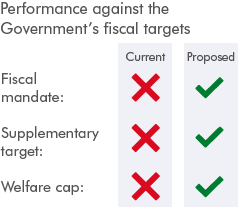

Our latest Economic and fiscal outlook was published on 23 November 2016. It sets out forecasts for the economy and the public finances, and an assessment of whether the Government is likely to achieve its fiscal mandate and supplementary target.

Economic and fiscal outlook – November 2016

At a glance

Supporting documents

Chapter 4, 5 and Annexes

Chapter 1, 2 and 3

Supplementary documents

Information or data which has been released alongside the Economic and fiscal outlook or as a result of external requests, since the original publication of the main document.