Box sets » External forecasts

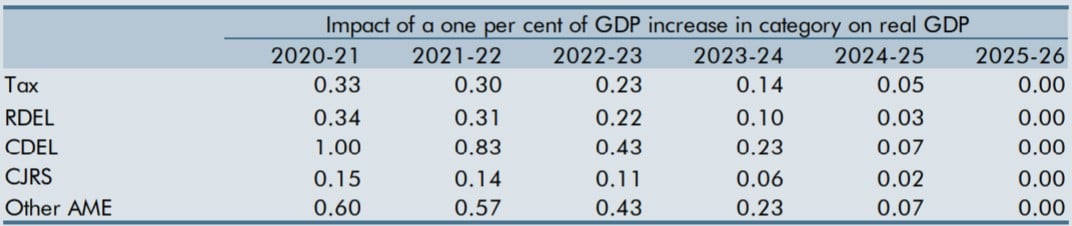

The unusual nature and size of the prevailing economic shock, and the Government’s fiscal response, raised the question of whether our usual fiscal multipliers were appropriate at the time. This box set out competing arguments for the multipliers being larger or smaller than those we usually employ and concluded that we would leave them largely unchanged.

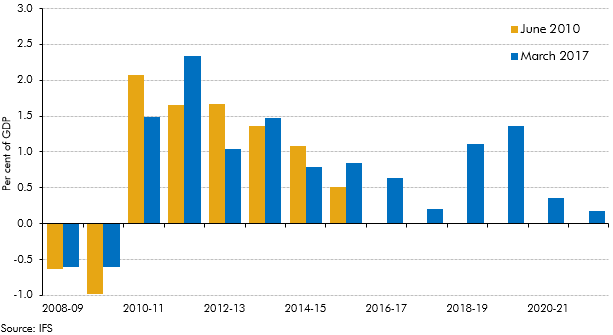

Over the past six years there has been a large discretionary fiscal tightening in the UK. This box set out estimates of the effect of fiscal policy changes on GDP growth, based on estimates of the consolidation produced by the Institute for Fiscal Studies (IFS) together with estimates of fiscal multipliers, which are drawn from the available empirical literature. The box also considered how changes in discretionary fiscal policy compared with our forecast errors for GDP growth.

The UK currently makes a substantial net financial contribution to the activities of the European Union. This box outlined the historical liabilities and other commitments entered into that officials, institutions and MEPs were said to be arguing that the UK should pay a share of, in light of Brexit. The box also listed government policy commitments to fund spending in certain areas where EU funding would be withdrawn.

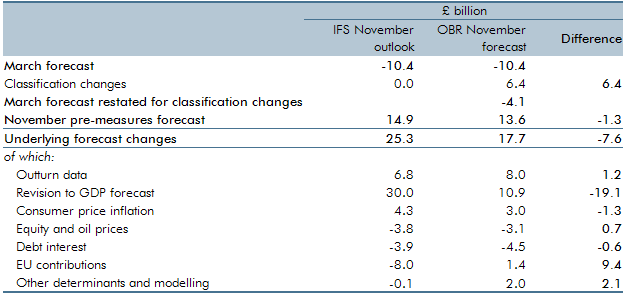

Ahead of the Chancellor’s Autumn Statement and our November 2016 Economic and fiscal outlook, the Institute for Fiscal Studies published an assessment of the outlook for the public finances. In this box, we described the differences between our new pre-measures forecast and that assessment.

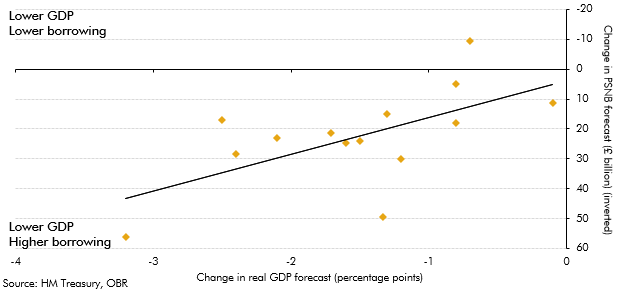

Our 2016 Forecast evaluation report was published around four months after the EU referendum was held. Over that period forecasters had revised their real GDP growth and borrowing forecasts. This box summarised those revisions and the relationship between them. It illustrated the uncertainty that forecasters faced in trying to predict the impact of the referendum result and Brexit on the economy and public finances.

Our forecasts must be prepared on the basis of current government policy. Before the EU referendum, that policy was to remain in the EU, so that was the basis for our March 2016 forecast. While we made no assessment at that stage as to what the economic and fiscal impacts of Brexit might be, in every forecast we highlight particular risks and uncertainties around our central projections. This box discussed Brexit as a particular source of uncertainty, by highlighting some pieces of external analysis which showed a wide range of views as to the possible impacts on trade, productivity and GDP growth.

