The Government is no longer on course to balance the budget during the current Parliament and has formally dropped this ambition in a significant loosening of its fiscal targets. Public sector net borrowing is now expected to fall more slowly than we forecast in March, primarily reflecting weak tax receipts so far this year and a more subdued outlook for economic growth as the UK negotiates a new relationship with the European Union.

Confronted by a near-term economic slowdown and a structural deterioration in the public finances, the Government has opted neither for a large near-term fiscal stimulus nor for more austerity over the medium term. Instead the Chancellor has proposed a much looser ‘fiscal mandate’ that gives him scope for almost 2½ per cent of GDP (£56 billion) more structural borrowing in 2020-21 than his predecessor was aiming for in March.

Forecast revisions have absorbed 0.9 per cent of GDP (£20 billion) of this extra room for manoeuvre and the Chancellor has given away 0.4 per cent of GDP (£9½ billion), mostly in infrastructure spending. This leaves 1.2 per cent of GDP (£26½ billion) spare, in case the structural outlook is worse than we think or he wants to announce more giveaways. (He can also run a bigger deficit if the cyclical slowdown is more severe.) But, if the Chancellor did borrow more, his aim to balance the budget as early as possible in the next Parliament would become even more challenging, especially given age-related spending pressures.

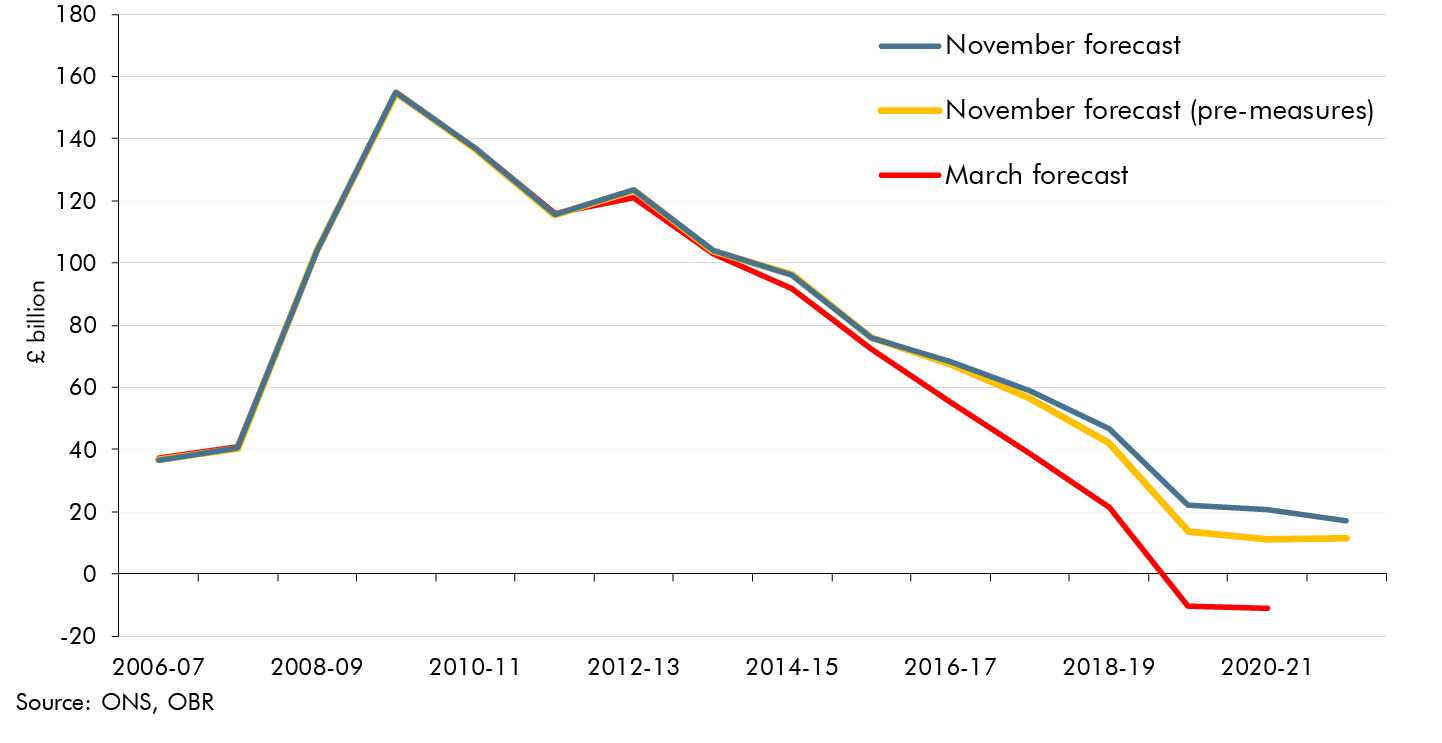

Public sector net borrowing

The OBR is required by legislation to produce its forecasts on the basis of current stated Government policy (but not necessarily assuming that specific objectives will be met). In the current context of looming Brexit negotiations, this is far from straightforward. Quite appropriately, we have been given no information regarding the Government’s goals or expectations for the negotiations that is not already in the public domain.

