The latest update of our forecasts was published on the 25 November 2020 in the November 2020 Economic and fiscal outlook. Read the overview or the Executive summary.

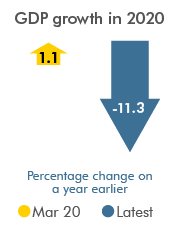

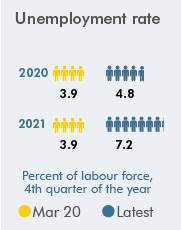

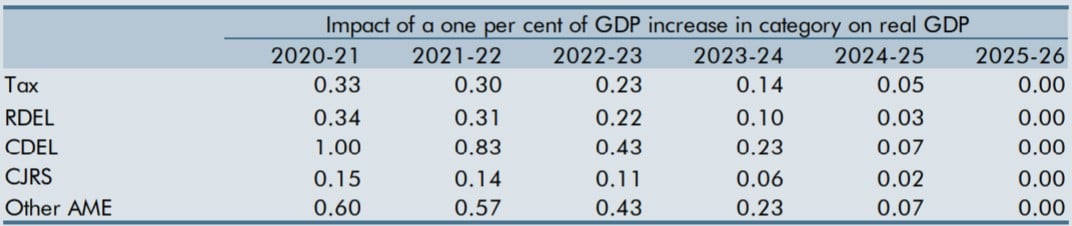

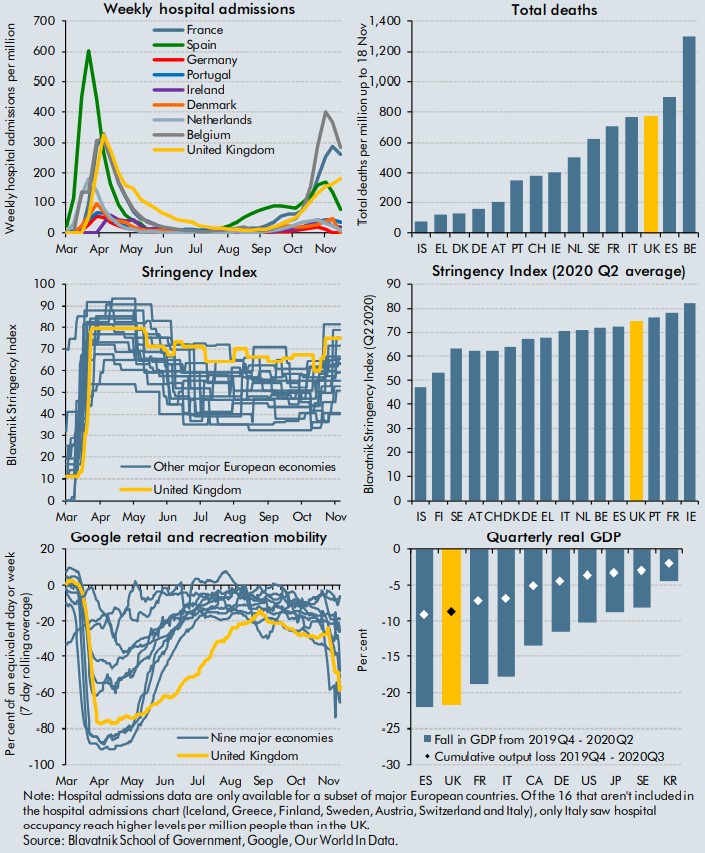

Chapter 2 sets out our forecasts for the economy over a five year horizon. We cover our assumptions regarding the coronavirus pandemic, set out our latest forecast and results from our upside and downside virus scenarios.

