Box sets » Public finances » Tax revenues

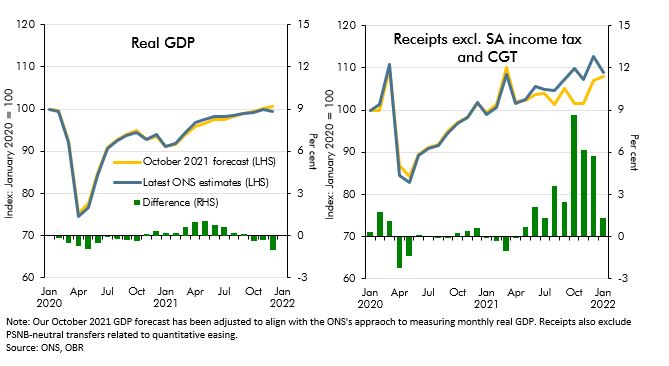

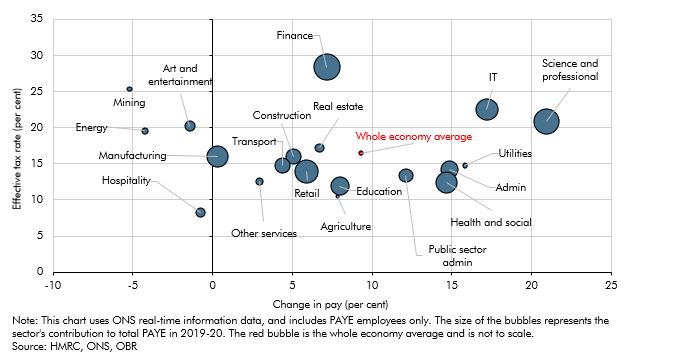

Since our October 2021 EFO the real economy has performed largely as expected in 21-22 but tax receipts have come in well above that forecast. In this box, we examined reasons why tax receipts have recovered so quickly particularly in comparison to economic data.

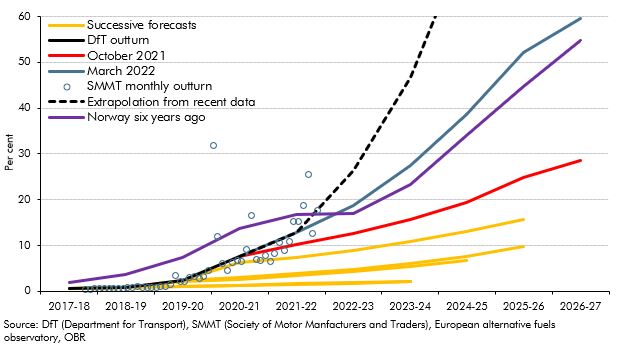

This box outlined the recent growth in electric vehicle sales and the fiscal implications of this and the role of policy in the transition.