Given the uncertainty surrounding the choices and trade-offs that the Government may have to make, and the consequences of different outcomes, we have not attempted to predict the precise end result of the negotiations. Instead we have made a judgement – consistent with most external studies – that over the time horizon of our forecast any likely Brexit outcome would lead to lower trade flows, lower investment and lower net inward migration than we would otherwise have seen, and hence lower potential output. In time the performance of the economy will also be affected by future choices that the Government makes about regulatory and other policies that are currently determined at the European level. These could move in either a growth-enhancing or a growth-impeding direction.

In the near term, as the negotiations get under way, we assume that GDP growth will continue to slow into next year as uncertainty leads firms to delay investment and as consumers are squeezed by higher import prices, thanks to the fall in the pound. But we do not assume that firms shed jobs more aggressively or that consumers increase precautionary saving, both of which are downside risks if the path to Brexit is bumpy. Our forecasts are currently somewhat less pessimistic than those in the Bank of England’s November Inflation Report and the Treasury’s published pre-referendum analysis, but in current circumstances the uncertainty around them is even greater than it would be in normal times.

The negotiations will also determine the scope and scale of any ongoing financial flows between the UK and the EU. Again we do not know enough about the Government’s preferences, or its chances of achieving them, to make a precise forecast. Instead we produce a ‘no referendum’ counterfactual for our transfers to the EU – a forecast of the flows we would expect to see if the UK had not voted to leave the EU – and make the fiscally neutral assumption that any reduction would be recycled into extra domestic spending.

On the basis of these assumptions, our central forecast suggests:

- the economy will grow more slowly than we expected in March, with GDP growth in 2017 revised down from 2.2 to 1.4 per cent and cumulative growth over the whole forecast revised down by 1.4 percentage points. A weaker outlook for investment and therefore productivity growth is the main cause. Inflation is forecast to peak at 2.6 per cent and unemployment to rise modestly to 5.5 per cent during 2018. Subdued earnings growth and higher inflation mean that real income growth stalls in 2017;

- the budget deficit has been revised up by £12.7 billion this year, thanks primarily to weakness in income tax receipts that largely pre-dates the referendum. The weaker growth outlook means that our pre-policy-measures forecast revision rises to £18.1 billion by 2020-21. Again, weaker income tax receipts are the biggest factor, reflecting the downward revision we have made to productivity and earnings growth; and