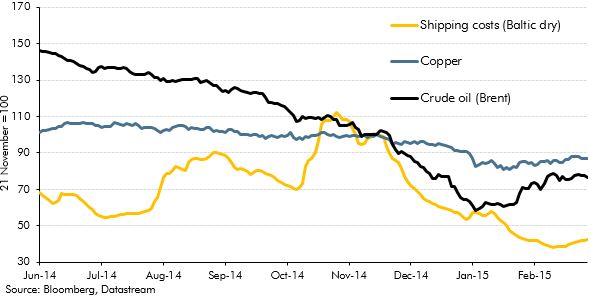

An important economic development in the run-up to our March 2015 Economic and fiscal outlook was the sharp drop in oil prices, which had fallen to less than half the $115-a-barrel peak that they had reached in June 2014. In this box we considered the relative importance of demand- and supply-side factors in explaining lower oil prices. (See also Box 3.1 from that EFO for a discussion of the effects of those lower prices on the UK economy.)

Each autumn, we publish our Forecast evaluation report (FER), a detailed examination of the performance of past economic and fiscal forecasts relative to the latest outturn data. This box discussed the OECD's and Bank of England's forecast errors, their explanations for these errors, and the lessons forecasters have learnt from the errors.

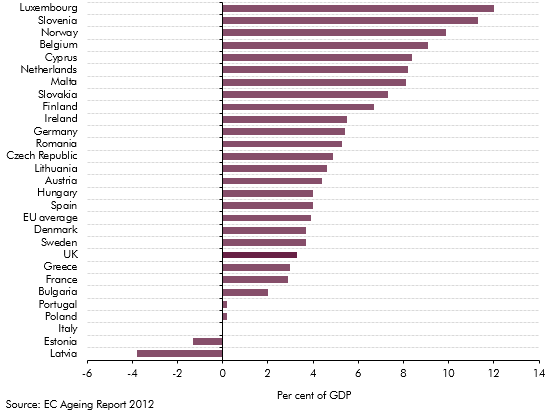

The European Commission (EC) produces its own analysis of ageing pressures for member states every three years. This box contrasted the forecast made by the EC and the OBR for UK age related spending such as pensions, health care and long-term care.

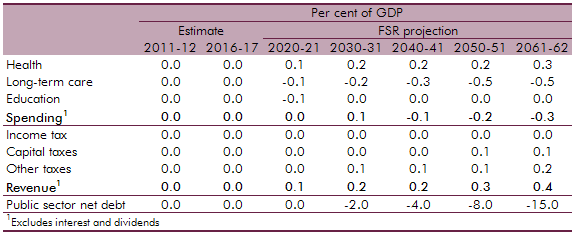

The National Institute of Economic and Social Research (NIESR) produce generational accounts estimates for the UK. The OBR produces its own long-term projections by using profiles that break down spending by year of age. This box compared the differences in public finance forecasts between the OBR and the NIESR with the latter implying a lower level of net debt by 2061‑62.

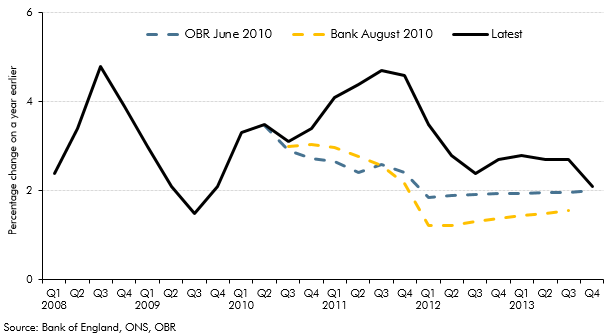

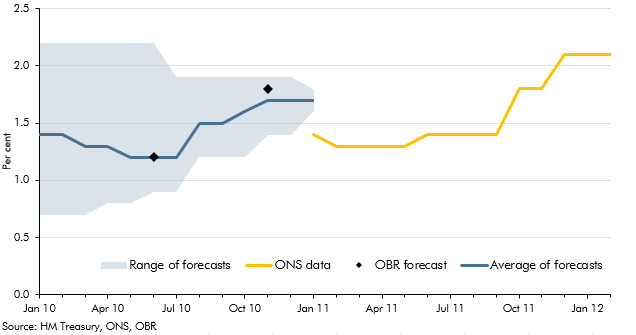

Both forecasts and National Accounts data are subject to revision. This box discussed how outside forecasts for growth in 2010 evolved through that year and compared these forecasts with ONS outturns, from the ONS' first estimate made in January 2011 through to their latest available estimate in February 2012.