Our fuel duty receipts forecast combines our underlying forecast assumptions about the amount of fuel that will be purchased and the Government’s stated policies on the fuel duty rates that will be levied on those purchases. This box outlined the changes in fuel duty and policy assumptions since 2010.

This box is based on HMRC fuel duty data from October 2016 .

Our fuel duty receipts forecast combines our underlying forecast assumptions about the amount of fuel that will be purchased and the Government’s stated policies on the fuel duty rates that will be levied on those purchases. Parliament has stipulated that our forecasts be based on those stated policies and that we must not consider alternatives. But it also requires us to note risks to our forecast. The possibility that the actual path of fuel duty rates policy will differ from the Government’s current stated policy is a risk that we consider worth noting.

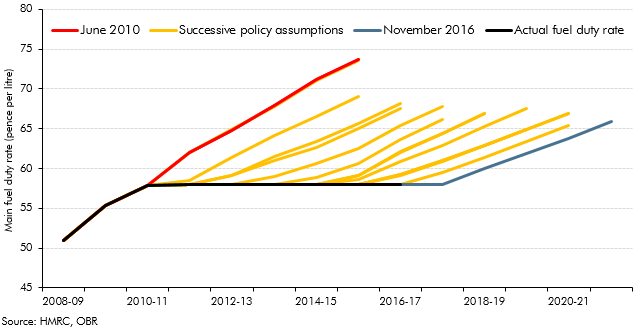

As Chart B shows, fuel duty policy has been changed at most Budgets and Autumn Statements since 2010. Specifically:

- in Budget 2011, the Government cancelled the pre-existing fuel duty escalator (where fuel duty rates were due to rise in line with RPI inflation plus a penny a litre in every year until 2014-15). The rate was also cut by one pence a litre in April 2011. The April 2011 RPI rise was delayed until January 2012 and the April 2012 rise was delayed until August 2012;

- in Autumn Statement 2011, it delayed the planned January 2012 RPI rise until August 2012– thereby planning a rise before the next Autumn Statement;

- in June 2012, it delayed the planned August 2012 RPI rise until January 2013;

- in Autumn Statement 2012, it cancelled the planned January 2013 RPI rise and pushed back each subsequent year’s April RPI rises until the end of the Parliament to September;

- in Budget 2013, it cancelled the planned September 2013 RPI rise;

- in Autumn 2014, it cancelled the planned September 2014 RPI rise;

- in Budget 2015, it cancelled the planned September 2015 RPI rise;

- in Budget 2016, it cancelled the planned April 2016 RPI rise; and

- in this Autumn Statement, the Government has cancelled the planned April 2017 RPI rise.

Chart B: Successive Government fuel duty rate policy assumptions

This box was originally published in Economic and fiscal outlook – November 2016