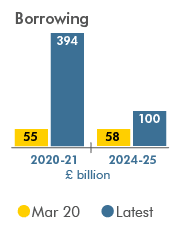

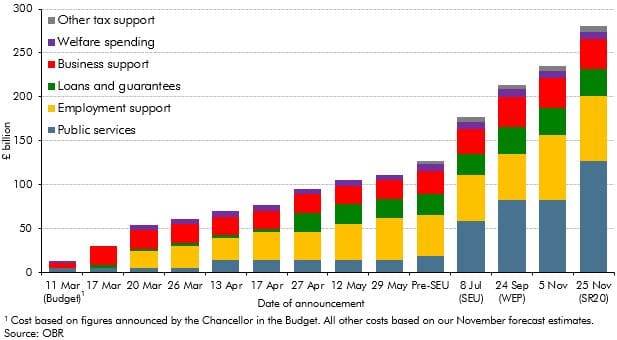

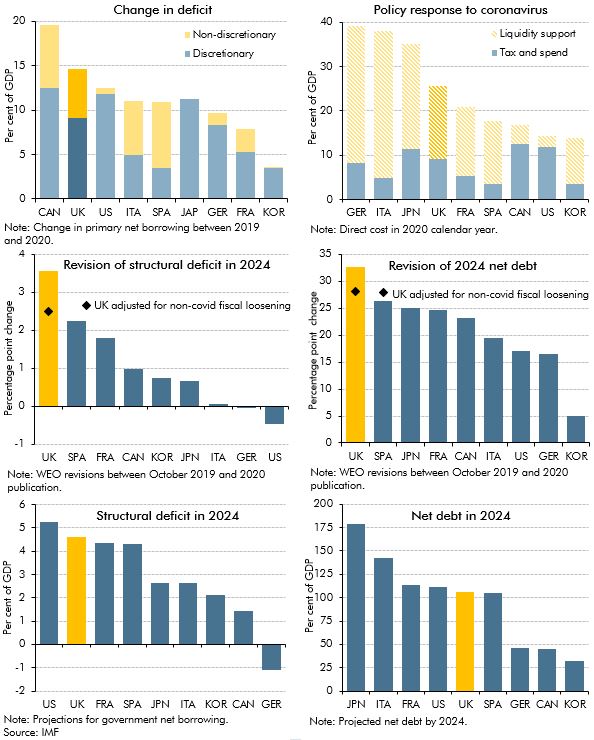

Chapter 3 sets out our forecasts for receipts and public spending over a five year horizon. We also explain our loans and other financial transactions forecasts. All this, together with new policy decisions, builds the outlook for borrowing and debt. We also set out our latest forecast and results from our upside and downside virus scenarios.

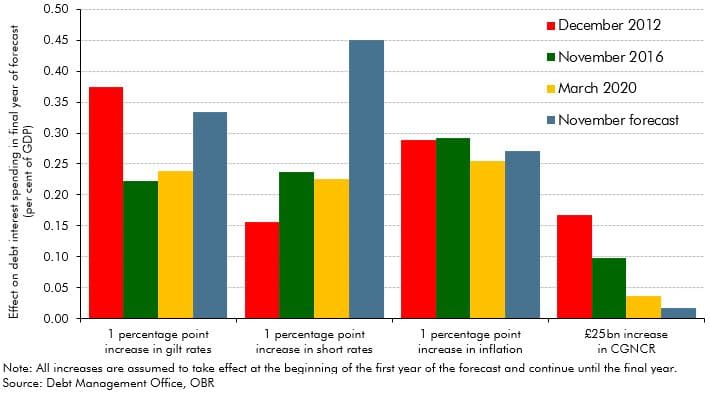

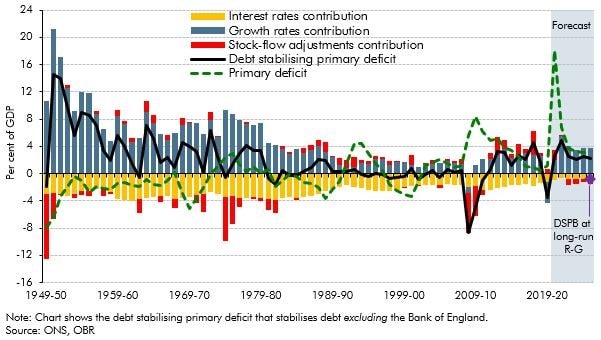

In Chapter 4, we assess the Government against its fiscal targets and present the significant uncertainty around our forecast.

Annex A covers the policy decisions since March, Annex B tests the impact of a no deal Brexit on our scenarios and Annex C sets out the major balance sheet interventions during the financial crisis and subsequent recession.