukraine. At the same time, household gas prices were on average around 200 per cent higher (left panel of Chart A). This implies a relationship between prices and demand that is close to our assumed elasticity of -0.1. All else equal, this elasticity would rise over time if consumers gradually purchased more energy-efficient items, such as insulation, although consumers may offset this by increasing energy consumption in other ways, such as by using central heating more often.b

The full supply response to higher gas prices is likely to take much longer. Averaging roughly 40 per cent of electricity generation, gas is both the baseload and marginal source of electricity for the UK when more intermittent renewable sources (such as wind) are not available. Despite continued investment in renewable energy and renewed interest in alternative sources that can provide a stable baseload such as nuclear,c the continued shift away from gas as our primary source of electricity is likely to be gradual rather than rapid. Hinkley Point C, the UK’s first new nuclear reactor in 52 years, is due to open in 2027, almost 20 years after its announcement in 2008. Sizewell C, also announced in 2008, is yet to begin construction.

So, in the near term, the supply response has primarily comprised a change in the sources of the UK’s imported gas. The UK has historically imported a smaller proportion of its gas supply from Russia than other European countries and has therefore had to substitute less of its gas supply for liquified natural gas (LNG) from outside Europe, which is largely replacing pipeline Russian gas in Europe. But LNG as a share of gas supplies has still risen to 47 per cent of UK gas imports in 2022 versus an average of 26 per cent over the previous decade, with supplies from Russia falling to less than 1 per cent (right panel of Chart A). The UK is relatively well positioned for this Europe-wide shift towards LNG imports, holding roughly one-quarter of Europe’s regasification facilities before the pandemic (in part the flipside to the UK’s relatively low gas storage capacity).d As such, the UK’s gas exports more than tripled in 2022 as some of the LNG imported into the UK was processed and exported to Europe through gas interconnectors. But in the short term, LNG supply to Europe is limited by a lack of regasification capacity and of pipelines from countries such as Spain and the UK that have large regasification capacity. This keeps wholesale gas prices in the region’s highly integrated market high. In the medium term, investment in liquification facilities is expected to increase world LNG supply by 19 per cent between 2021 to 2026.e Significant investment in new regasification facilities in Europe also contributes to the fall in market expectations for European gas prices over the coming years.

Chart A: UK demand for and supply of gas

Our central forecast is based on futures market prices for gas up to the end of 2025 and then holds them constant in real terms. Evidence supports using futures in the near term (up to one year ahead), with market signals consistent with further demand and supply responses lowering wholesale prices; in the long run a futures-based forecast is not significantly better than a random walk,f and medium-term futures could also embody a risk premium over future spot prices.g Given this uncertainty, Chapter 5 explores upside and downside gas price scenarios.

This box was originally published in Economic and fiscal outlook – March 2023