Ahead of the Chancellor’s Autumn Statement and our November 2016 Economic and fiscal outlook, the Institute for Fiscal Studies published an assessment of the outlook for the public finances. In this box, we described the differences between our new pre-measures forecast and that assessment.

This box is based on IFS, Winter is Coming: The outlook for the public finances in the 2016 Autumn Statement data from November 2016 .

The IFS published an assessment of the outlook for the public finances in November.a In this box, we describe the differences between our latest pre-measures forecast and that assessment.

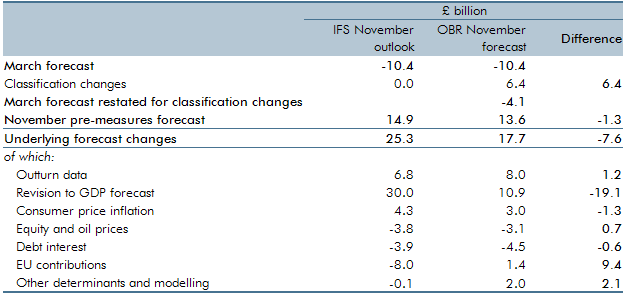

The IFS forecast for the deficit in 2019-20 was £14.9 billion, a £25.3 billion deterioration relative to our March forecast.That is very close to our pre-measures forecast of £13.6 billion in 2019-20. But Table B shows compares the sources of the revisions to each forecast:

- our forecast has been adjusted for classification changes. These add £6.4 billion to borrowing in 2019-20, largely reflecting the removal of the effect of the corporation tax timing measure in that year. This change is not reflected in the IFS forecast;

- we have increased our 2016-17 borrowing estimate up significantly and we have assumed that most of the factors driving that are structural, so persist across the forecast. This boosts borrowing by £8.0 billion in 2019-20. The IFS estimated this effect to add £6.8 billion in 2019-20;

- the downward revision to our GDP growth forecast increases borrowing by £10.9 billion in 2019-20. The IFS expected lower GDP growth to raise it by around £30 billion in that year. Two-thirds of the difference reflects their assumption of an even weaker GDP profile than ours, with the rest likely to reflect either the approach taken to estimating the hit or the composition of the hit assumed;

- higher consumer price inflation adds £3.0 billion to our forecast in 2019-20, reflecting weaker tax receipts (as faster uprating of income tax and NICs thresholds mean that less income is taxed at higher rates) and higher spending (where some welfare and public service pension payments are uprated in line with CPI inflation). The IFS estimated that this effect would add £4.3 billion in that year;

- we expect higher equity and oil prices to boost receipts by £3.1 billion in 2019-20 via higher capital gains tax and North Sea revenues. The IFS estimated this to add £3.8 billion in that year;

- lower debt interest payments (more than explained by lower interest rates) lower our forecast by £4.5 billion in 2019-20, broadly in line with the IFS forecast; and

- we have made the fiscally neutral assumption that any reduction in expenditure transfers to the EU would be recycled fully into domestic spending. Our forecast for this spending is £1.4 billion higher in 2019-20, largely due to the effect of a weaker pound. The IFS assumed that these transfers will be reduced to zero and that this will reduce borrowing by £8.0 billion in that year.

Table B: Revisions to net borrowing in 2019-20: IFS and OBR estimates

This box was originally published in Economic and fiscal outlook – November 2016