Our long-term fiscal projections focus on public spending on health, but private spending accounts for a significant share of health expenditure in the UK and particularly in other advanced economies. This box explored recent trends in private health spending in the UK and how this compares with other advanced economies.

This box is based on ONS and OECD data from May 2023 and 2024 .

Our long-term fiscal projections focus on public spending on health, but private spending accounts for a significant share of health expenditure in the UK and particularly in other advanced economies. This box explores recent trends in private health spending in the UK and how this compares with other advanced economies.

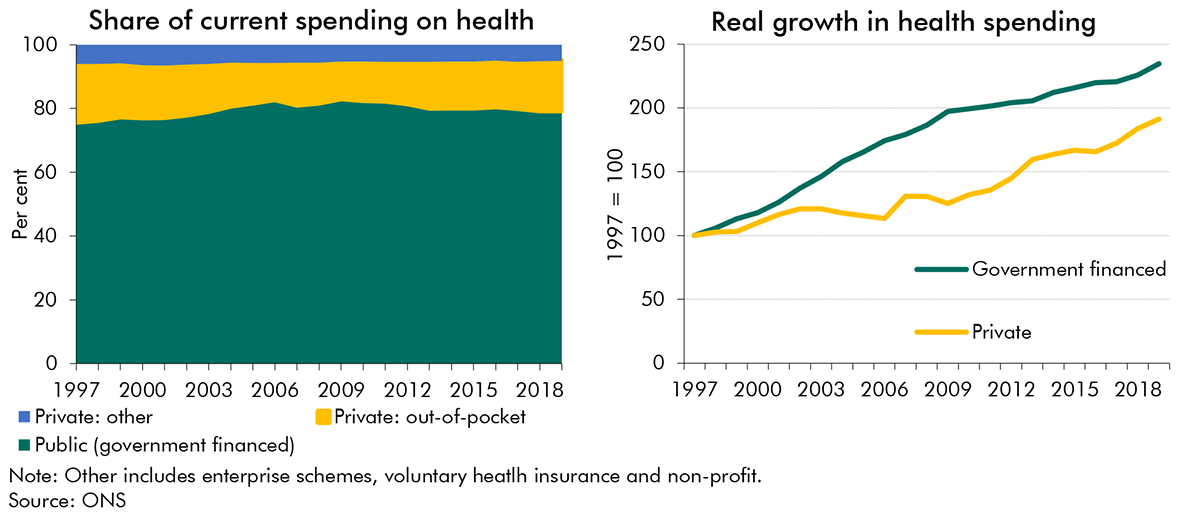

Private health spending accounted for 24 per cent of total UK health spending in 1997, with out-of-pocket spending the largest source of private spending, at 18 per cent (Chart A).a Private health spending grew relatively strongly in real terms, at around 9.8 per cent annually, until the pandemic. Annual growth peaked at 37.8 per cent in 2000 then slowed down to 8.6 per cent a year on average to 2009. From 2010 to 2019, real growth in private health spending picked up to 11.3 per cent a year, as public health spending growth slowed to 1.8 per cent annually. As a share of total health spending, private spending fell to a low of 16.9 per cent in 2009 before rebounding to 20.7 per cent before the pandemic. This recent trend is supported by more timely Private Health Insurance Network data, which suggests that medical insurance and self-pay/out-of-pocket admissions were at record high levels in 2023.b

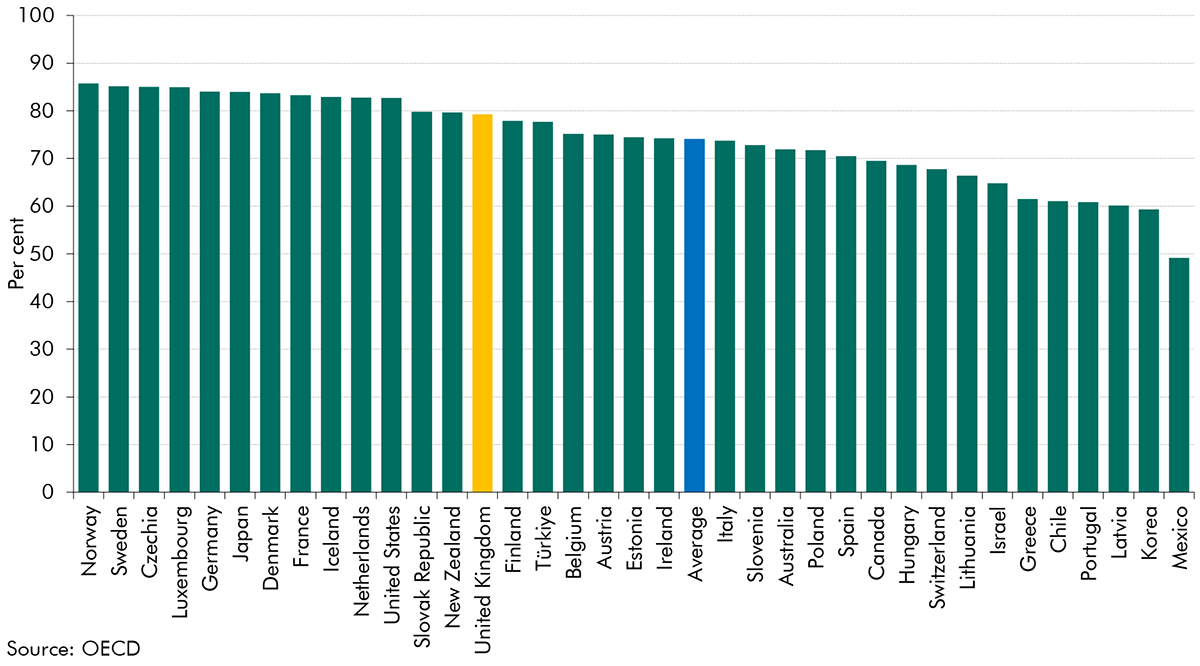

These recent trends mean that the UK’s share of overall health spending that is financed by government has fallen by 3.1 percentage points between 2009 and 2019. This is in contrast to the average across G7 countries, where the share financed by government has increased by 5.2 percentage points. But, as shown in Chart B, the UK continues to be above average in comparison to other advanced economies in terms of the share of health spending financed by government, at around four-fifths, compared to an advanced-economy average of three-quarters.

Chart B: Share of health spending that is government financed, 2019

The rebound in the private share of health expenditure since 2010 in the UK likely reflects some combination of the slowdown in real growth in public spending on health, rising NHS waiting lists, and an increasing preference for private healthcare as disposable incomes rise. Increased use of private healthcare could mitigate some of the fiscal pressures we discuss later in this chapter, including those driven by rising incomes. However, at present, public health spending still accounts for the large majority of overall health spending in the UK, and slightly more than half of the upward pressures on health expenditure in our projections are driven by factors other than pure income effects.

This box was originally published in Fiscal risks and sustainability – September 2024