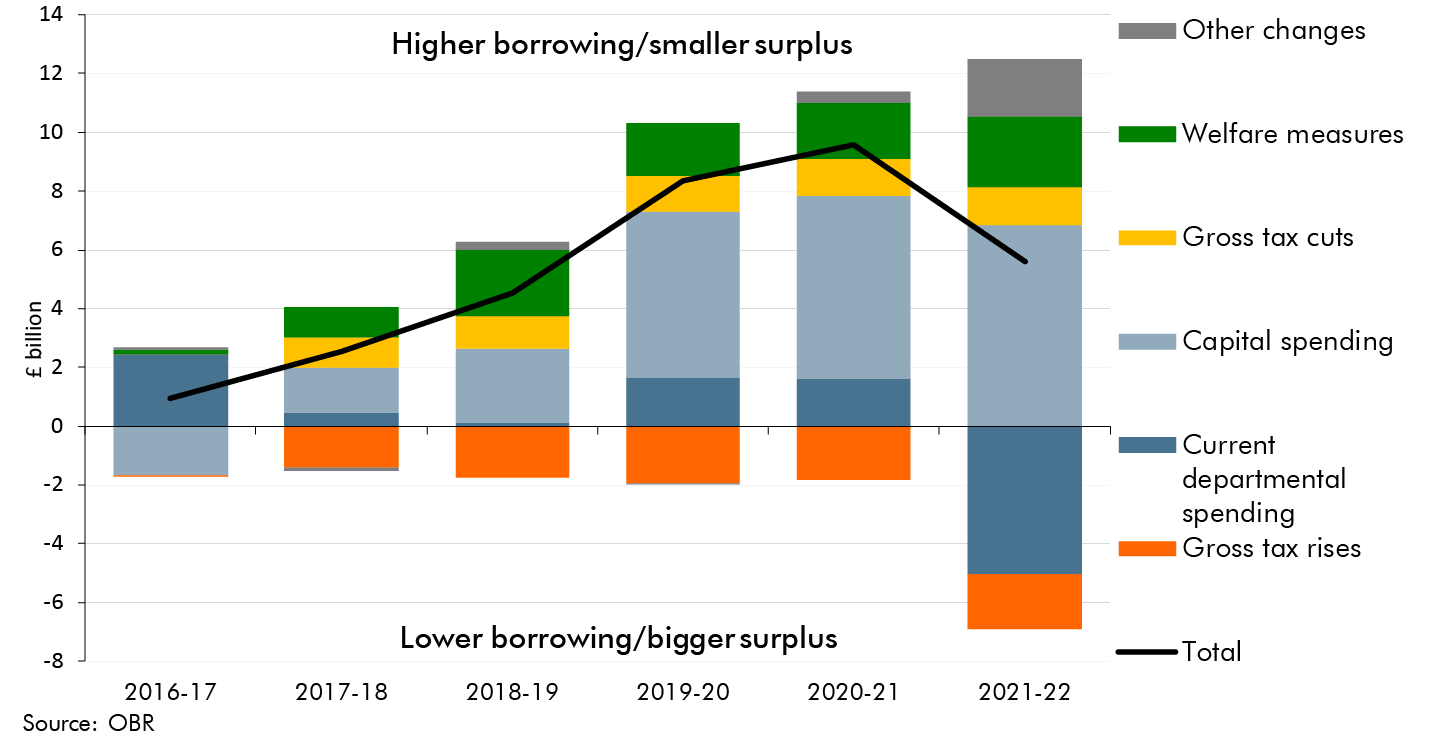

- on top of that, Autumn Statement policy decisions add to the deficit in every year. As Chart 1.2 shows, capital spending has been increased by rising amounts across the Spending Review years to 2020-21 and into 2021-22. The Government has also announced a small net tax increase. Tax rises include another increase in the insurance premium tax and more anti-avoidance measures. These outweigh the tax cuts, notably freezing fuel duty next year for the sixth year in a row. Welfare spending is higher after the disability benefit cuts announced in the March Budget were abandoned and because of a decision to taper away universal credit awards less aggressively. Departmental resource spending plans have been increased in 2019-20 and 2020-21, but held flat in real terms in 2021-22. So in that year they fall in real per capita terms and as a share of GDP. Taking forecast changes, classification changes and policy measures into account, we now forecast a deficit of £20.7 billion (0.9 per cent of GDP) in 2020-21, compared to an £11.0 billion surplus in March.

The effect of Autumn Statement decisions on public sector net borrowing

With our underlying borrowing forecast higher – and policy decisions pushing the deficit up further – the Government’s three existing fiscal targets would all be missed by considerable margins. The current fiscal mandate requires a budget surplus in 2019-20, but we now forecast a deficit of £21.9 billion. The ‘supplementary target’ requires debt to fall relative to national income every year, but we now expect it to rise sharply this year and next – partly due to the measured effect of August’s monetary policy changes. And the ‘welfare cap’ requires a subset of welfare spending to be held below a cash limit set in July 2015, but we now expect this to overshoot by more than 7 per cent by 2020-21. These rules do not apply in the event of a ‘significant negative shock’, on the Government’s definition, but with our growth forecast remaining above 1 per cent this escape clause is not triggered.

The Government has proposed new fiscal targets in a draft Charter alongside the Autumn Statement. These are much less constraining than the existing ones. The new fiscal mandate requires a structural deficit – i.e. borrowing unrelated to temporary weakness in the economy – below 2 per cent of GDP in 2020-21, which would mean halving it in this Parliament. Separately, net debt must fall relative to GDP in 2020-21. The new welfare cap only applies in 2021-22 and is only to be assessed at the start of the next Parliament.

Our central forecast shows the new targets all being met. But given the uncertainty around any fiscal forecast at that horizon, the chance of any being missed is significant. For the fiscal mandate, past forecast performance suggests that there is a 35 per cent chance of the new target being missed despite £26.6 billion of headroom.