Box sets » Forecast evaluation report - October 2016

Stamp duty land tax (SDLT) is one of the more volatile sources of receipts. In our 2016 Forecast evaluation report, this box identified a number of reasons why forecasting SDLT receipts is challenging, including the concentration of receipts in a small proportion of expensive properties and the effects of significant policy changes.

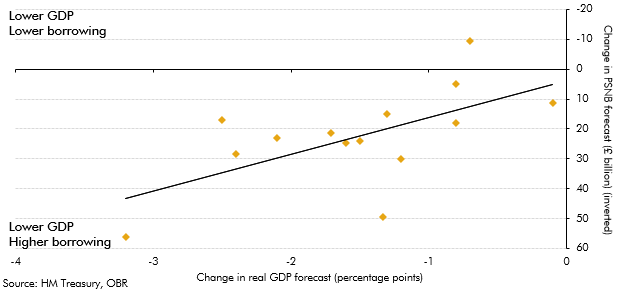

Our 2016 Forecast evaluation report was published around four months after the EU referendum was held. Over that period forecasters had revised their real GDP growth and borrowing forecasts. This box summarised those revisions and the relationship between them. It illustrated the uncertainty that forecasters faced in trying to predict the impact of the referendum result and Brexit on the economy and public finances.