The debt-stabilising primary deficit depends on the level of debt, nominal growth rates, the effective nominal interest rate, and any 'stock-flow adjustments'. This box discussed the historical evolution of the debt stabilising primary balance, and also explained why it may appear to be ‘easier’ to stabilise debt the higher it rises, and the fiscal risks that such an interpretation entails.

This box is based on ONS and OBR data from October and November 2020 .

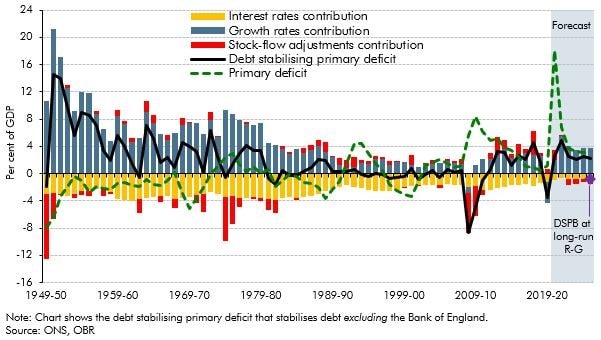

The debt stabilising primary deficit (DSPD) is the level of the primary (i.e. non-interest) deficit at which debt would stay constant as a share of GDP.a It must be large enough to offset the effects of: (i) the growth rate of nominal GDP, which lowers debt relative to GDP, and so raises the DSPD; (ii) the nominal interest rate on government debt, which has the opposite effect; and (iii) any stock-flow adjustments (factors other than borrowing that affect debt), like loans and asset sales, which can have either a positive or negative effect.

If the interest rate exceeds the growth rate, then – absent stock-flow adjustments – a primary surplus would be necessary to stabilise debt. If, as in recent years, growth rates exceed interest rates then a primary deficit would be necessary to stop debt from falling. Moreover, the higher the starting debt level is, the higher the debt stabilising level of the deficit: not only can more be borrowed without debt rising, more must be borrowed to stop it falling. So, at face value, it appears ‘easier’ to stabilise the debt to GDP ratio when it is higher. But this also leaves the public finances more vulnerable to rises in financing costs.

As Chart A shows, the DSPD was at its most favourable (at 15 per cent of GDP) in 1951-52, when high debt and an expanding economy helped bring the debt to GDP ratio down from its post Second World War peak. It was at its least favourable (at minus 8.7 per cent of GDP) in 2008-09, when the government acquired stakes in several large banks during the financial crisis. The DSPD averages 2.8 per cent of GDP in our central forecast which is high by post-war standards when it spent decades close to zero. These historically favourable dynamics reflect the higher debt level, catch-up growth after the sharp fall in output this year, and the financing of deficits at ever lower interest rates. However, at our estimate of long-run interest and growth rates, a primary surplus of 0.9 per cent of GDP would be required to stabilise debt – a 4 per cent of GDP improvement relative to the primary deficit in 2025-26 implied by the government’s current plans.

Chart A: Trends in the debt stabilising primary deficit

This box was originally published in Economic and fiscal outlook – November 2020