The latest update of our forecasts was published on the 11 March 2020 in the March 2020 Economic and fiscal outlook. Read the overview or the Executive summary.

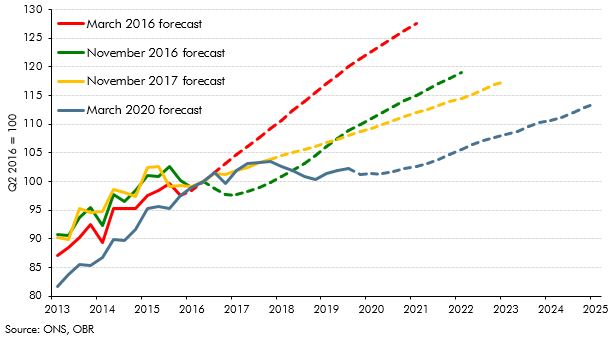

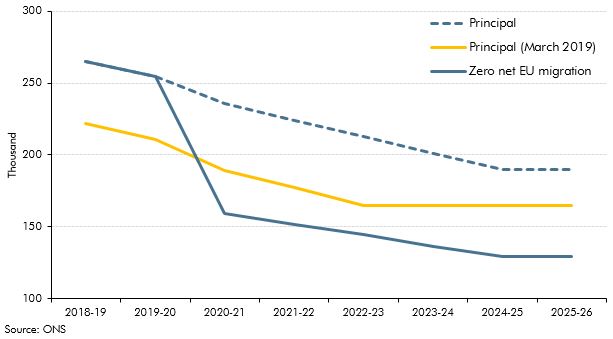

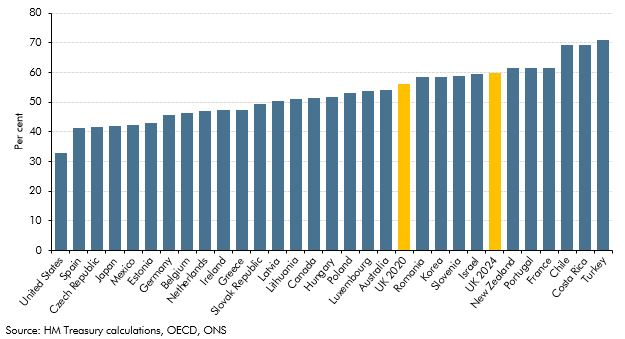

In Chapter 2, we set out our forecasts for the economy over a five year horizon. We cover our assumptions regarding the UK’s exit from the EU, our latest forecast changes in light of recent developments and the effect of policies in the Spring Statement.

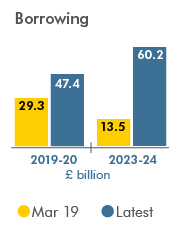

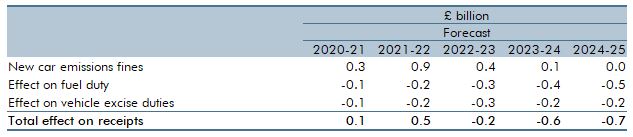

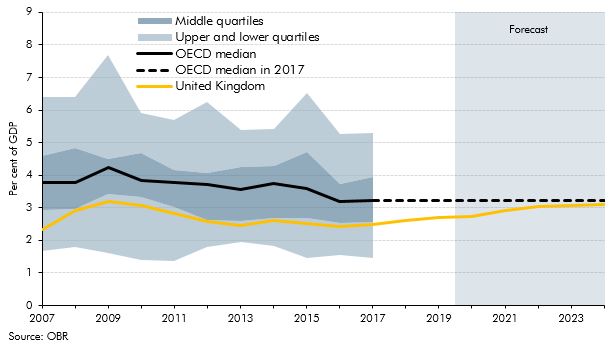

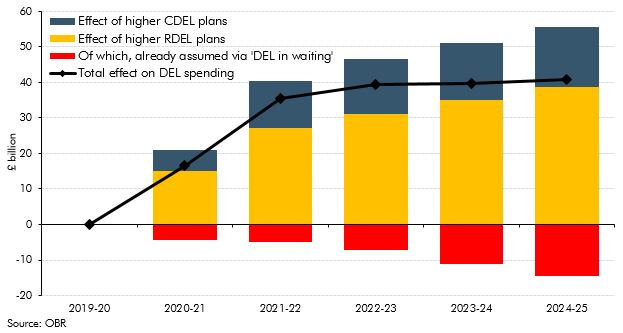

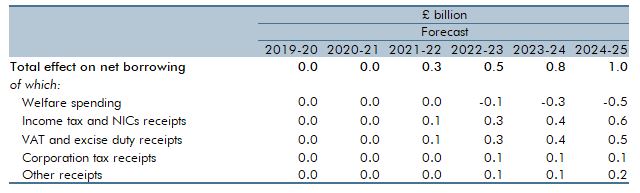

Chapter 3 sets out our forecasts for receipts and public spending over a five year horizon. We also explain our loans and other financial transactions forecasts. All this, together with new policy decisions, builds the outlook for borrowing and debt.

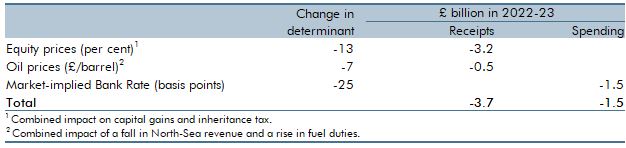

In Chapter 4, we assess the Government against its fiscal targets. We examine whether the Government has a better than 50 per cent chance of meeting them on current policy. We also test the sensitivity of our fiscal forecasts in an alternative economic scenario.

Annex A covers the Budget 2020 policy decisions and Annex B sets out our long-run economic determinants.