An important economic development in the run-up to our March 2015 Economic and fiscal outlook was the sharp drop in oil prices, which had fallen to less than half the $115-a-barrel peak that they had reached in June 2014. In this box we considered the relative importance of demand- and supply-side factors in explaining lower oil prices. (See also Box 3.1 from that EFO for a discussion of the effects of those lower prices on the UK economy.)

This box is based on Bloomberg commodity prices and Datastream oil price data from February 2015 and February 2015 respectively.

During the second half of 2014, oil prices fell by over 50 per cent from their peak in June 2014 of $115 a barrel (Chart A). Some of this fall is expected to be reversed over the next two years. As discussed in Chapters 3 and 4, the fall in the oil price has important implications for our economic and fiscal forecasts. To an extent, those implications depend on why exactly it is that the oil price has fallen so far. In particular, negative demand and positive supply shocks will have different effects on our forecasts. This box considers the evidence and external views on that question. Box 3.1 in Chapter 3 reviews estimates of the effect of oil prices on the economy.

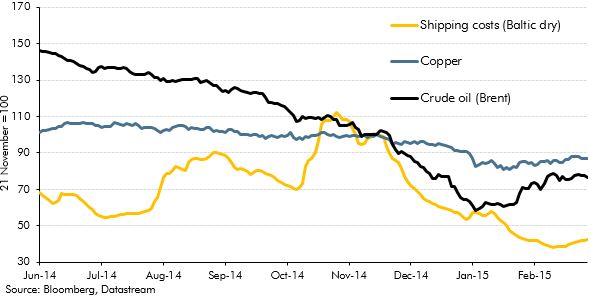

On the demand side, a fall in crude prices may reflect expectations of weaker growth or of a lower oil intensity of GDP. Other primary commodities are generally also sensitive to global demand shocks. So the fact that copper prices have fallen by around 14 per cent since June 2014 – a significant decline, but substantially less than that of the oil price – suggests that weaker demand and greater supply have both played a role. The Baltic dry index, which measures global shipping costs, has fallen 95 per cent since its peak in mid-2008 and around 40 per cent over the same period as the fall in oil, to reach its lowest level since the mid-1980s. Shipping costs are seen as a leading indicator of economic activity, so this also points to some role for weaker demand, although it may also signal greater shipping capacity. The lag between orders and delivery of vessels means the 2013 post-crisis boom in shipping orders is likely to be pushing costs lower.

Chart A: Oil prices relative to copper and shipping prices

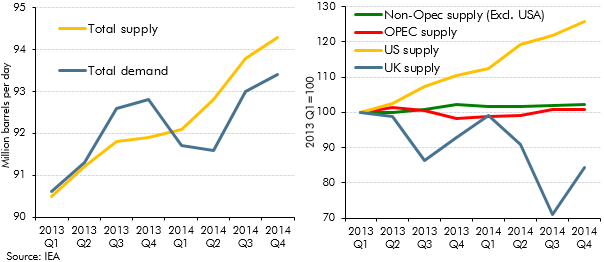

On the supply side, over 2014 the International Energy Agency (IEA) estimates that crude oil supply increased by over 2 per cent. Demand for oil is relatively price inelastic, so changes in supply can have large impacts on price. The growth in oil supply was faster than growth in oil demand, leading to an increase in implied stocks (Chart B). Supply has risen in part because of the boom in the US fracking industry. US oil production is up 26 per cent over the past two years. Iraqi supply has hit its highest level in 35 years and, according to the IEA, further capacity coming online in 2015 is likely to boost production further. That has offset lower Libyan oil production. Overall, OPEC supply has remained fairly constant and, in contrast to previous periods of falling prices, OPEC has recently reaffirmed its intention to maintain current production. Indeed, OPEC production has been exceeding its target of 30 million barrels a day.a These factors also suggest that increased supply has also played a part in the fall in oil prices.

Chart B: Supply and demand for oil

External views on the precise balance of demand and supply factors vary, though most believe that both have played a role. The IMF has concluded that a higher weight should be placed on positive supply factors. It argues that ”the persistence of this supply shift will depend largely on the long run motives of OPEC’s current output strategy.”b The IMF has estimated that demand explains only around 20 to 35 per cent of the fall in oil prices.c The IEA’s view is broadly similar to that of the IMF. It has concluded that rising supply has coincided with demand weakness, which has exacerbated the fall in oil prices. The IEA has argued that ”oil supply remains abundant and that investment cuts will take some time to make more than a relatively small dent on production.”a The Bank of England stated in its latest Inflation Report that “Oil supply news is likely to have been the biggest driver of [the]drop in oil prices, although a weakening outlook for world demand is also likely to have played a material role.”d Our forecasts are also conditioned on a view that both supply and demand factors have been responsible for the fall in oil prices.